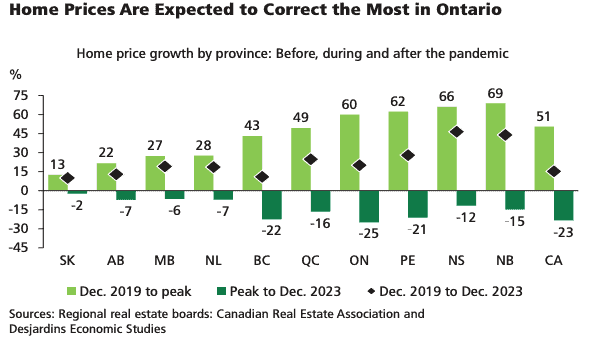

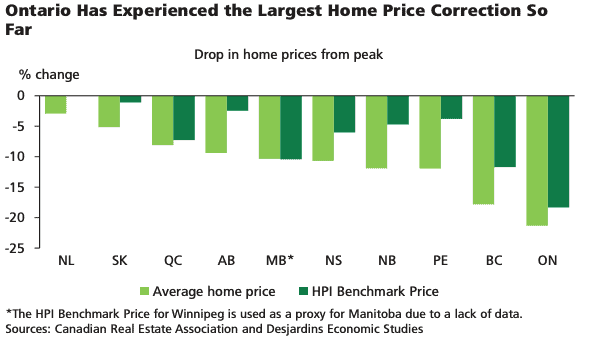

While home sales and average prices have fallen sharply from their pandemic peaks in Canada, the pace of the correction in the housing market has slowed.

According to a recent report from Desjardins, the bottom is near; economists expect sales to find a bottom early in the second half of 2023 and home prices to begin rising shortly after.

With interest rate cuts expected following a prolonged pause by the Bank of Canada, a persistently tight labour market and high levels of immigration will support the high demand for housing.

However, the report also shows enormous variability in the outlook for provincial housing markets, reflecting better economic performance expected for commodity-producing provinces as energy and non-energy primary goods prices are likely to remain elevated.

Ontario, in particular, should see some of the largest price corrections due to the province’s economic exposure to the housing market.

Ontario’s market under the microscope

The report highlights that Ontario has posted the biggest decline in prices of any province since the market peaked nationally in February 2022. Desjardins economists note this has weighed heavily on economic activity, particularly residential investment.

Nearly half of existing home sales occur in the Greater Toronto Area (GTA), which tends to attract the most attention; however, during the pandemic, it was surrounding communities that grabbed more of the headlines. Home prices rose significantly in the GTA, but not nearly as much as they did in smaller Ontario communities.

This increased demand for more space when working remotely and homeschooling drove up house prices in Ontario during the pandemic.

The price increases were most pronounced within a few hundred kilometres of the GTA. Still, there were some notably outsized exceptions to this as well.

Communities such as Bancroft, Parry Sound, Quinte, Renfrew, Northumberland Hill, Muskoka, Haliburton, Woodstock-Ingersoll, and North Bay saw average home prices more than double from December 2019 to the peak.

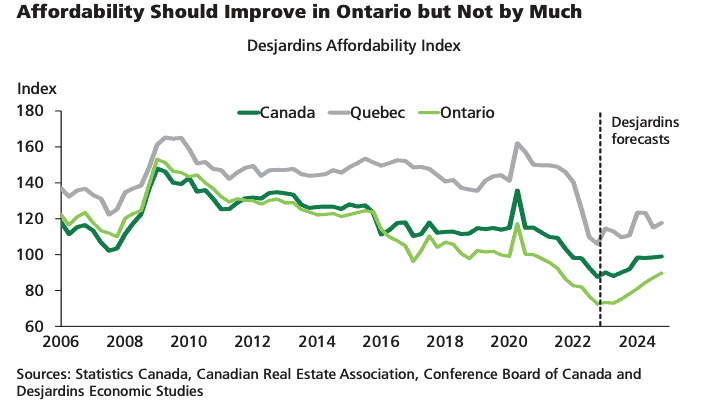

Affordability in Ontario

Housing affordability in Ontario eroded significantly during the pandemic, with the affordability gap with Quebec and the rest of the country widening considerably.

