In the ever-turbulent waters of the Greater Toronto Area (GTA) housing market, February 2024 emerged as a month where hope springs eternal for both buyers and sellers — or so the narrative goes.

Small sales and listings boost last month

According to the latest press release from the Toronto Regional Real Estate Board (TRREB), there’s been a quaint uptick in home sales and listings on both an annual and monthly basis, with selling prices making a shy nod upwards compared to the year prior.

This is ostensibly buoyed by population growth and what’s described as a “resilient” regional economy — phrases that seem to gloss over the ongoing saga of individuals grappling with the reality of higher borrowing costs, a souvenir from the Bank of Canada’s rate hikes.

With a market allegedly looking forward to rate cuts, Wednesday’s hold from the Bank of Canada could be a bit of a punch in the gut. Furthermore, the governor’s hawkish tone during their press release and a revisiting of their concern that rates could heat up the housing market seems to make it clear that rate cuts are not coming anytime soon.

Can the strength of the spring market survive without rate-cut optimism? Let’s look at the data.

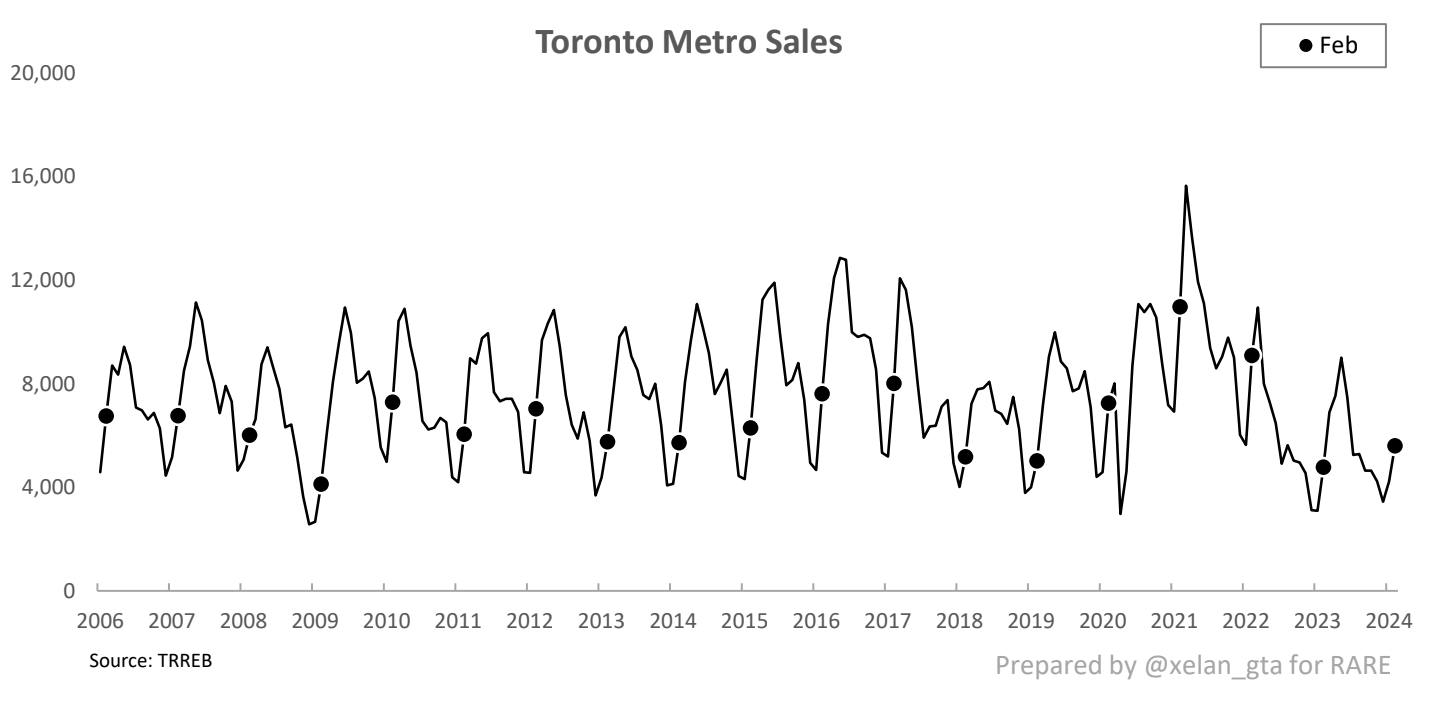

Demand (home sales)

