Canadians may have become used to unprecedented irregularity in the real estate market, but things may be headed toward normal conditions next year, according to Royal LePage.

Its Market Survey Forecast reports that in Q4 of 2024, the aggregate home price will increase by 5.5 per cent year over year to $843,684, with the median price of a single-family detached home and condominium increasing by 6 per cent and 5 per cent to $879,164 and $616,140, respectively.

“Looking ahead, we see 2024 as an important tipping point for the national economy as the majority of Canadians acknowledge that the ultra-low interest rate era is dead and gone,” Phil Soper, president and CEO of Royal LePage, notes. “We believe that the ‘great adjustment’ to tolerable, mid-single-digit borrowing costs will have a firm grip on our collective consciousness after only modest rate cuts by the Bank of Canada.”

Home prices to rise in all Canadian markets, Calgary in the lead

The company expects home prices to rise next year across all major Canadian markets, with Calgary set to see the most gains, at 8 per cent. Over 2023’s second half, this city has gone against the trend of falling prices, with rising prices, instead.

Royal LePage forecasts the aggregate home price at the end of next year in the greater regions of Toronto and Montreal to be 6 per cent and 5 per cent, respectively, above 2023’s last quarter. Greater Vancouver is expected to see an increase of 3 per cent.

All depends on Bank of Canada holding back

This forecast is based on the assumption that the Bank of Canada is done with its interest rate hikes and that its key lending rate will stay at 5 per cent over the first half of next year.

Small rate drops are expected in late summer or fall of 2024, and several financial institutions are already offering fixed-rate mortgage discounts.

“For the last year, many Canadians have been fixated on the idea of interest rates needing to come down significantly before they can afford to enter or re-enter the housing market. Acceptance that a mortgage rate of 4 to 5 per cent is the new normal should untether pent-up demand as first-time buyers, flush with savings collected during the extended down market in housing, regain the confidence to go home shopping. And, with the return of first-timer demand, we expect families who have put off upgrading their homes to begin to list their properties in much greater numbers,” Soper continues.

“Canada’s real estate market has been on a roller coaster ride for the last four years”

During the past year and a half, most of the country’s sales activity has declined, with inventory gradually increasing. Though in some areas transactions are down as much as 20 or 30 per cent, home prices have decreased only modestly at the same time (though are still above 2022 levels), because of simultaneous lower demand as prospective buyers hold out for lower interest rates.

“Canada’s real estate market has been on a roller coaster ride for the last four years. A global pandemic briefly brought market activity to a grinding halt in early 2020, followed by a rapid, widespread spike in demand and price appreciation as Canadians sought safety and greater living space in their homes among a world of uncertainty. By the spring of 2022, home prices had reached unprecedented highs, but when interest rates started rising quickly and steeply to combat inflation, the extended market correction began,” says Soper.

“Markets take time to adjust. We see a move toward typical home sale transaction levels in 2024, and as the year progresses, appreciating house prices.”