While affordability in Canada’s most populous province is expected to improve as home prices continue to fall and borrowing costs ultimately come down, it is not expected to return to its pre-pandemic level by the end of 2024.

However, reduced affordability is not just a GTA story; while Toronto remains the most unaffordable city in the province, it is followed closely by St. Catharine’s, Hamilton and Kitchener.

London, Windsor, Kingston and Oshawa have also seen affordability decline more modestly.

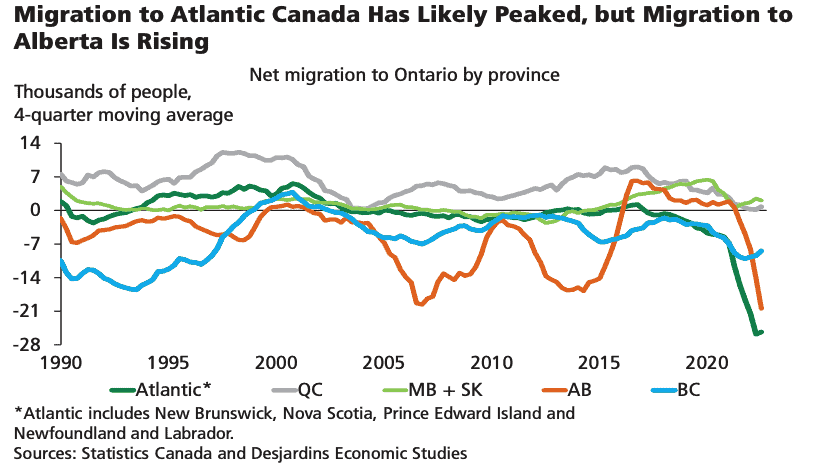

The erosion of housing affordability has also led to further unintended consequences for the province of Ontario. Families have been leaving the least affordable parts of the province for greener pastures elsewhere in Ontario; some are leaving Ontario altogether, with the Atlantic provinces being the preferred destination since the start of the pandemic and Alberta more recently.

Despite the population outflow from Ontario to other provinces, the housing market is still under pressure due to the rapid growth of its population. The growth is mainly attributed to international migration and net non-permanent resident admissions, according to Desjardins.

This continued growth will likely keep housing demand high, even with sustained high-interest rates.

However, economists expect ongoing price declines and the Tax-Free First Time Savings Account, which will be available starting April 1, will provide some support to first-time homebuyers, particularly in the Greater Toronto Area (GTA), but will also have spillover effects to other communities.

The recent downturn in housing starts is expected to continue throughout 2023, which suggests that the supply of housing will continue to fall short of demand from the rapidly growing population in Ontario and nationwide.

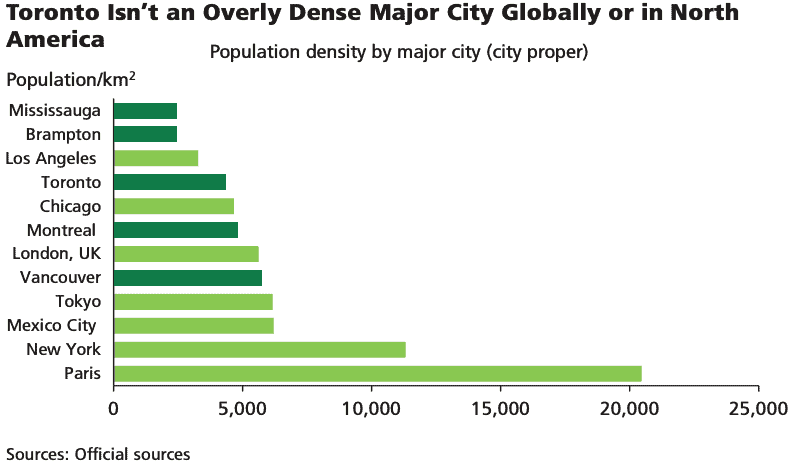

According to the report, this is a missed opportunity, as there is still plenty of room for increased construction within existing urban boundaries in the GTA and surrounding cities.

Desjardins recently estimated that housing starts would have to increase by 100,000 nationally per year on average in 2023 and 2024 to offset price gains amid rising immigration.

“Policymakers should take up the mantra ‘location, location, location’ and focus their affordability measures on overpriced markets,” the report states.

Read the full report here.