The Canadian real estate market is in a recession — a place it’s been for well over a year now. This means that the amount of earnings available within the industry has been in contraction, regardless of what’s happening elsewhere in the economy.

As acknowledged by Jon Flynn, one of the most popular YouTubers in Canadian real estate, Canadian home sales have been below the 10-year moving average for a record amount of time now, trending down again 0.9 per cent in November.

The bright side

Since I always get flak for being too pessimistic, let me try to find the silver lining here. It’s worth noting that in a typical seasonal sales cycle, sales trend down into December, with this month and January being the slowest months of any given year for home sales, due to the holidays.

So, on the bright side, it’s possible that December 2023 and January 2024 could mark the absolute bottom in sales volume for Canadian real estate — meaning that volume recovery could start thereafter.

In historic Canadian real estate cycles, volume recovery typically precedes price recovery by 12-16 months. Based on this assumption, we could expect to see house prices find a bottom sometime in 2025 and begin recovery into 2026, barring any massive black swan events in the Canadian or global economies.

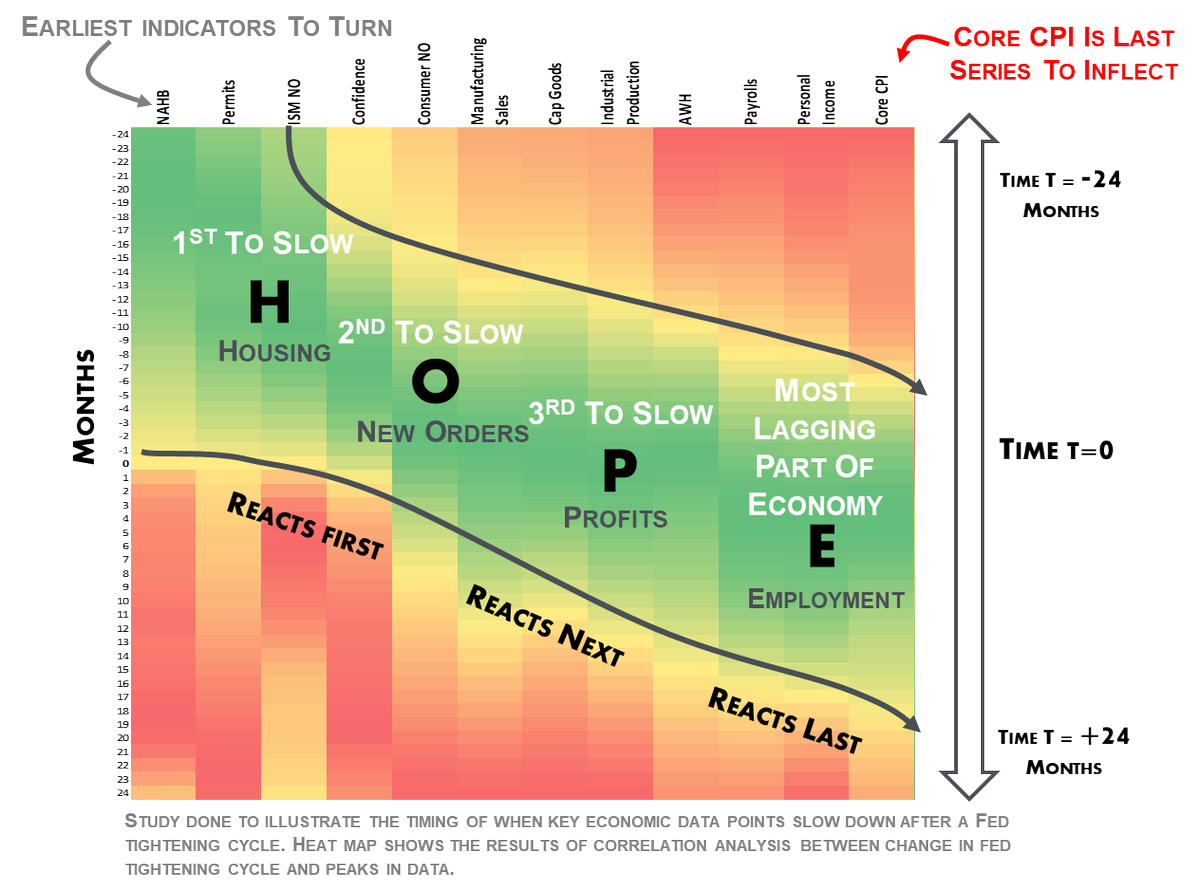

Based on economist Michael Kantro’s HOPE model for economic downturn and recovery, we can expect what we’re seeing in the housing market can and will materialize in economic contraction across the Canadian economy.

