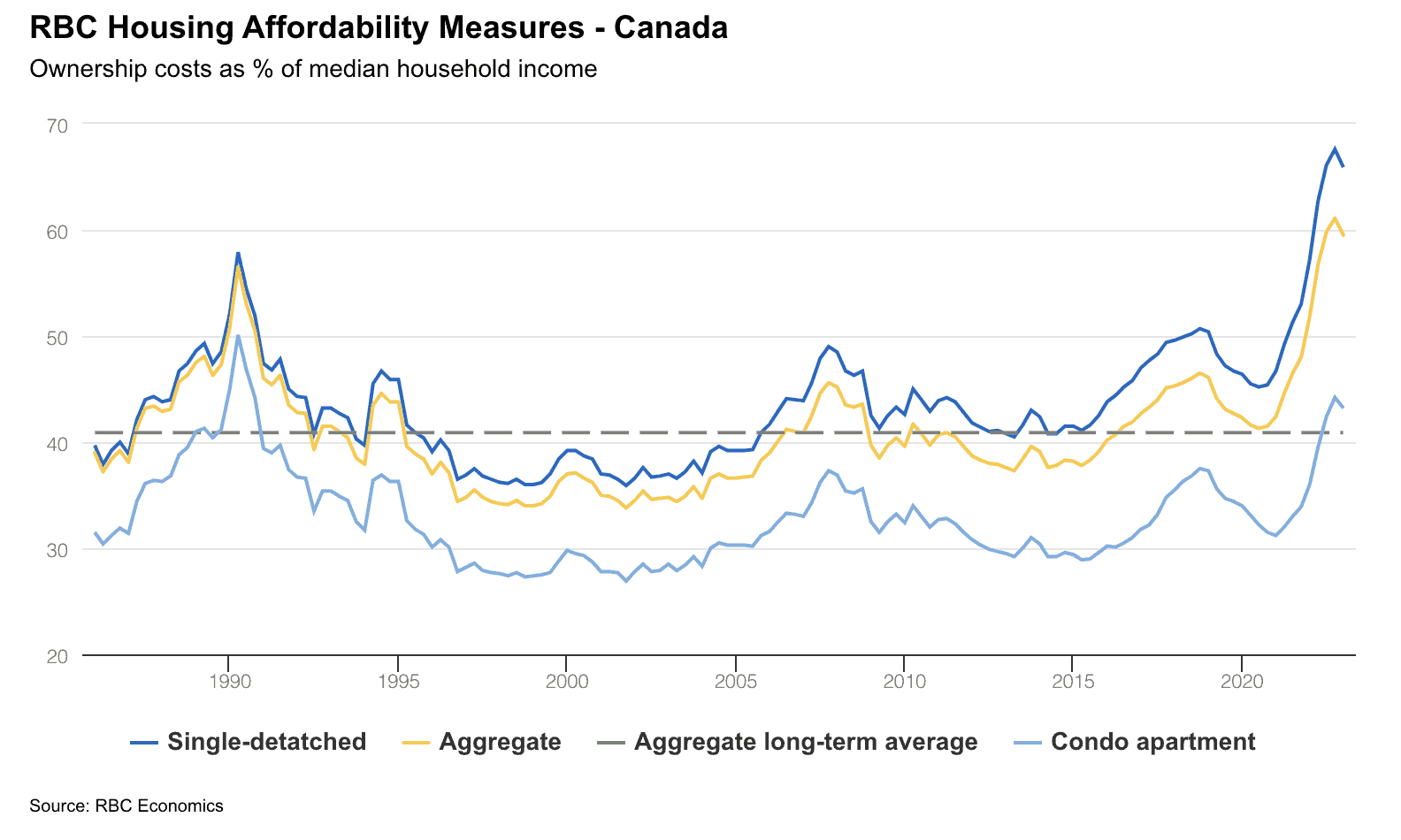

Escalating mortgage rates in the previous two quarters had overshadowed any benefits from declining home prices. On average, mortgage rates had added 4.3 percentage points to RBC’s national aggregate measure, while declining prices subtracted only 2.1 percentage points. However, in the first quarter, the improvement in affordability occurred despite a slower rate of price decline thanks to flat mortgage rates.

Affordability challenges persist despite modest improvement

While the temporary improvement in affordability is a welcome change, the report highlights that it only makes a small dent in the overall loss of affordability that has occurred since mid-2020. Middle-income households in cities such as Vancouver, Victoria, Toronto, Montreal, Ottawa and Halifax still face significant challenges when it comes to affording a home. RBC’s local affordability measures indicate that conditions remain tougher than usual across the country.

