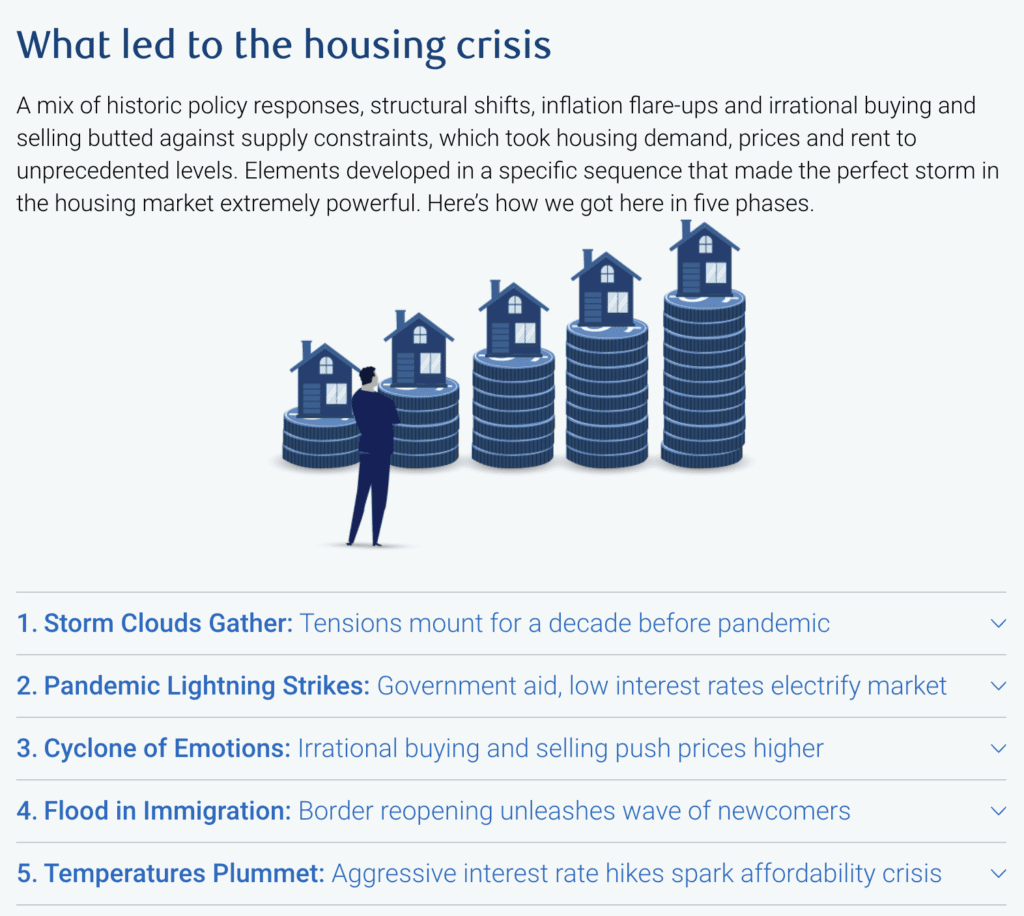

Recently, RBC Economics and Thought Leadership released its report, The Great Rebuild: Seven ways to fix Canada’s housing shortage which discusses factors that led to Canada’s housing crisis and policy ideas to address it.

