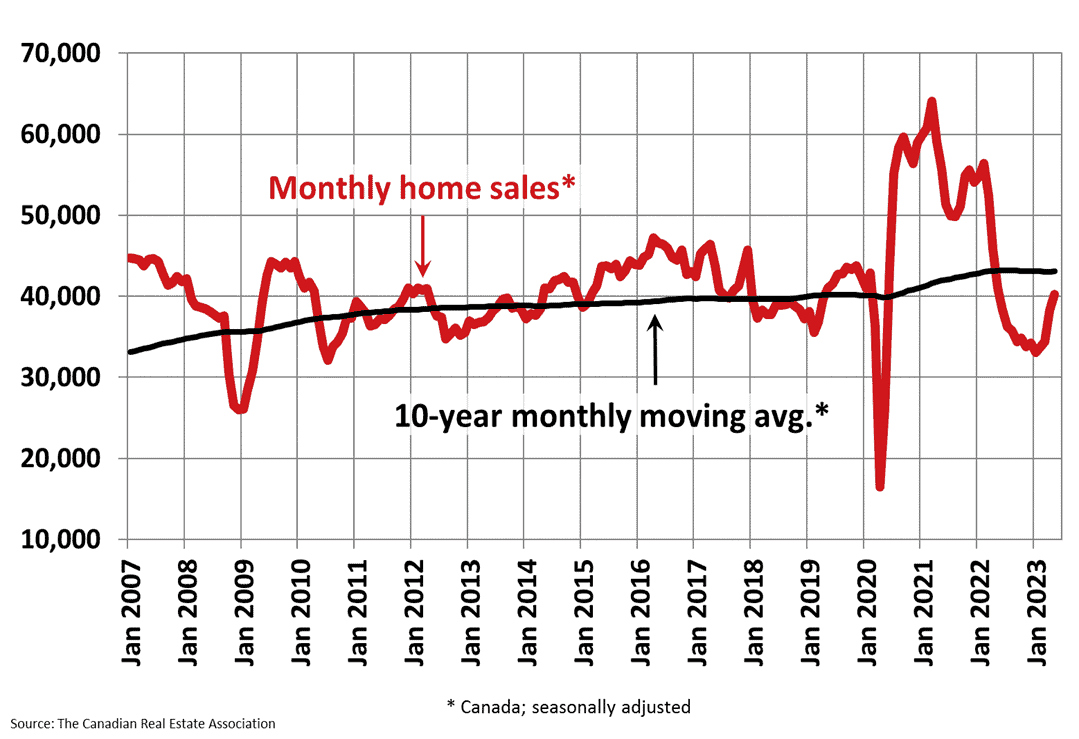

For the first time in several years, the number of homes sold in Canada went up on a year-over-year basis. The market saw 1.4 per cent more transactions than this month last year, continuing its growth towards the 10-year monthly moving average. This movement is a relief after a sustained lull below the average since last year’s spring market ended with a spectacular drop in price.

The continued rebound tells us that the worst could be behind us when it comes to the volume of homes sold — although price could be a different story.

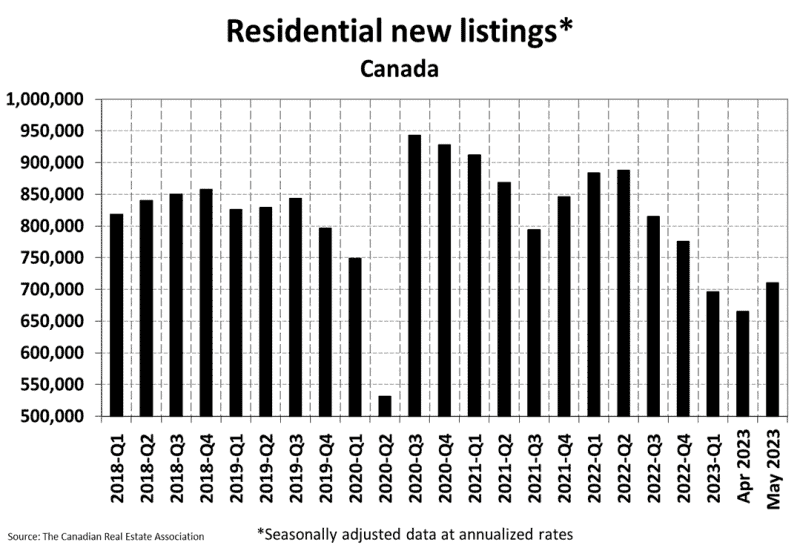

Supply supported volume growth

The number of new listings grew 6.8 per cent since last month — one of the biggest monthly jumps in supply we’ve seen on record. This increase in supply could be a signal that homeowners are responding opportunistically to the strong spring market and the seasonal price growth we’ve seen in house prices since January 2023.

