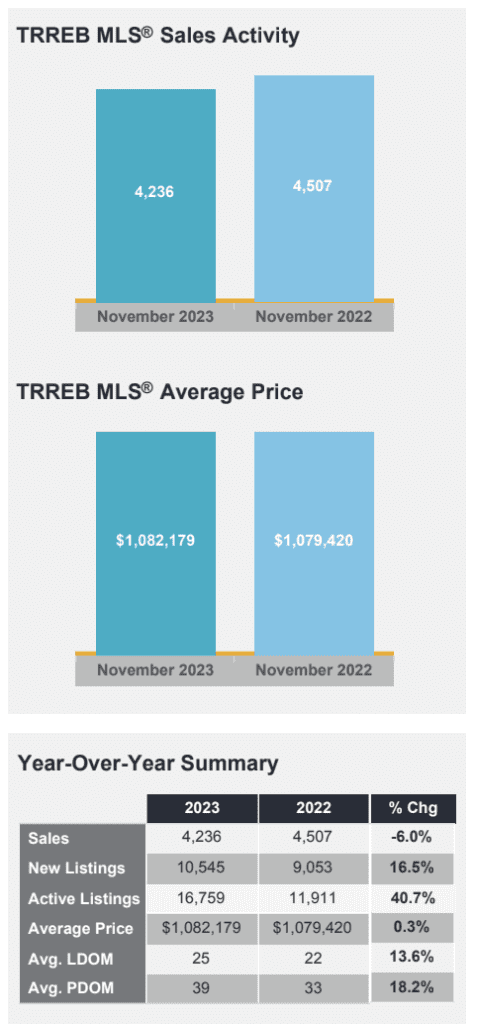

The Great Toronto Area (GTA) real estate market remained in a slump in November. Monthly sales reached numbers not seen since 2008, a year in which just 3,640 properties sold in November on the Toronto real estate board.

This year, the market saw 4,236 homes sell in November – 16 per cent more than in 2008. While this gap seems significant, in 2008, the population was 5.309 million. The area’s population is up 20 per cent in the same period, presently 6.372 million. So, when you account for population growth, the per capita sales number is technically worse than one of the lowest months of sales volume experienced during the 2008 recession.

The worst is yet to come

Given that sales typically reach their lowest point in December and January, it’s likely that the real estate market will reach comparable lows to 2008, fulfilling its cyclical bottom in sales volume over the next few months.

While price recovery can take a few years to catch up, volume does usually begin to recover after reaching this bottom, meaning that the real estate industry could expect a much-needed growth in earnings. When looking at the entire year of real estate sales, we will likely finish 2023 with sales numbers as low as in 2001. When looking at population growth since then, there’s a solid chance that we see a record-low number of homes sold per capita.