5,607 homes sold in the GTA on TRREB’s MLS system in February, a 17.9 per cent increase from a year prior. Coincidentally, this is almost exactly in line with TRREB’s prediction that we’d see an 18 per cent jump in home sales volume this year, or an expected increase from just over 65,000 sales in 2023 to 77,000 sales this year.

Demand looks stronger for product under $1 million, which is the cutoff for mortgage insurance products like CMHC. As a result, it seems like mortgage insurance has cemented the price floor in many markets, by concentrating buying.

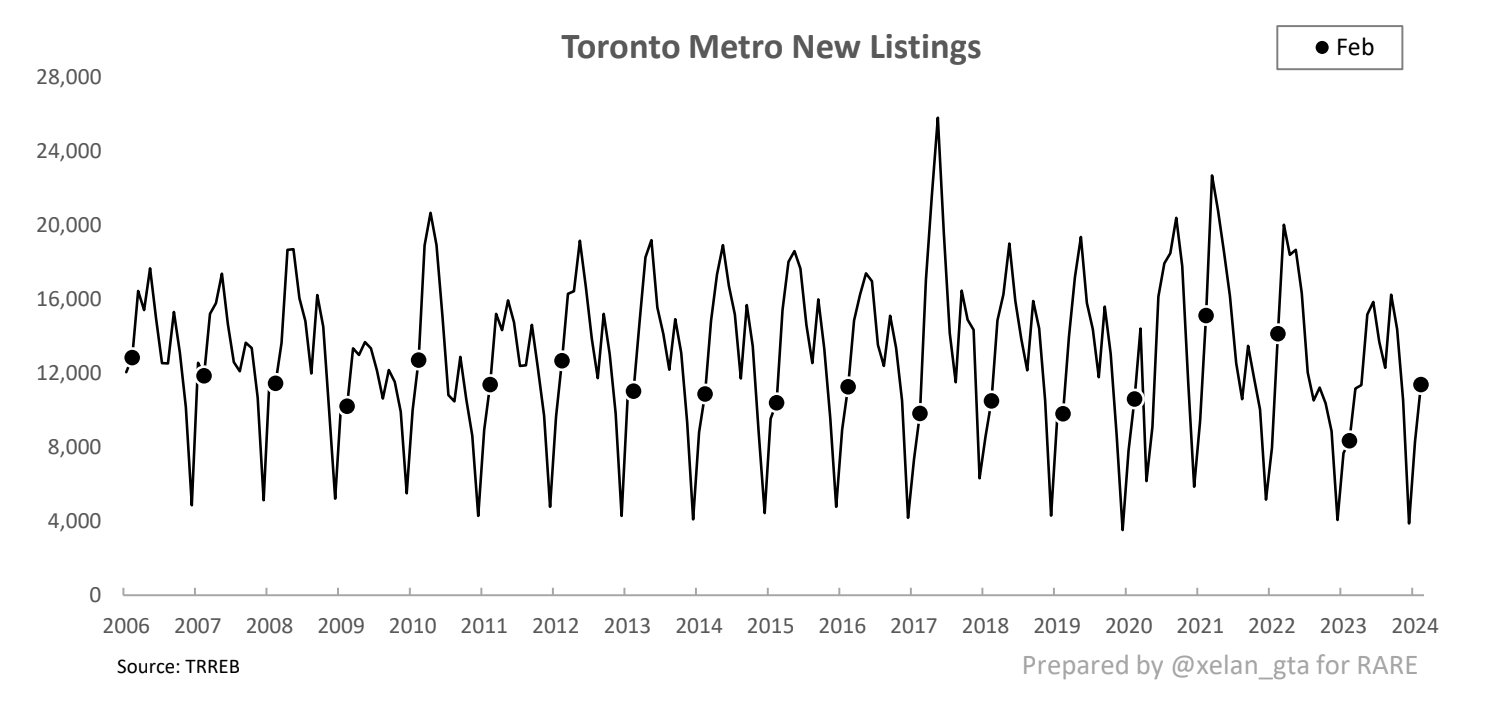

Supply (listings)

