For both singles and couples, getting into the market for the first time can be a huge challenge these days, particularly in 16 major Canadian cities with benchmark home prices well above $1 million.

A study from Point2 found that all hope is not lost though. It says that in some markets, both single and coupled-off first-time buyers have a nearly equal shot of buying a home without breaking the bank.

Here are the study’s main findings.

Savings disparities

It takes significantly longer for single homebuyers to save for a starter home compared to couples. The nationwide average saving time is around four years for couples and 29 years for singles.

The required time also varies widely across Canadian cities, ranging from three to 75 years for single buyers to cover an affordable bank loan for a starter home. Couples might take about two years in 11 of the country’s largest, most affordable cities.

City disparities

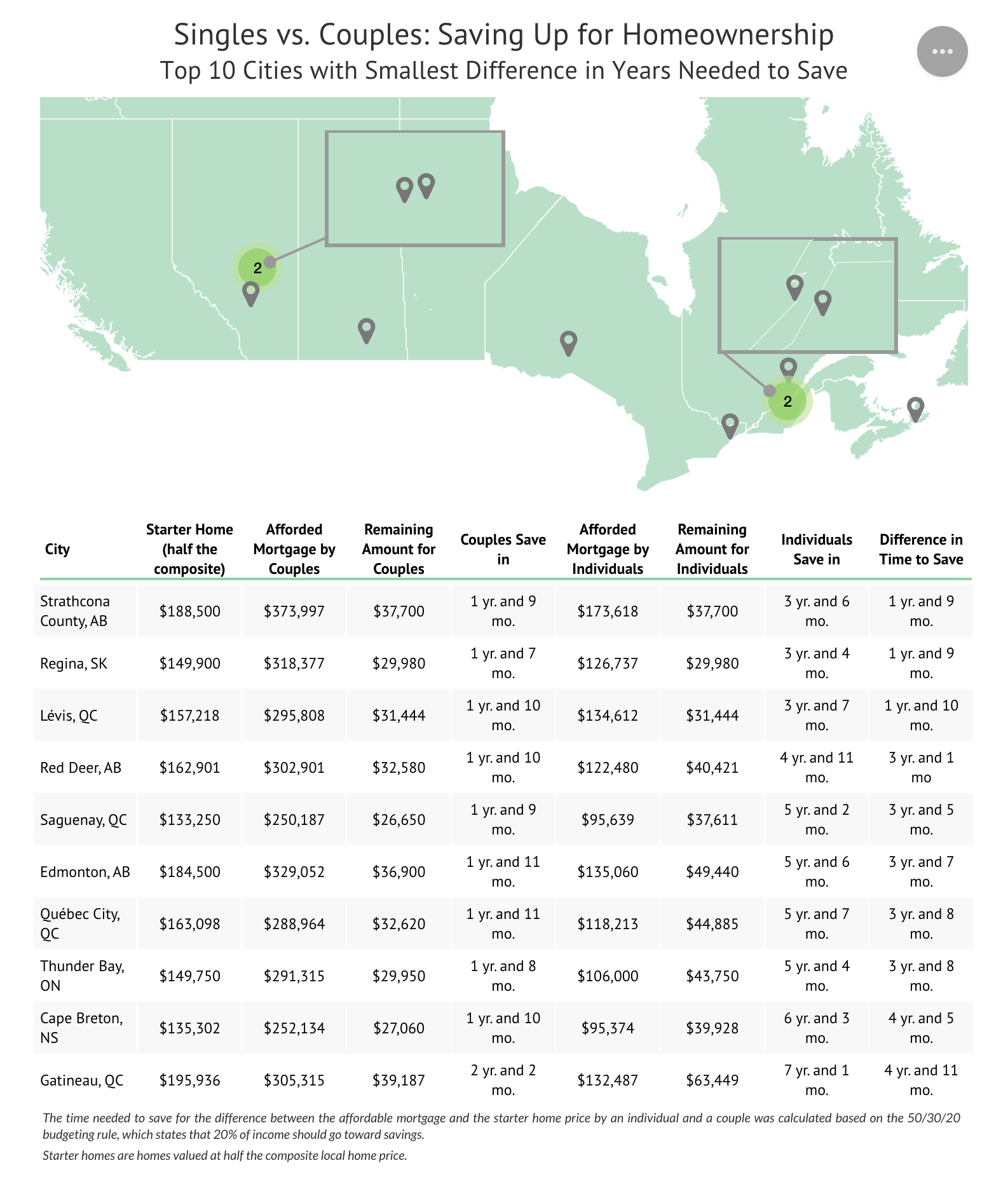

Some cities, like Strathcona County, Alberta, Regina, Saskatchewan and Lévis, Quebec, show minimal gaps in saving time between singles and couples, making homeownership achievable for both groups in a relatively short time.

Source: Point2

Conversely, some Ontario cities, like Richmond Hill, Newmarket and Vaughan, have significant gaps in saving timeframes, making it much more challenging for single buyers to save for a home compared to couples (possibly up to 50 years longer).

Income disparities: A catch-22

The disparity in incomes between cities affects the ability of buyers to save, with high-income cities also having the most expensive homes.

And, although many couples can technically save faster than singles, they would also need to spend more on a larger home to accommodate two people.

High prices, low incomes in cities with $1 million+ prices

Cities with home prices exceeding $1 million (16 of them) pose significant challenges for both single and coupled homebuyers, limiting their options and making finding a starter home difficult.

Starter home scarcity

The scarcity of starter homes in highly populated urban centers adds another obstacle for first-time buyers looking to enter the housing market.

Read the full study here.