Calgary’s real estate market in February 2023 continued to show typical seasonal behaviour, with sales, new listings, and inventory levels increasing over January.

However, the Calgary Real Estate Board (CREB) is reporting inventory levels remained low, with only a slight improvement month-over-month, and were among the lowest February levels seen since 2006.

CREB’s Chief Economist, Ann-Marie Lurie, noted that higher lending rates are impacting sales activity as expected, but a stronger pullback in new listings is keeping supply levels low, supporting some stronger-than-expected monthly price gains.

“However, if we do not see a shift in supply, we could see further upward pressure on prices over the near term,” Lurie says.

According to the board, sales activity remained stronger than long-term trends and levels reported throughout the 2015 to 2020 period, but new listings fell below long-term trends.

The market struggled to move into balanced territory, causing further upward pressure on home prices.

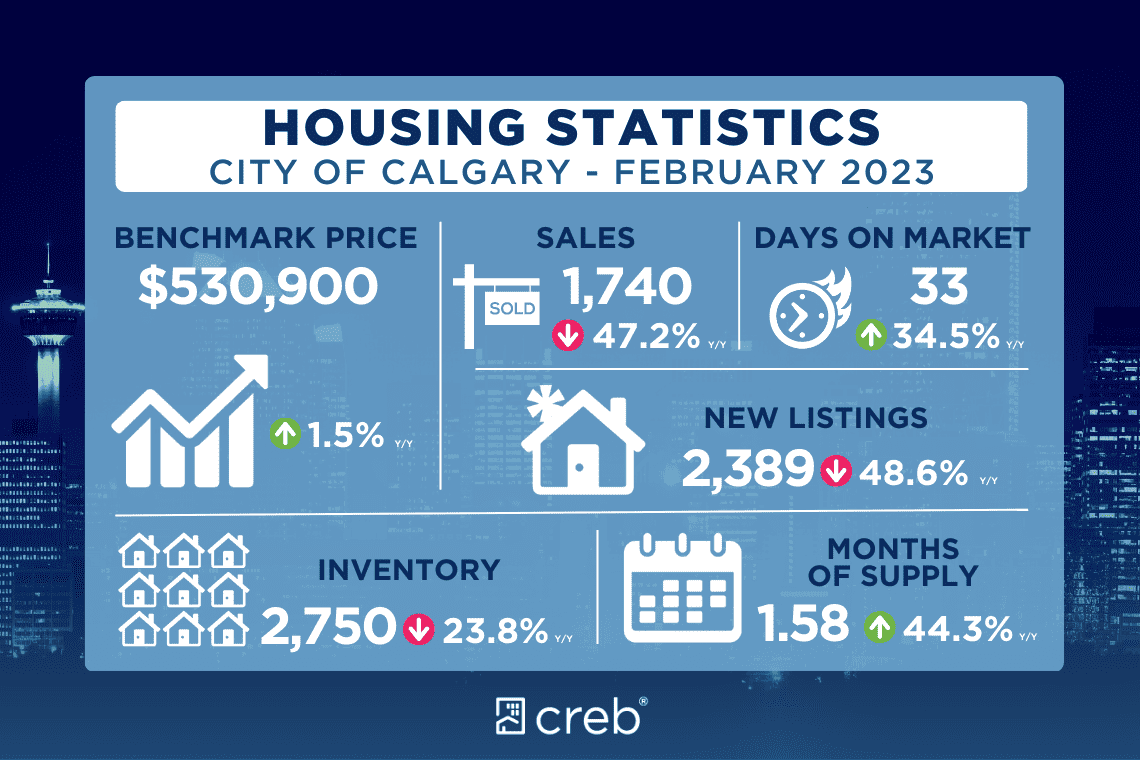

While still below the May 2022 peak, Calgary is one of the few markets that has seen an increase in price year-over-year; the unadjusted benchmark price increased by nearly two per cent over January levels and last year’s prices, according to CREB.

Source: CREB

Detached

Detached properties saw significant year-over-year declines in both sales and new listings, with inventories still among the lowest seen in February.

The unadjusted benchmark price increased over last month’s levels but is still below the peak reported in May 2022.

CREB reports that while supply remains a challenge relative to demand for lower-priced homes, the conditions are shifting into balanced territory for homes priced above $700,000.

Semi-detached

Semi-detached properties also reported a decline in sales and new listings compared to last year’s record high, with persistently tight market conditions causing the months of supply to fall below two months in February.

The unadjusted benchmark price reached $568,100 in February, nearly two per cent higher than last month and a three per cent gain over last February.

Row

In the row sector, the persistently tight conditions caused further upward pressure on prices.

In February, the unadjusted benchmark price reached a new high of $369,700, with only one month of supply and a sales-to-new listings ratio of 87 per cent.

Apartment condominiums

Sales for apartment condominiums did not see the same pace of decline as other property types in February, partly due to the level of new listings coming onto the market.

Persistently strong sales compared to listings caused inventory levels to remain relatively low, and the months of supply dropped below two months.

The unadjusted benchmark price reached $286,000 in February, nearly three per cent higher than last month and over 11 per cent higher than last February.

While prices are still higher than the levels reported last year, they remain nearly seven per cent below the peak levels reported in 2014, according to CREB.