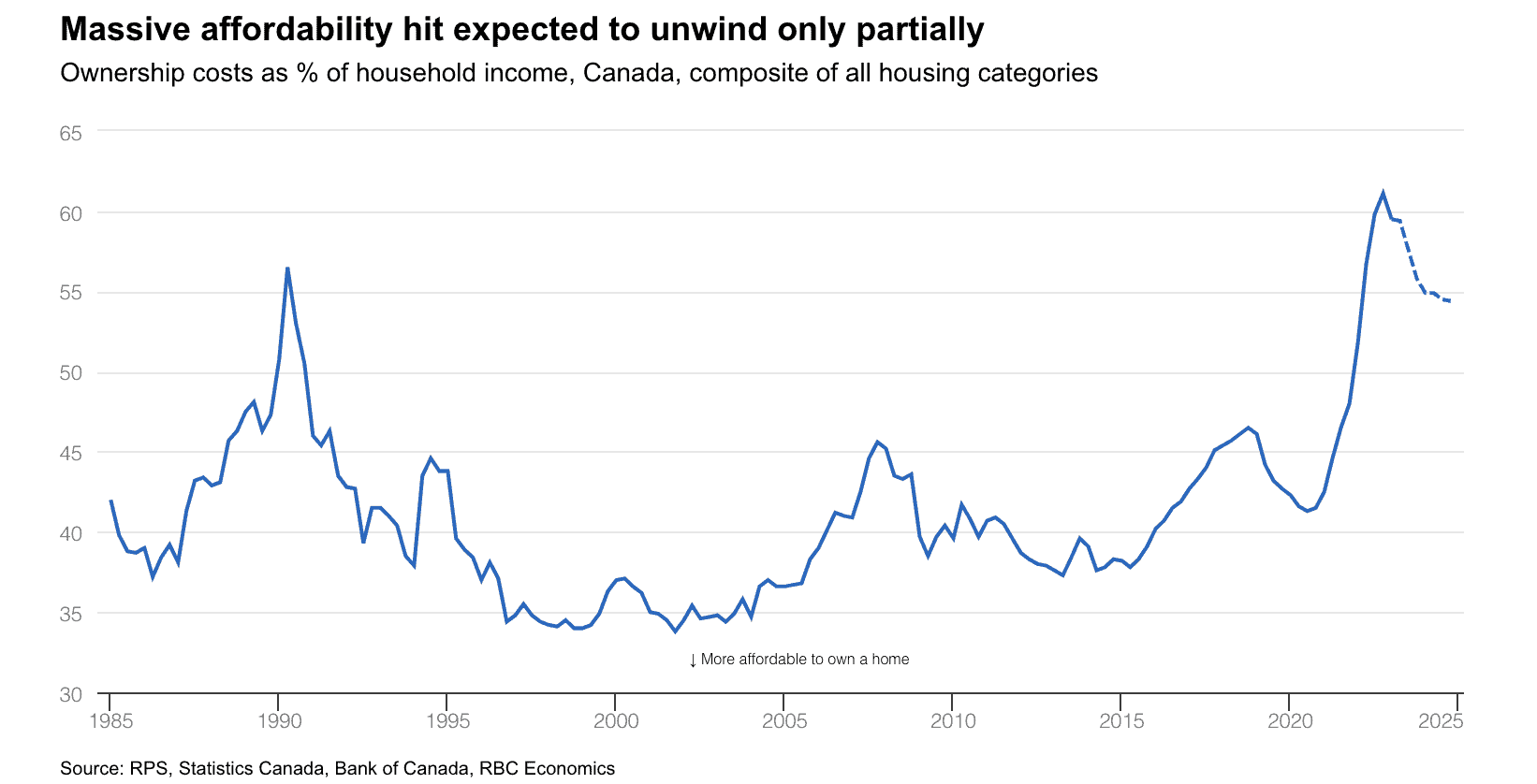

Market rebound raises concerns about affordability

Despite expectations that the housing market would take longer to recover, Hogue notes the surprising rebound in demand and a tightening of supply in many parts of Canada, including Ontario and British Columbia. He says this could potentially put upward pressure on prices, reversing the recent improvements in affordability.

The Bank of Canada’s return to hiking interest rates could further impact affordability, although the report’s forecast suggests that a moderate rate increase could help restrain demand and keep affordability on an improving track.

Regional insights: Victoria, Vancouver, Calgary, Edmonton, Saskatoon, Regina, Winnipeg, Toronto, and Ottawa

The report provides insights into specific regional housing markets in Canada:

- Victoria: Affordability improved slightly, but the market remains the third least affordable in Canada. Rising prices could limit further affordability gains.

- Vancouver: Affordability showed a small improvement but remains extremely unaffordable. Resale activity has picked up, but the market’s recovery may be limited by extreme unaffordability.

- Calgary: The market has remained relatively strong compared to other major cities, with higher resale activity and stable prices. Its affordability advantage continues to attract buyers.

- Edmonton: Affordability improved slightly, but price declines and tighter demand-supply conditions may limit further improvements. Positive economic prospects support the market.

- Saskatoon: Ownership costs dipped, leading to a rebound in market activity. Affordability remains relatively favourable for buyers.

- Regina: Affordability improved in the first quarter, but rising resale activity and prices may hinder further improvements.

- Winnipeg: Affordability showed signs of recovery after a significant shift in market conditions. Further improvement and recovery are expected in the near term.

- Toronto: Affordability remains deeply unaffordable, despite a small improvement in the first quarter. Increased sales transactions have tightened demand-supply conditions and raised prices, potentially slowing down affordability restoration.

- Ottawa: Affordability remains challenging, with minimal improvement in the first quarter. Recent activity recovery needs to be sustained to make a significant impact on affordability.

Read the full report, including detailed regional breakdowns.