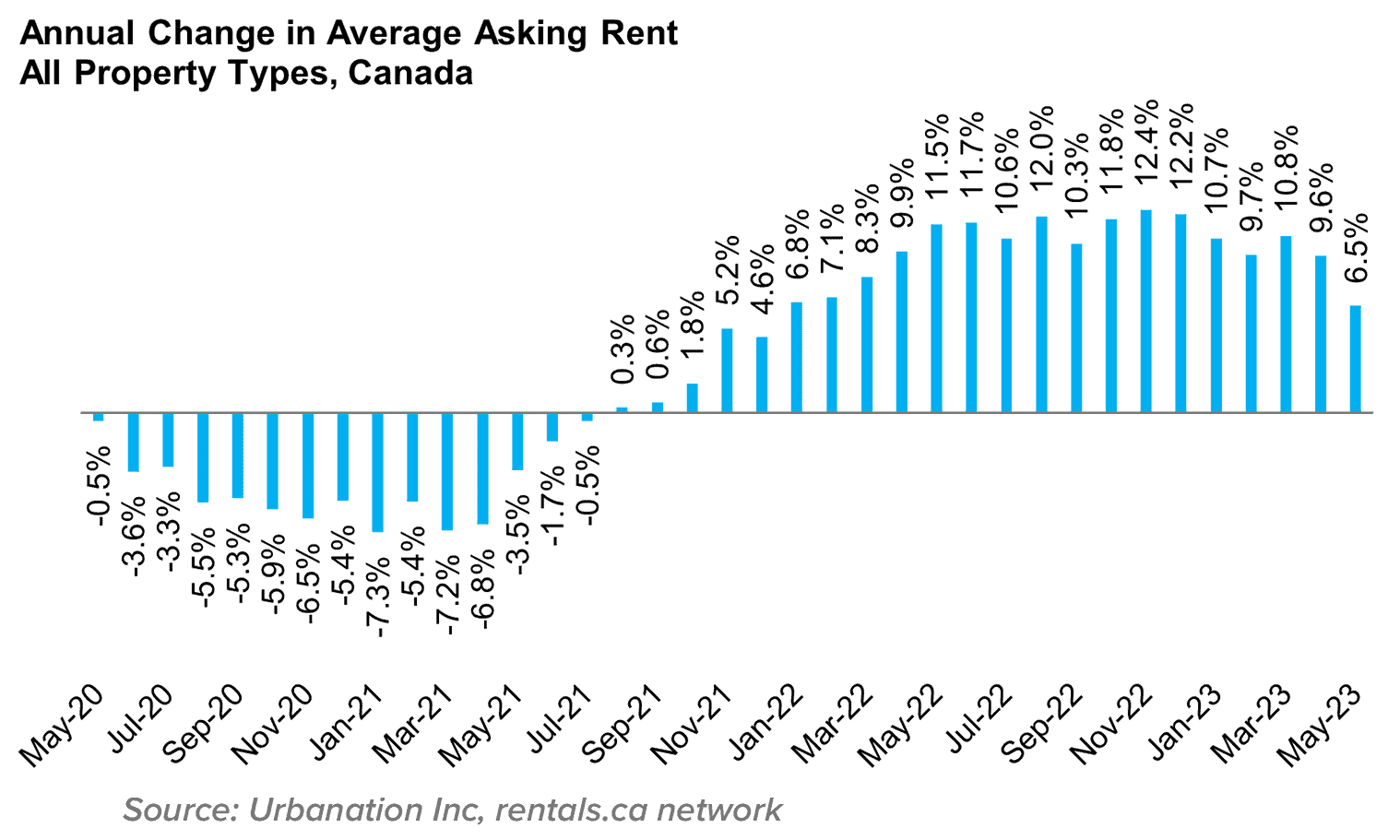

Canada’s rental market experienced a slower annual increase in May, according to the latest National Rent Report by Rentals.ca and Urbanation.

While average asking rents rose by 6.5 per cent year-over-year, it was the lowest percentage increase since December 2021. However, despite this moderation, the report reveals that rents for all property types were still up by a significant 19 per cent over the past two years.

Month-over-month, average rents in Canada increased 0.6 per cent to $2,014.

Provincial trends: Alberta leads in rent growth

Alberta led the provinces in annual rent growth in May, with average rents for purpose-built and condominium apartments rising by 13.4 per cent year-over-year to $1,521. Despite this growth, Alberta’s rents were still 22 per cent below the national average.