By the same token, this model also has us expecting housing would lead the economy’s recovery once the contraction is over — something to possibly look forward to in our profession.

Setting expectations

The reality is the last time we saw a counter-cycle this powerful in Canada’s housing market was in the 1990s and, in that period, we saw a massive exodus of real estate professionals from the industry. During the recovery phase, it took over 10 years to reach the previous nominal house price peak (from 1989 to 2002).

But, after 1995, when volume and price started to recover, there were significantly fewer real estate professionals trading during the recovery than during the downturn. History tells us that the professionals who can weather the storm will have a more opportune market during recovery.

Tapped out

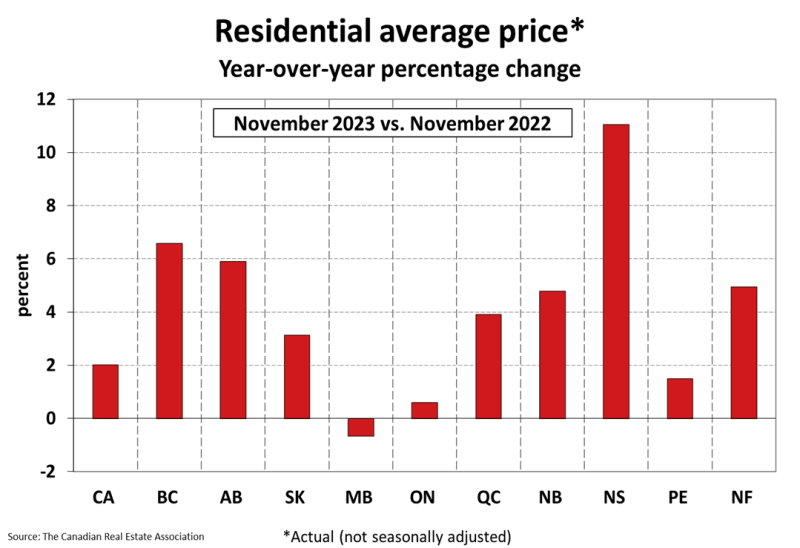

Consequential to the volume story, it appears that price growth is tapped out in Canadian real estate. And, although year-over-year prices are up in most provinces, this trend should be expected to reverse next year based on the data we see in front of us.

Prices are up year-over-year in most markets because November and December 2022 fell at the tail end of the largest price drop in Canadian history, coming off the peak in Q1 2022 that coincided with the Bank of Canada’s rate hiking cycle.

Now, we can see the price growth trend reversing, with prices trending down on both metrics (HPI and Average) for several months now:

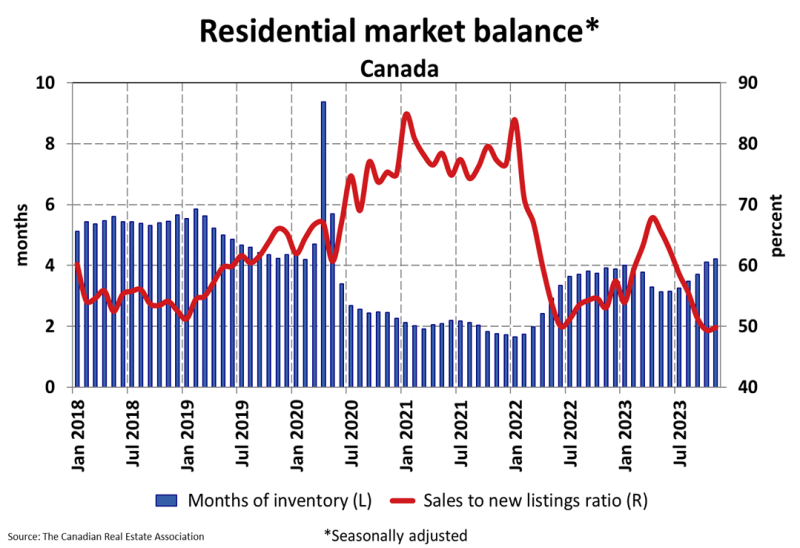

Saved by the sell

The only saving grace is that supply is no longer outpacing demand. Inventory is continuing to pile up, with months of it climbing further into buyers’ market territory, but the sales-to-new-listings ratio has reversed itself, which illustrates that sellers are no longer flooding the market with supply against decreasing prices and decreasing sales volume.

With all of this being said against two slow winter months ahead, we will likely now need to wait until spring 2024 to see whether or not the Canadian real estate market will spend 2024 in a buyer’s market or a balanced market.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.

Too bad that you are continuing to ignore the 50% bloat (of Re-lists being double counted) in the TRREB New Listings (a huge component of the CREA stats).

You have a great platform here and could be the “revealer” of a great truth.