February observed a larger-than-usual uptick in new listings. As the chart below shows, listings typically jump up from January to February each year. This year’s jump was larger than last year, though smaller than the strong spring markets of 2021 and 2022.

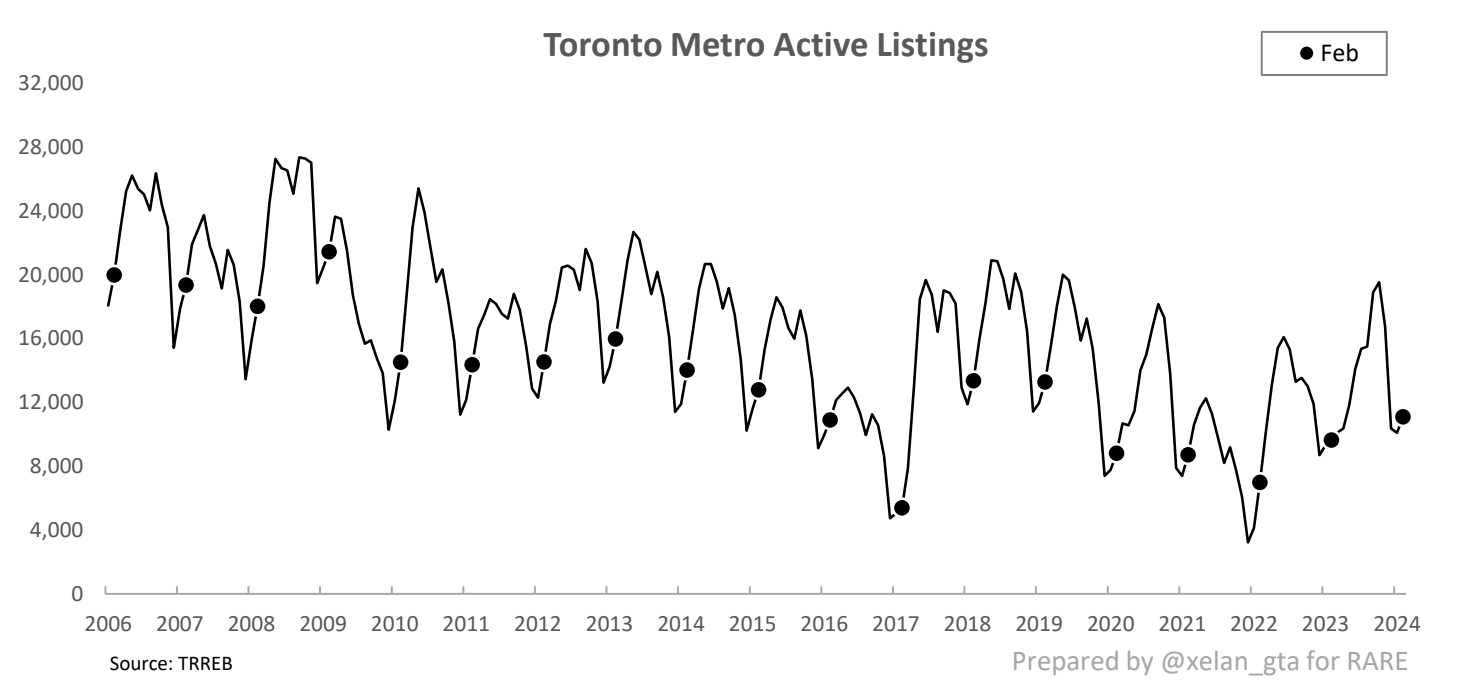

Active listings are at their highest point in February since the pandemic began, which shows we could be returning to a more long-term supply and demand balance compared to the volatile and imbalanced markets we saw over the past few years.

