Canada’s real estate market has been experiencing unprecedented changes in recent years, partly driven by the surging population. The country is now home to 40 million people, after hitting the milestone this year, and the federal government’s plan to welcome an additional 1.5 million immigrants by 2025 has set the stage for a significant demographic shift.

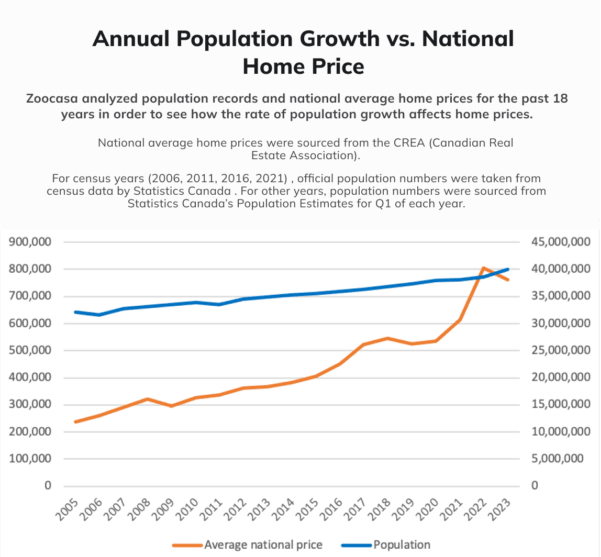

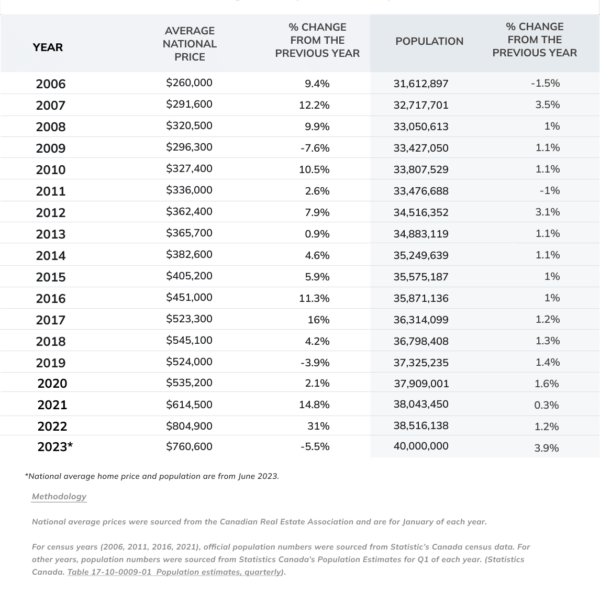

Historically, population growth has played a role in home prices, as more people require housing. Zoocasa looked closer at the relationship between population growth and home prices and analyzed data from Statistics Canada census records, population estimates, and CREA’s benchmark prices spanning the past 18 years.

The findings reveal a clear correlation between population growth and home prices, though the impact is not always immediate or proportional. As Zoocasa notes, home prices are influenced by a myriad of factors, including economic cycles, government policies, and interest rates, in addition to fluctuations in population. However, the rising demand for homes resulting from population growth contributes to an already limited supply, putting upward pressure on prices.

National home price growth outpacing population

In 14 out of the past 18 years, national home price growth has outpaced population growth by a significant margin, often doubling or even tripling the population growth rate. While population growth has been relatively steady, hovering just above one per cent most years, “national home price growth has been much more volatile.”

One standout year was 2022, during which Canada witnessed a record-breaking influx of immigrants and experienced a staggering 31 per cent increase in the national average home price compared to 2021. However, 2023 took a different turn, with a 5.5 per cent drop in the national home price, despite immigration reaching a new record of 3.9 per cent year-over-year growth, though rising interest rates likely played a significant role in the price decline.

Long-term outlook: home prices and population growth on the rise

Despite occasional price drops, the long-term trend suggests that home prices and population growth are likely to continue their upward trajectory, particularly in major metropolitan areas like Toronto, Vancouver and Calgary, which attract the majority of newcomers. This is a vital consideration for potential homebuyers, as waiting for a significant downward trend in prices might not be realistic.

Zoocasa’s analysis also highlights that the largest drop in the national average home price in the past 18 years occurred in 2009, during the Financial Crisis, when prices fell by 7.6 per cent. However, prices quickly rebounded, and over the subsequent years, housing affordability worsened due to population growth.

Zoocasa is now owned by EXP.

First it was Rogers with no experience commenting on our MLS data.

Then is was Penelope Graham with no experience commenting on our MLS data.

(she was a BNN star like the other no experience realtors they cite from Toronto and Vancouver who cause us on the ground so many problems daily)

Now it’s EXP who refuses to allow any of its realtors to comment on our MLS data but still issues the report causing fellow realtors to have explain how bad the report actually is.

At least Remax, Royal Lepage and Sothebys use spokespeople for their reports who are not realtors allowing us to discredit them without violating the code of ethics.

At the end of the day, people have to pay for and be able to afford a house/dwelling; there is no affordability if you strip out equity from sale by existing homeowners; they are the only demographic that can afford a house. Are the price increases sustainable?

It’s common sense that if you increase demand without increasing supply then price will go up. We don’t need a biased and bogus study to tell us that. The study is lacking in so many places and there is no “clear correlation” as mentioned above. The angles of the lines are different, and prices in the chart do not follow the same increases in population. The study mentions other factors but disregards them at the same time. I think low interest rates had more to do with the spike in home prices than population over the last few years. If you’re going to do a study, do it properly, not haphazardly.