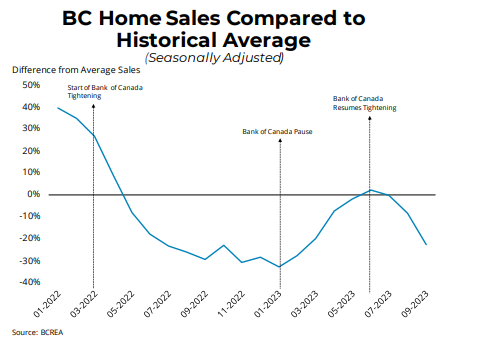

British Columbia home sales have been hit by the interest rate hikes the Bank of Canada reignited in June. According to the British Columbia Real Estate Association (BCREA), the province’s average home price went up by 4.9 per cent last month, compared to September 2022.

BCREA Chief Economist, Brendon Ogmundson, reports, “Home sales in BC have clearly been impacted by the Bank of Canada’s recent tightening of interest rates, along with the resulting surge in mortgage rates.”

He says sales are trending at below-average levels, again, and high borrowing costs are causing challenges and struggles for buyers.

How September fared

B.C. homes sold in September for $966,500 on average, which is a 4.8 per cent jump year-over-year (and about the same as August).

5,531 home sales were made last month, which is seasonally about 20 per cent below normal. Ogmundson points out that even though sales were about 10 per cent higher than September 2022, “ … that month was a low point for sales last year.”

Sales price and volume

The association reports that total September sales was about $5.3 billion, nearly a 16 per cent jump from September the prior year.

Compared to that same period, year-to-date sales volume went down by 15 per cent, to nearly $58 billion.

Unit sales also decreased by 11.5 per cent, to 59,570 units, while year-to-date average price dropped 4 per cent to $972,049.

Active listings and inventory

The province saw active listings up a bit month-over-month to more than 33,000 total and about 8 per cent up year-over-year. In fact, total inventory is the highest it has been in three years.

B.C.’s sales-to-activity ratio sits at about 17 per cent, with Victoria being the only market above 20 per cent.

Ogmundson points out that as sales slow and listings rise, we’re getting into balanced market territory. However, for B.C. to see a sustainably balanced market in the long run, active listings would need to increase by more than half.