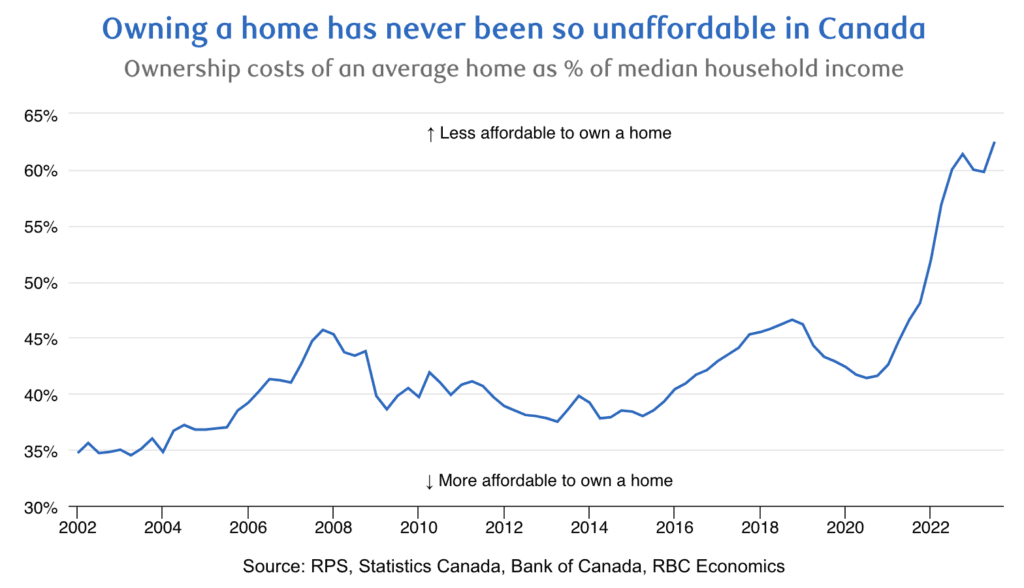

The organization’s research found that one million of 1.9 million new households by 2030 won’t be able to purchase a home if affordability remains near where it is now. On top of this, over 40 per cent of those households also won’t earn enough to afford market rent prices.

Source: RBC Economics

“The current affordability crisis has been driven by a massive undersupply of housing in the face of booming demand,” says Robert Hogue, assistant chief economist, RBC Economics. “Canada needs to significantly grow its housing stock, especially rental and affordable housing, and it needs to do so quickly. Addressing this challenge will require greater collaboration between governments, industry and other stakeholders.”

Ideas to fix the country’s housing shortage

The report suggests these seven actions for bringing meaningful home price and rent relief:

1. Aggressively expand the construction sector’s labour pool by prioritizing immigrant skills, recognizing credentials from other jurisdictions and setting ambitious targets for trade enrollments.

2. Develop and adopt innovative designs, building techniques and technology to boost productivity through prefabricated housing and pre-approved building designs.

3. Speed up housing project approvals by reducing regulatory requirements, harmonizing building codes and prioritizing projects with faster turnaround times.

4. Ease zoning restrictions to allow more density in cities and diversify the types of houses built to make more productive use of land.

5. Lower the cost of building new housing by using more cost-efficient materials and modulating government charges.

6. Change the housing supply mix with incentives to build purpose-built apartments by waiving development charges and using publicly owned land.

7. Expand the housing stock from within by reclaiming units from short-term rental businesses, making it easier to build secondary suites and convert non-residential buildings.

“We’re working with Canadians across the country — homeowners, builders, policymakers — to help ensure home ownership remains part of the Canadian dream. Efforts will have to go beyond what’s been done so far, and we hope these pragmatic ideas help rebalance supply and demand and do so in ways that continue to drive Canadian prosperity,” explains John Stackhouse, SVP, Office of the CEO, RBC.

Read the full report here.

The main cost for housing except purpose built rentals is HST for housing as it is also applied to service, interest and development charges at the end.Rebates upto 450,000 is capped since inception. If inflation over time is considered the cap should be more than double. Only way to reduce housing costs is to reconsider all government costs at three levels which add upto 32% of newly built home. This additional costs automatically raises price of existing homes as comparative.

This is the only way to reduce costs. All other free gift giving is immaterial and only political blah blah,

Causes and Effects of Stress Test:

Financial Stress Test in 2010:

In 2010, the government introduced a financial stress test. This test had a dual impact:

Decreased Affordability: It reduced the affordability levels for home buyers.

Interest Rate Impact: Simultaneously, interest rates started to decrease, which drove house prices even higher.

Seniors and Bridge Financing (

Around 2020):

Around 2020, when unconditional multiple offers were common:

Many seniors who owned their homes outright faced challenges.

They couldn’t obtain bridge financing because they didn’t qualify due to the stress tests.

As a result, these seniors stayed out of the real estate market.

This situation had two effects:

Reduced Supply: Fewer seniors selling their homes decreased the supply.

Increased Demand: The reduced supply contributed to an increase in demand for available properties.