Canada’s luxury home market is poised for further growth in the months ahead, according to a new Re/Max report. However, tight inventory levels are making it challenging for buyers to find the right home.

Luxury sales are expected to continue climbing in the second quarter of 2023 as pent-up demand drives activity in most major markets across Canada, according to the 2023 Spotlight on Luxury Report.

The report examined 15 Canadian housing markets from coast to coast and found that rapid depletion in housing stock is placing upward pressure on values at lower price points and sparking an uptick in demand in the luxury segment.

Tight inventory levels challenge Canadian luxury homebuyers

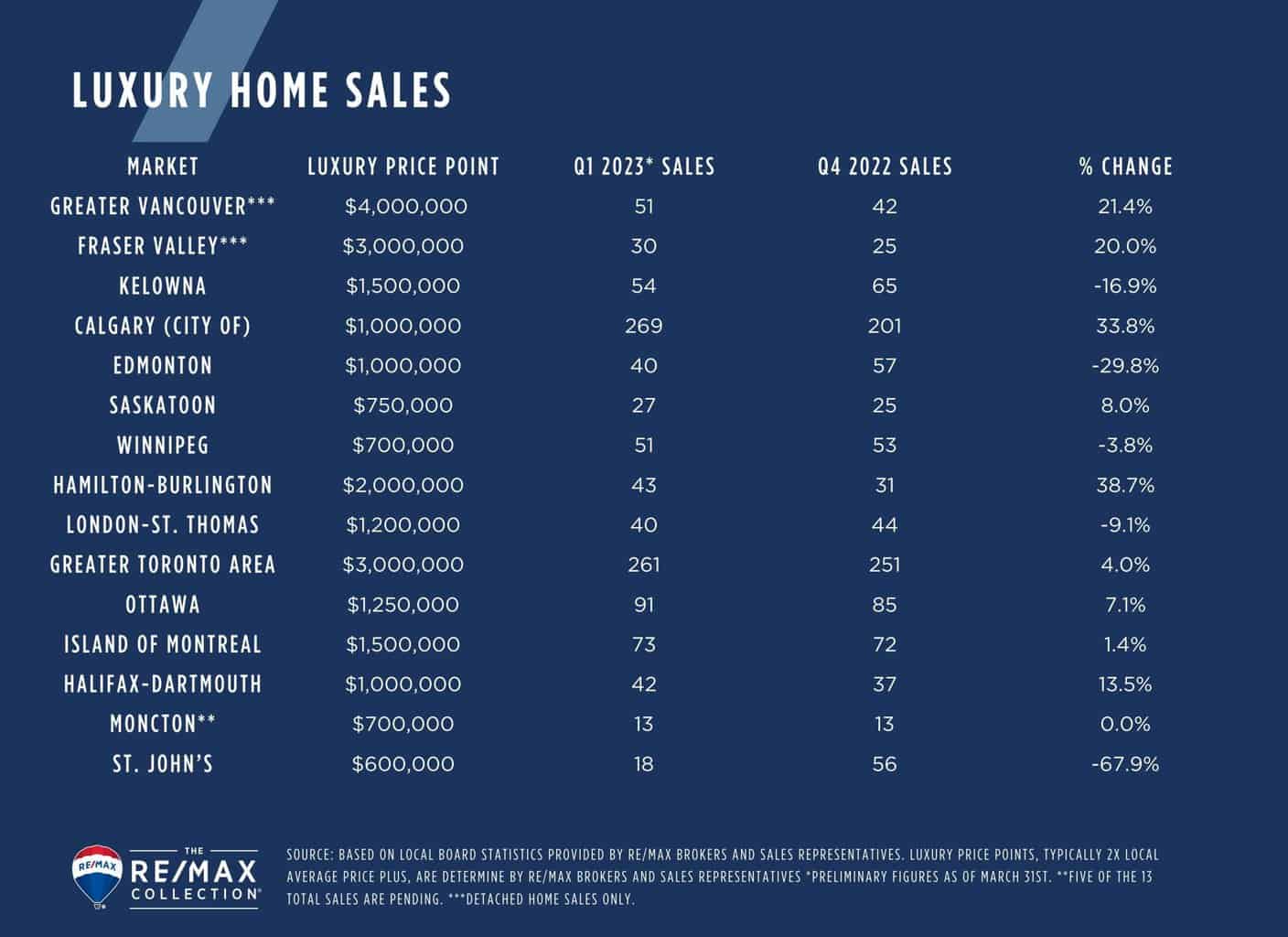

While upper-end sales in the first quarter of 2023 have fallen short of peak levels in Q1 2022, activity is on par or ahead of Q4 2022 figures in 10 of the 15 markets surveyed.

Saskatoon bucked the national trend, with luxury home sales exceeding Q1 2022 levels in Q1 2023.

“Much of the activity in the market can be attributed to pent-up demand, which has been building since mid-2022,” says Christopher Alexander, president of Re/Max Canada.

“Bolstered by lower fixed-term mortgage rates and attractive housing values, buyers are taking advantage of this window of opportunity to secure homeownership. Listings, however, are few and far between in most areas of the country, and finding the right home has proved challenging.”

According to the report, sidelined buyers jumped back into the market in Q1, as anticipated inventory failed to materialize and housing values stabilized.

Lack of available homes drives up housing values in major centers

Supply levels are now tighter than during the pandemic in some markets. In the Fraser Valley, for example, Re/Max notes listings recently hit a 30-year low. In St. John’s, Newfoundland, a property recently listed for sale at the $800,000 price point had 15 showings and three offers and sold on its first day on the market.

“Inventory continues to be the lynchpin of the Canadian housing market,” explains Alexander. “The pattern of heating and cooling housing markets emerges time and time again, and it is directly linked to our issues with supply and the inability of governments at all three levels to get shovels in the ground across our nation, which is now approaching 40 million people…

“We welcome the news that our country is growing, but with one million new Canadians added in 2022, we also need to be certain that adequate housing, not to mention vital infrastructure, is in place to support the influx of newcomers.”

The report also shows that a lack of available homes listed for sale has propelled housing values across the country, despite softer overall demand. After double-digit declines from peak to trough in the second and third quarters of 2022, prices have held up relatively well in major centers.

The year-over-year value of luxury homes in markets such as Calgary and Moncton increased; in Saskatoon, the values have increased by more than 10 per cent, while the GTA, Hamilton-Burlington, Ottawa and Greater Vancouver have fallen just short of peak Q1 2022 levels.

In Toronto, the market remains competitive for luxury properties; nearly 20 per cent of freehold homes over $3 million sold at or above list price in Q1 2023.

Homebuying activity expected to ramp up in the months ahead

Re/Max is also reporting the uber-luxe segment is beginning to pick up in line with overall activity in the higher end, though inventory is even more scarce.

“Homebuying activity is expected to ramp up in the months ahead, with stronger demand and upward pressure on price characterizing the second quarter of 2023,” says Elton Ash, executive vice president, Re/Max Canada.

“Recent stock market volatility and bank failures south of the border that have sent shockwaves throughout the financial markets may provide an additional boost for Canadian housing markets as buyers turn to the security of bricks and mortar yet again. While concerns exist over the possibility of rising overnight rates and recessionary

pressures later in the year, the spring market appears to be shifting into full swing.”

Read the 2023 Spotlight on Luxury Report here, including the market-by-market overview.