Royal LePage is updating its price forecast for 2023 following a stronger-than-expected start to the year.

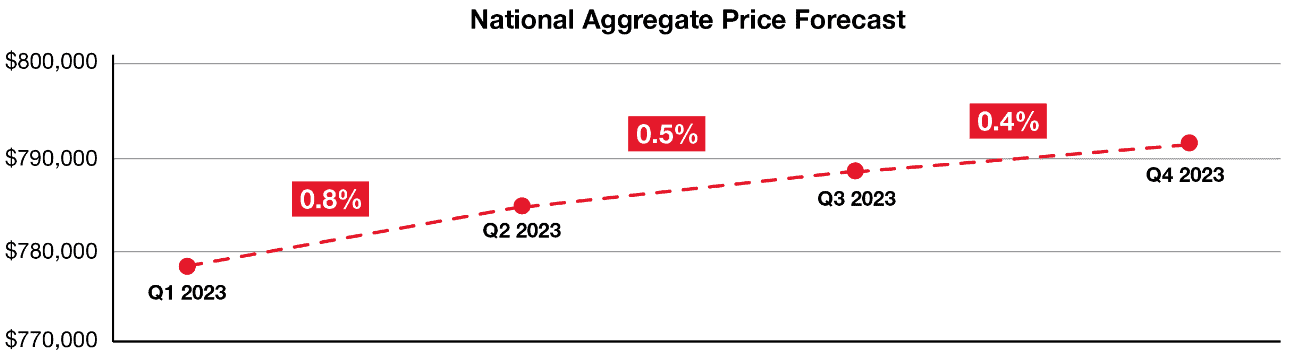

In a report released Thursday, Royal LePage is forecasting home prices in Canada will increase 4.5 per cent year-over-year in the fourth quarter of 2023, a steep increase from the company’s December prediction that the national aggregate home price would end the year one per cent below Q4 2022.

On a quarter-over-quarter basis, Royal LePage expects prices to continue rising modestly but steadily over the next nine months.

“Coming out of a correction, it is common to underestimate the speed at which the market will turn itself around. As market activity is rebounding quicker than anticipated, we are looking ahead with a sense of cautious optimism,” noted Phil Soper, CEO, Royal LePage.

“While we do not expect huge price gains this year, some sense of normalcy is returning to the market.”

Source: Royal LePage

Canadian market begins to recover after downturn

The Royal LePage House Price Survey showed that home prices in Canada decreased by 9.2 per cent year-over-year to $778,300 in Q1 2023.

However, there has been a 2.8 per cent quarter-over-quarter increase following the Bank of Canada’s decision to pause interest rate hikes, which prompted many buyers to return to the market.

“We have turned the corner, and the housing economy is growing again; none too soon for many buyers, who have been waiting patiently for prices to bottom out,” says Soper.

The national median price of a single-family detached home fell 10.7 per cent year-over-year to $808,700, while the median price of a condominium fell 6.7 per cent year-over-year to $571,700. Quarter-over-quarter, median prices rose for these two property segments by 3.4 per cent and 1.8 per cent, respectively.

“Sanity is slowly returning to the housing market,” added Soper. “While some buyer hopefuls will remain sidelined by a reduced capacity to borrow in this higher rate environment, our market data shows that many of those who chose to pause their search to see where prices and interest rates would land have resumed their home buying plans.”

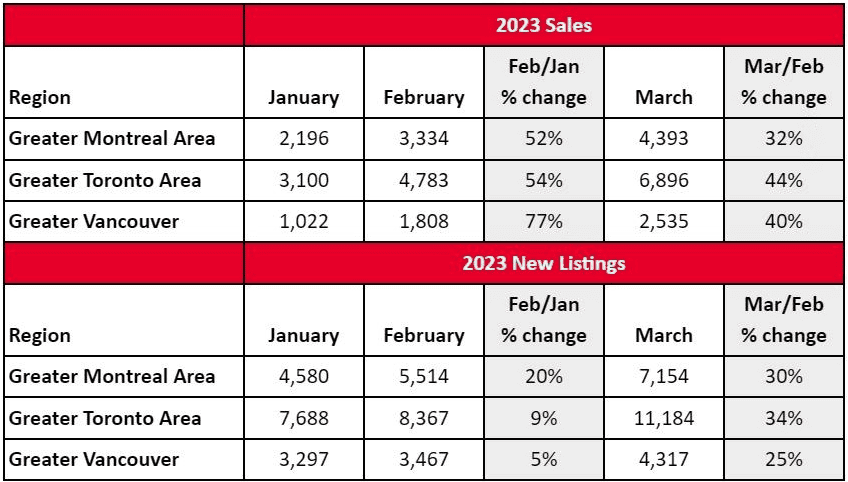

While sales have been trending upward since the start of the year, the number of listings remains too low to satisfy demand.

Source: Royal LePage

Soper explains that the challenge now is the severe supply shortage: “We are grappling with a growing problem here that once was the burden of our largest cities but is increasingly being felt in secondary markets as well.”

He adds, “Yes, governments are adopting policies intended to address the problem, yet the pace of progress is far from encouraging. And challenges facing developers—such as the increased cost of materials and labour, and a shortage of skilled tradespeople— persist.”

Public policy

The report notes the Office of the Superintendent of Financial Institutions’ (OSFI) proposed changes to Canada’s mortgage stress test that would impose more restrictive access to mortgage financing in an effort to mitigate risk for major banks against potential consumer default.

However, Soper warns against tightening restrictions in an environment where rates are high and likely to fall. He believes such a move could do more harm than good, forcing families into the unregulated B-lender market.

“Despite a year of rapidly-rising interest rates, we see that the number of Canadian homeowners who have failed to meet obligations to their financial institution remains exceptionally low,” Soper says. “Our banks have managed their mortgage portfolios well, and it helps that unemployment is very low.”

B.C.’s Home Buyer Rescission Period

Royal LePage says British Columbia’s newly-implemented Home Buyer Recission Period (a cooling-off period that allows buyers to rescind an offer within three business days of fan APS being signed) has not “proven to be useful.”

“Few B.C. buyers are exercising their right to use the cooling-off period the way it was intended—to allow them an ‘out’ after a rash decision to purchase a property.

“Unfortunately, we are seeing people blatantly abusing the program by making offers on multiple homes as they shop around, locking up scant housing inventory as if clothing in a retail store. The legislation is harmful, not helpful, and should be amended or scrapped.”

Interest rates

The Bank of Canada’s made the decision Wednesday to maintain its overnight lending rate at 4.5 per cent and has indicated it will continue to main the rate if inflation continues to come down.

“This was the signal that so many Canadians were waiting for. The Bank of Canada’s rate hold was the green light that stability is returning to the market, and it has had a swift and significant impact on buyer demand,” said Soper.

According to a recent survey by Royal LePage, found that one in four Canadians was in the market for a new home over the last year, and rising interest rates caused 63 per cent of them to postpone their plans, but 26 per cent of those planned to resume their search this spring and another 36 per cent said they would return to the market in the near future once the central bank paused rate hikes for several consecutive months.

Read the full report from Royal LePage, including regional breakdowns, here.

DREAM ON. WHO IS GOING TO WASTE MONEY IN CANADA WHEN THEY CAN BUY 50 HOUSES FOR A MILLION DOLLARS IN SOME AMERICAN STATES?

You should have a read on foreign tax laws. Would you want to be a long distance landlord, renovator, or property manager dealing with contractors, bad tenants, rent arrears and squatters. Got a spare million to buy a lot of headaches?