Buying a condominium might be easier than purchasing a single-family home, especially for first-time buyers. Traditionally, two incomes are better for achieving homeownership dreams. However, a new trend is emerging among Canadian homebuyers, as a recent Point2 survey reveals.

It found that four in 10 Canadian renters are willing to apply for a mortgage alone. What was once the norm — applying for a mortgage with a spouse — is now taking a backseat to solo home buying.

Andra Hopulele, the writer of the study, emphasizes: “Young adults and single people are starting to separate two ideas that truly seemed inseparable: Buying a home doesn’t necessarily mean they need to find a partner and get married, and getting or being married isn’t a prerequisite for home ownership. Although the reasons vary depending on the generation, the number of Canadians living alone is increasing, and they are increasingly becoming comfortable with the idea of taking up the challenge of home ownership on their own.”

Here are some generational highlights from the study:

Most generations

42 per cent of renters across all generations except one are considering applying for a mortgage alone. High home prices are cited as the main obstacle (39 per cent), followed by concerns about down payments (27 per cent).

Gen Z and Millennials

Gen Z, the youngest renters, are ambitious: 72 per cent plan to buy within the next 12 months, with many having saved up to $30,000. 57 per cent of younger Millennials want to buy within a year, and 76 per cent have saved up to $50,000, while half of their older Millennial counterparts still prefer buying with a spouse. This group is slightly more concerned about down payments (35 per cent) than high home prices (34 per cent).

Gen X and Baby Boomers

47 per cent of renters aged 45-54 (Gen X) want to buy alone but are more worried about their credit scores than other age groups, while Baby Boomers (those over 60) are looking for smaller single-family homes and are mostly unsure when they will make the move.

The shift in homeownership: Young adults and singles

Young adults and single people are redefining homeownership. Marriage is no longer a prerequisite for buying a home. This is evidenced by the increasing number of Canadians living alone who are comfortable taking on homeownership by themselves.

Despite worries about rising home prices and high mortgage rates, renters’ desire to own a home remains strong. Student debt is the least of their concerns, even though a bachelor’s degree often comes with significant debt.

In a culture valuing autonomy, significant life decisions are increasingly seen as individual pursuits. This includes applying for a mortgage.

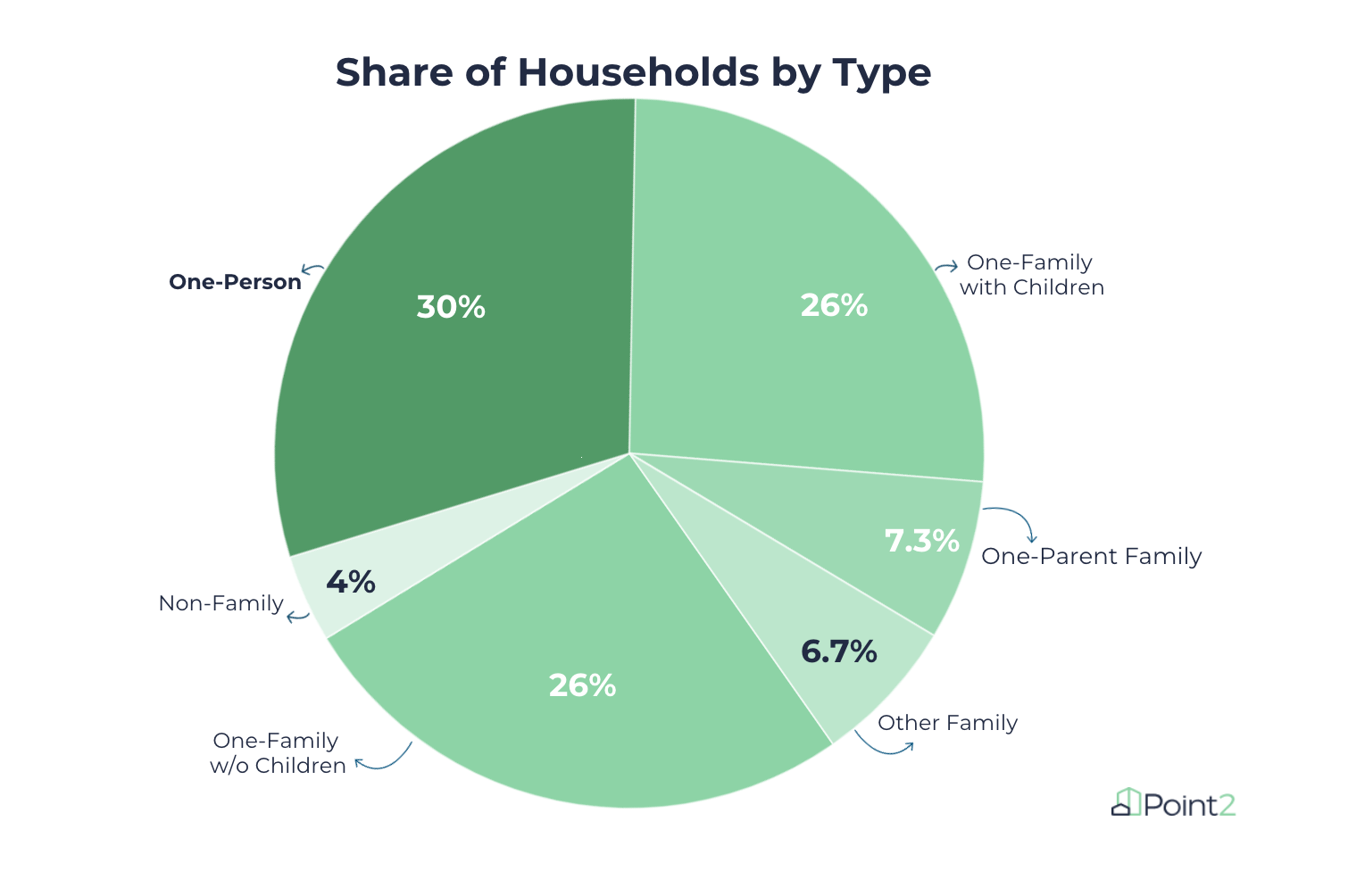

According to Statistics Canada, single-person households are the most common household type (30 per cent) for the first time in history, and the number of these households has more than doubled since 1981.

The new homebuyer has ambitious goals

The survey found that eight out of 10 Canadian renters aim to buy a single-family home, particularly of a large size. Both the youngest renters and Baby Boomers over 65 show strong determination to purchase within the next 12 months.

Gen Z and Baby Boomers are particularly determined. Many have significant savings set aside for a down payment. Despite the competitive housing market, Canadian renters are not deterred. They are committed to achieving homeownership, even if it means doing it alone.

This is only applicable if people bought pre 2020 for low, gained equity, OR had the bank of mom and dad for that 100k down payment. Average income is 50-ish thousand a year. On that you get a mortgage of about 275k. The average home is triple that. This is delusional and not everyone’s reality.

I am not sure a point2survey is very accurate. Or how a single person could afford to buy a single family home particularly of a larger size! Or why a single person would even need a single family home of a larger size. I mean the description “single family home” really defines the property type. The increase in singles illustrates the changes in society over the decades. There was once a time when women did just get married and the dream of a family , and the man was the one that applied for a loan. I believe there was once a time when a female could not even apply for a mortgage! Archaic by today’s standards. None of this survey seems to make any sense or connects any dots representing society today.