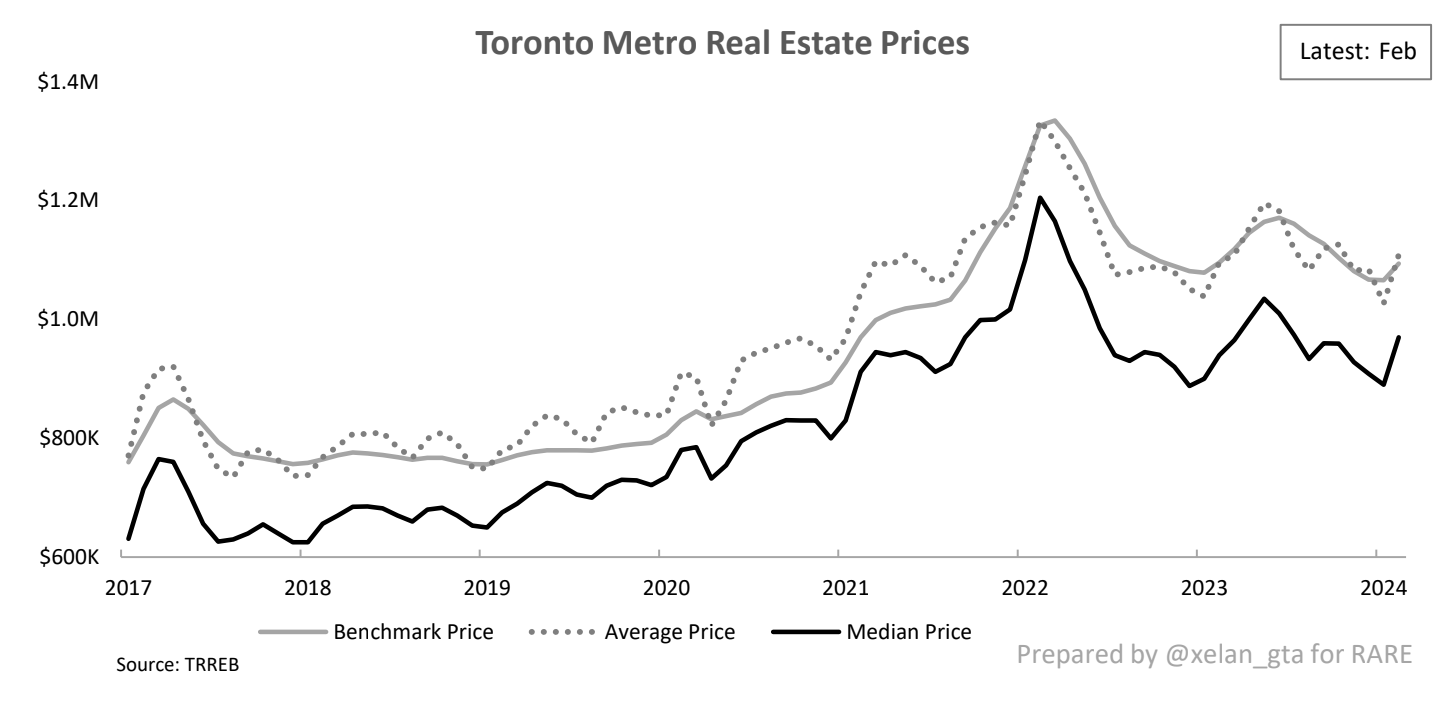

Price

House prices jumped sharply in February, which is typical in the spring market. Prices usually grow from January until May, then settle or fall throughout the summer. That being said, this jump was the steepest increase we’ve seen in price since 2022’s spring market.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.

steepest increase since 2022, so basically more than last year?

not really a strong metric