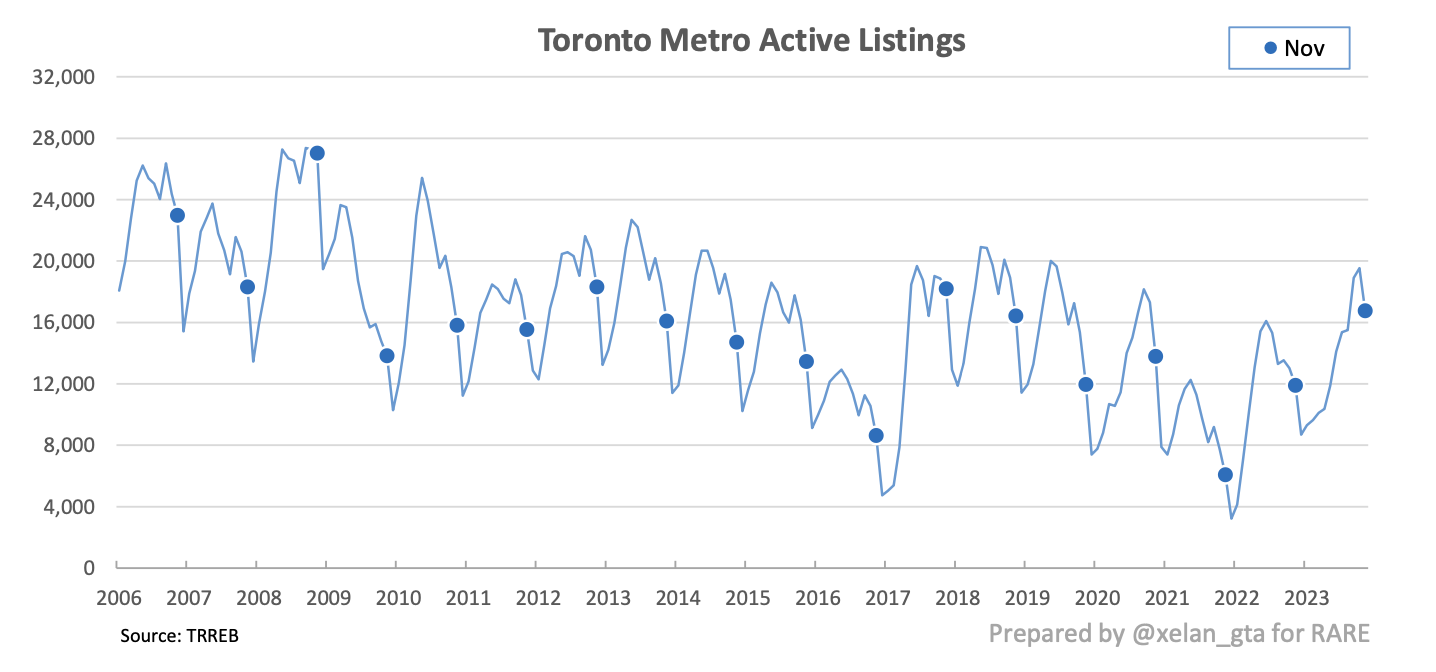

Supply easing

While the market has been pretty oversupplied in the past while, both new listings and active listings started their typical seasonal downtrend.

It wasn’t enough to move the market balance back toward sellers’ market territory, so the market remains in favour of buyers as we head into the slowest months of the year. Given that new listings and active inventory both also see their lowest levels in December and January, we will likely need to wait until the spring market to determine whether or not we’ll see 2024 fall into buyers’ market or sellers’ market territory.

Price pressure

As expected, this sustained negative state of the market has put downward pressure on house prices in the GTA. All metrics for house prices declined in November, and the market now sits roughly 20 per cent below its 2022 peak values.

Source: Toronto Regional Real Estate Board

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.

In the Market Stats Menu, you’ll find that 3.601 Terminate & Re-Lists were tracked by the TRREB algorithm last month (same property, same Owner, same LBO, within the original Listing period).

If you subtract that 3,601 from the published 10,545 New Listings you have 6,944 Actual NET-New Listings.

With 4,236 reported Sales the “SNLR” is 61.00%

If 60%(or 65%) is Seller’s Market then this is ‘on the cusp’.

No wonder active Buyers think that there is nothing for sale and say “many of the “New Listings” on the Hot Sheets – I’ve already seen”

I believe the year will end with about 70000 sales at Trebb. And with 70000 agents the math is pretty scary.

We’ll be lucky to get 65000 sales for this year

Will be interesting to see how that 70,000 treb members number changes after January 15th when the $2000 invoice comes due

To simplify. The market will continue to decline due to higher interest rates, high consumer debt, and the fact that there are few buyers. To have a Buyers market you need the buyers. As consumers in negative amortization situations are now being forced to sell or pay higher monthly payments, the banks are on edge. I have no doubt the banks are sitting on many properties that are in power of sale situations. Owners with zero equity due to HELOCS as well as mortgages. But they cannot flood the market as they are still trying to keep real estate values high. Real Estate values could easily drop another 20-30%. Then the reality sets in. All levels of Government talk about affordable housing but they cannot provide affordable housing because so much debt or loans are in Real Estate. Bad situation. I believe Canada is in for an American style 2008.