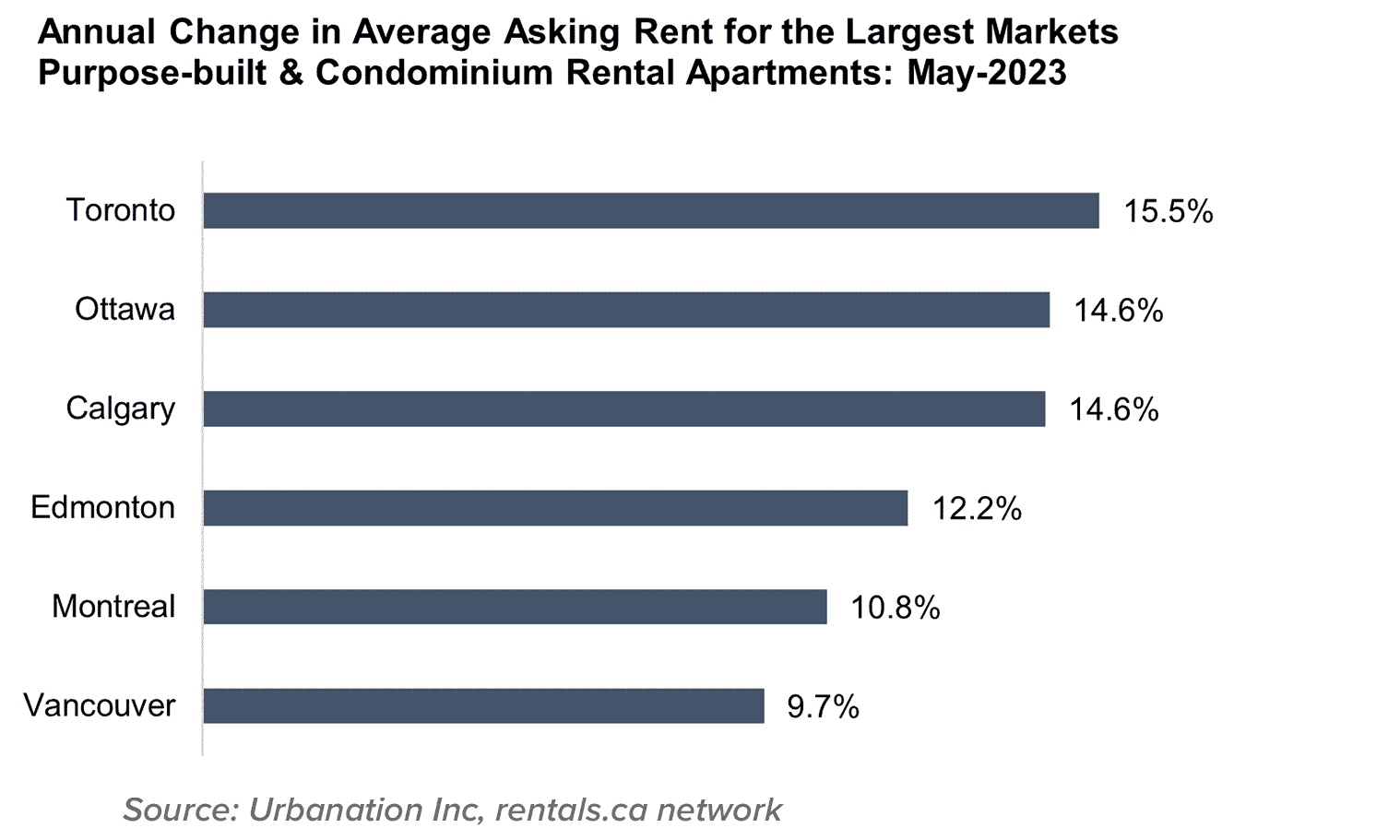

Ontario recorded the highest increase in average rents, rising by 12.4 per cent year-over-year to $2,409 for purpose-built and condominium apartments.

Quebec also posted double-digit annual rent growth in May, with a 10.6 per cent increase to an average of $1,875.

British Columbia remained the most expensive province for rent, although rent growth slowed to 5.2 per cent in May, with average rents at $2,468 for purpose-built and condo apartments.

Vancouver maintains its position as the most expensive city for rent

Vancouver once again claimed the top spot as the most expensive city for rent among the 35 cities surveyed. In May, the average monthly rent for a one-bedroom home reached $2,831, while a two-bedroom rented for an average of $3,666. These figures represent year-over-year increases of 16 per cent for one-bedroom units and 8.7 per cent for two-bedroom units.

Toronto follows as a costly rental market

Toronto ranked second on the list of 35 cities for average monthly rent in May, with the average rent for a one-bedroom unit reaching $2,538. For a two-bedroom, the average rent was $3,286. Year-over-year, average monthly rent in Toronto rose by 17.5 percent for one-bedroom units and 12.4 percent for two-bedroom units.

Calgary rents, which averaged $1,944 for purpose-built and condo apartments, increased 14.6 per cent year-over-year in May compared to 22.9 per cent annual growth in April.