This increase in supply, coupled with evidently strong existing demand, allowed the number of homes sold to grow 5.1 per cent since April 2023. Supply remains relatively balanced heading into the summer market, with 3.1 months of inventory, evidence that a typical summer reduction in demand could cool the market significantly over the next few months.

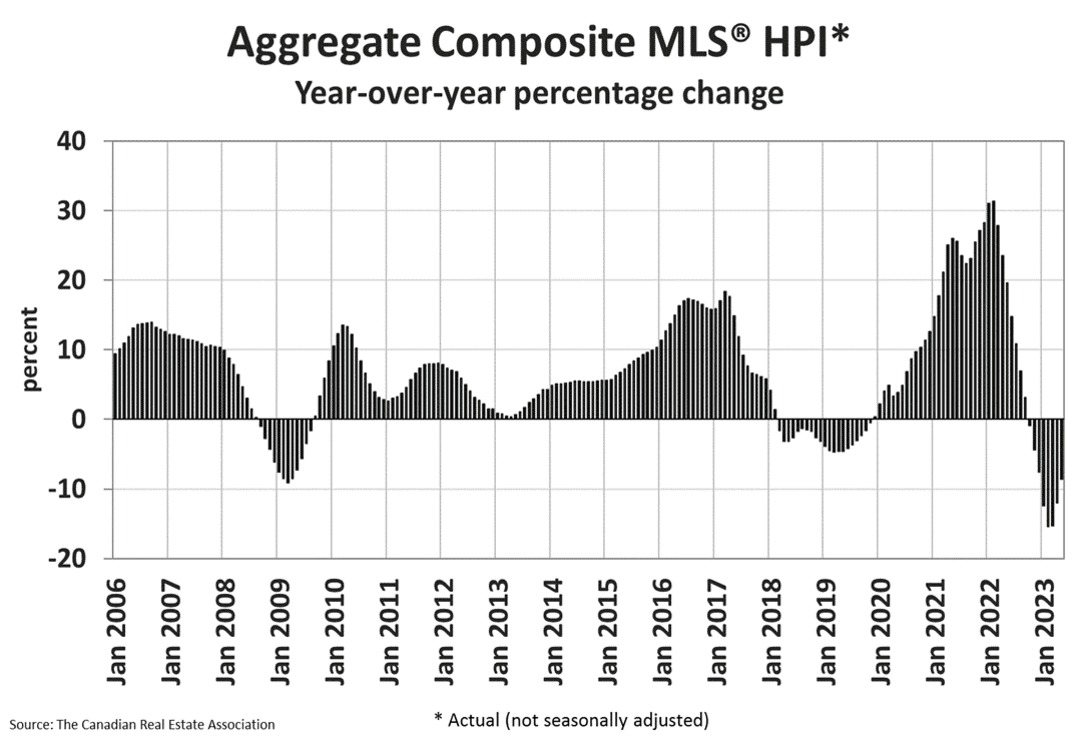

Prices still down

The recovery in volume is just beginning to produce positive results from a pricing perspective in Canadian real estate – though the MLS Home Price Index still down 8.6 per cent since May of last year, it was up 2.1 per cent since last month.

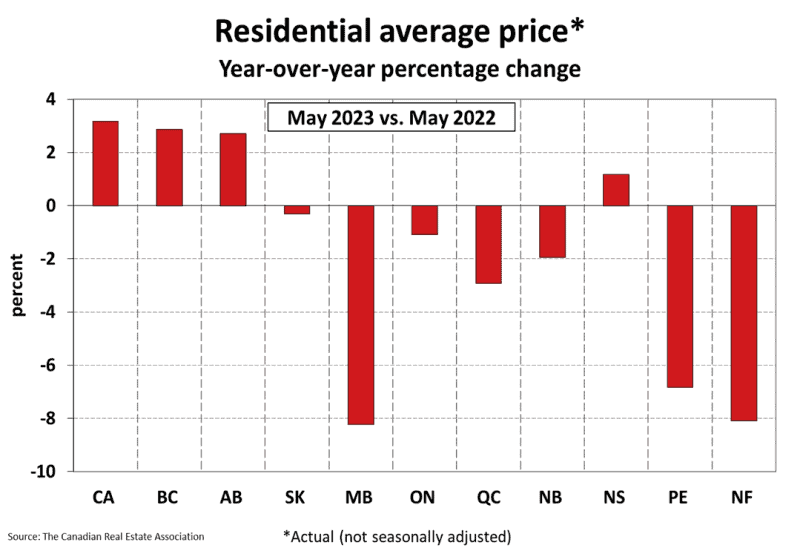

When looking at the average price perspective, the majority of markets are still down since this time last year, though the national average is up about 3.0 per cent, with positive annual gains posted in British Columbia, Alberta, and Nova Scotia.

The remaining question is whether or not the impact of summer seasonality against the headwinds of recession will allow the Canadian real estate market to sustain this strength until the end of 2023.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.