A decade can bring significant changes to any landscape, and the Canadian real estate market is no exception.

In a recent blog post, Zoocasa delved into the evolution of the Canadian real estate market over the past 10 years.

In 2013, the country was still recovering from the aftermath of the global financial crisis, and buyer sentiment was cautiously optimistic. Fast-forward to 2023, and the market is adapting to the post-pandemic era, facing interest rate hikes and shifting demographics.

Prices: A tale of two markets

Then: Consistent price growth

A glance back to 2013 reveals a real estate market characterized by steady price growth. CREA reported an average national price of $365,700 in January, a slight dip from the previous year’s peak. Throughout the year, prices climbed, culminating in a 4.1 per cent increase to $380,600 by December. While these figures might seem modest in hindsight, they marked a historic high at the time.

According to the Bank of Canada’s Housing Affordability Index, unaffordability increased from Q1 of 2013 to Q4 of 2013 and has since never gone as low as in Q1 of 2013.

Regions like Greater Toronto and Metro Vancouver experienced predictable price growth, with benchmarks rising by 6.8 per cent and 4.7 per cent, respectively, over the same period.

Now: Prices stabilizing after pandemic spike

In stark contrast, the past few years have witnessed remarkable price volatility. After surging to $855,800 in March 2022, the national average price plummeted, bottoming at $705,000 in January 2023 — the lowest since August 2021, according to CREA.

A resurgence of buyer confidence and limited inventory since fueled a rebound, driving prices to $760,600 by June. The rollercoaster ride of recent years seems to be settling into a more stable pattern, hinting at a future of measured growth. The recent cooling off in price inclines can be attributed, in part, to interest rate hikes by the Bank of Canada.

Changing demographics

Then: Homebuyers drawn to urban centres

A decade ago, the allure of urban centers such as Greater Vancouver, Greater Toronto, Calgary, and Hamilton-Burlington drew prospective buyers, despite the lingering effects of stricter mortgage lending guidelines. Low-interest rates and affordable mortgage payments incentivized first-time homebuyers, contributing to a moderate resurgence in the market.

Now: Newcomers and first-time buyers creating demand

Today’s real estate landscape tells a different story. Record immigration has propelled Canada’s population to 40 million, intensifying the demand for housing. As inventory dwindles, competition among buyers heats up, pushing prices higher. Additionally, a wave of first-time buyers has entered the scene, encouraged by adjusted interest rate expectations and a preference for affordability and spacious living spaces, fostering interest in smaller maritime cities and the prairies.

Mortgage rates: From favourable to challenging

Then: Interest rates at historically low levels

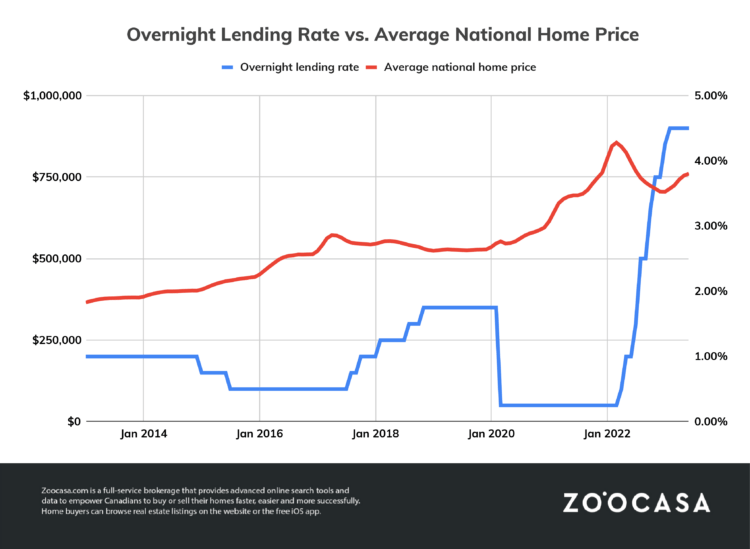

In 2013, historically low-interest rates prevailed, creating favourable borrowing conditions. The overnight lending rate remained at 1.0 per cent until 2015 and didn’t exceed 1.25 per cent until 2018. Such conditions provided variable-rate holders with advantageous terms, while fixed-rate holders faced slightly higher rates.

Now: Highest borrowing costs in more than 10 years

A shift in the economic landscape, precipitated by the pandemic-induced price surge and rising inflation, has led the Bank of Canada to raise interest rates multiple times since 2022. The overnight lending rate currently stands at 5.0 percent, significantly impacting mortgage affordability. Fixed rates have also climbed, with the average 5-year fixed rate reaching 6.79 per cent. While present borrowing costs pose challenges, historical patterns suggest that rates may gradually decrease in the coming years.

House type: The enduring appeal of condos

Then: Condo boom

In 2013, apartments, particularly in Vancouver and Toronto, dominated new construction as demand for affordable housing surged. Condo sales enjoyed robust growth, reflecting a preference for these more attainable properties.

Now: Condo demand remains hot

Fast-forward to 2023, and condos continue to hold the market. First-time buyers, who largely remained on the sidelines in the preceding year, are flocking to condos as an entry point into homeownership. These properties offer an affordable gateway into the market, especially in smaller cities and regions. In Toronto and Vancouver, condo apartments have demonstrated impressive year-over-year growth, reflecting sustained demand.

2012-2022 is where we all know the change happened but apparently exp doesn’t?

We could excuse Penelope and Heather for their totally irresponsible reports because they had no experience in the business but exp the current owner of Zoocasa should know better.

Then:

No Benchmark Price

Now:

Benchmark Price and since 2019 all the hold out boards finally caved and began releasing it.

Then:

NO FSBOs counted in Sales

Now:

FSBOs totally counted

Then:

Single Homes were often posted 3 to 6 times increasing inventory counts and MOI

Now:

Down to Double and only then it three specific markets rendering old/new comparisons a violation in Ontario.

Then:

Under Listing Strategy was well know as Deceptive Advertising

Now:

Joe lets every one do it and the consumer is at their mercy

Then:

The Common Average Commission Charge was $21,000

Now:

The Common Average Commission Charge in 2022 was $46,000

Then:

Undisclosed Dual Agency was legal

Now:

Undisclosed Multiple Multiple Agency will become legal in Ontario on December 1st this year.

Our industry must change. Sooner than later these types of comparisons will be targeted by governments as the housing crisis only will get worse.