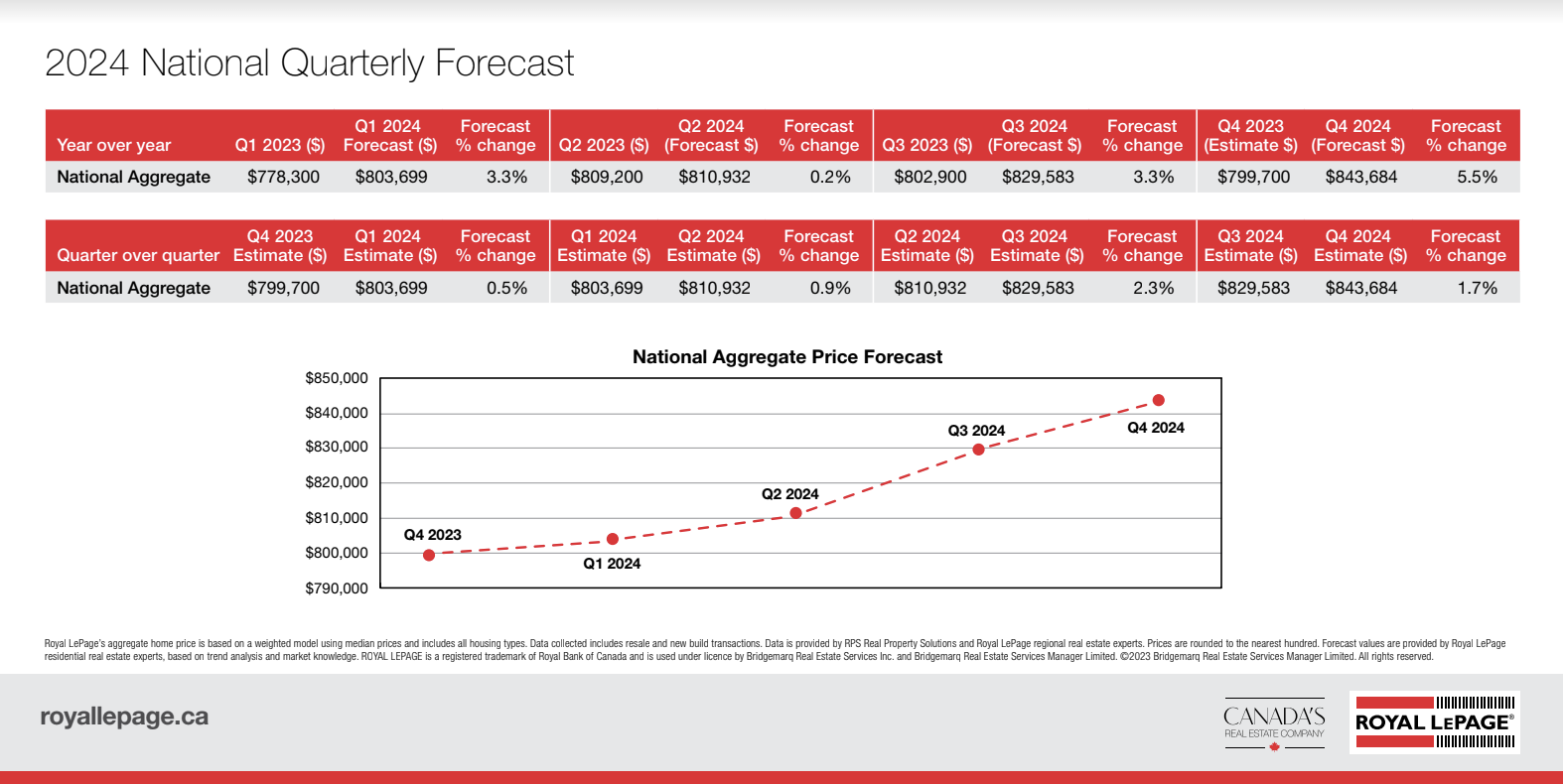

National quarterly forecast

Nationally, Royal LePage expects home prices to go up slightly over the first half of 2024, and then more so over the next half, after the Bank of Canada’s anticipated interest rate cuts.

A home’s aggregate is thought to be 3.3 per cent higher in Q1 next year compared to the same 2023 quarter, a 0.5 per cent increase over the fourth quarter of 2023. In Q2 of next year, it’s forecast at 0.2 per cent higher year-over-year and 0.9 per cent above the previous quarter. In the third quarter, prices are expected to be 3.3 per cent higher year-over-year and 2.3 per cent higher quarterly. Finally, in 2024’s fourth quarter, the national aggregate home price should be about 5.5 per cent above the same quarter of this year, an increase of 1.7 per cent quarter-over-quarter.

By 2024’s end, based on this forecast, home prices will have gone back to their pandemic peak from the first quarter of 2022.

Read the full forecast, including individual market summaries, here.

Love the optimism. In over 25 years I have yet to hear a Realtor ever say the market will continue in decline as jobs become an issues and Canadians barely meeting their financial obligations on a monthly basis. Or the fact that Canadians have gone from having excess cash in the billions during the pandemic to now living on credit. Yes those billions have evaporated. Or the fact with high real estate values and a prediction of values increasing that first time buyer’s will never be able to save up for a down payment. IMO the market will continue in decline as mortgages become due and consumers will be forced to sell because as they will not qualify or do not want to pay the increased monthly payments. Weather or not they have accepted mid single digit interest rates. But alas they have bought at the peak of the market so selling will be difficult, as we are seeing now with continued high asking prices, and they will have to sell at an extreme loss or just walk away from the property. It is more likely that power of sales will increase, bankruptcies will increase , employment will decline ( due to a falling real estate market) and Canada will be in the 4th quarter of a recession. Canada has been in a recession since the spring of 2023. Feds will not admit this as they skew numbers, But the Liberals have sunk Canada into the septic system with their policies and accumulation of debt. The U.S is now lowering interest rates as the enter an election year. Typically Canada would follow suit. Hence the reason many Canadians time their mortgage renewals with the American election cycle. HELOCs are another problem facing Canadians. These lines of credit attached to their residence will dilute any equity in that property making it even more difficult to sell. Based on a more realistic market conditions 2024 will be a very difficult year for the real estate market as well as Canadians.

agree 100% with the above comment! right on, D O Reality.

Please stop misleading and don’t create any hype in the market . Talk to Bank of Canada to bring interest rates back to affordability to all Low and Middle income people families. Also look around the world all kind of wars , food cost , Car thefts, hike insurance rates and unlimited list , before you can think of normal Real estate market.

How many builders are in receivership and how many people either selling underprice or assigning their pre-constructions with loosing full deposit.

Think seriously before you provide any comments or suggestions to the public.