Ottawa rents also increased at a 14.6 per cent annual rate in May, reaching an average of $2,134.

Rent increases in mid-sized Ontario cities

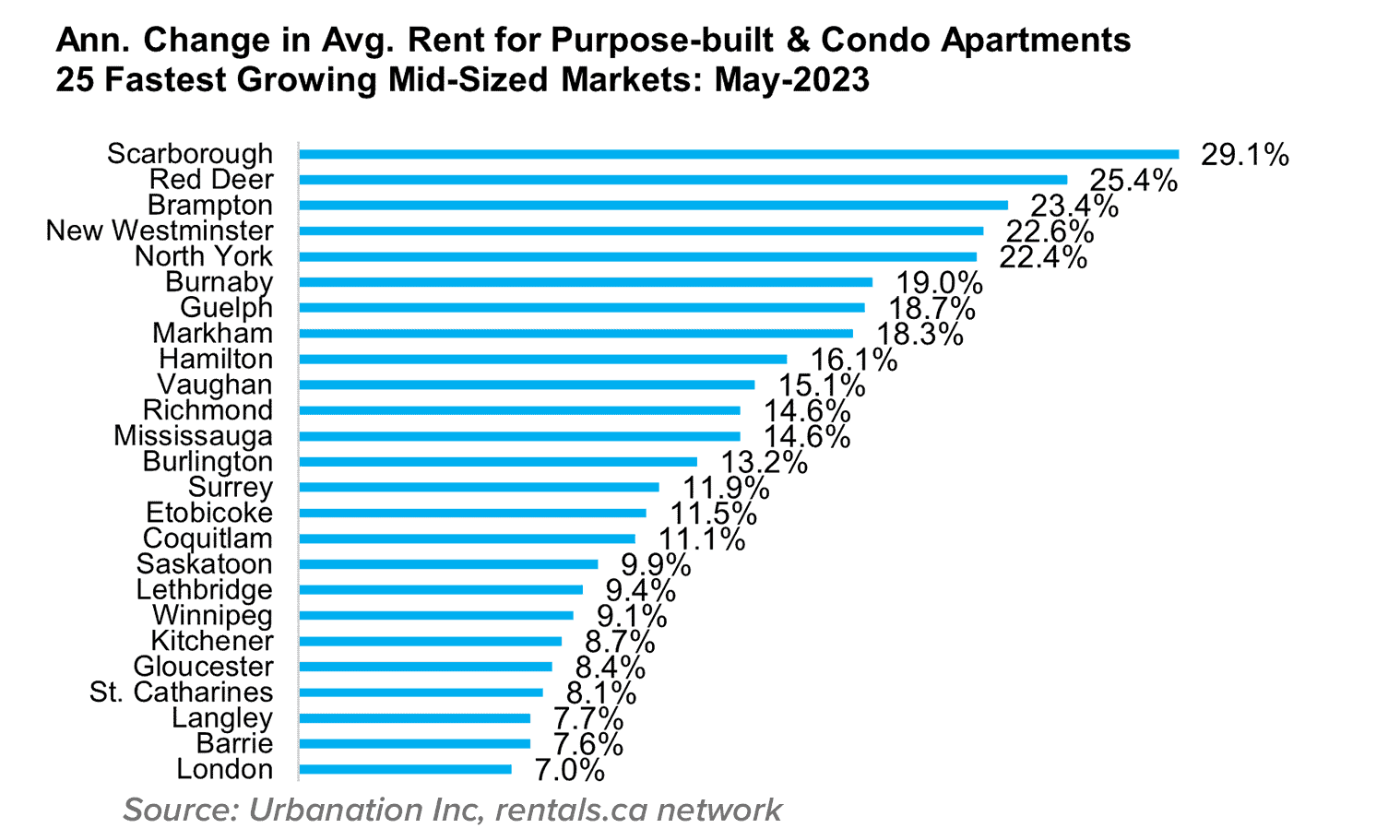

Fifteen mid-sized cities and areas in Ontario experienced the fastest rising rents year over year for condo rentals and apartments in May.

Scarborough led the list, with rents skyrocketing by 29 per cent annually to an average of $2,527. Several other cities in the Greater Toronto Area (GTA) and surrounding regions witnessed double-digit rent increases in May. Brampton saw a 23 per cent increase, North York rose by 22 per cent, Guelph experienced a 19 per cent hike, and Markham recorded an 18 per cent surge. Hamilton, Vaughan, Mississauga, Burlington, and Etobicoke also experienced notable rent increases.

Oakville remained Canada’s most expensive midsize market, with an average rent of $3,373 for purpose-built and condominium apartments.

Rising rents and factors driving the market

The report highlights several factors contributing to the rising rents in Canada. One significant factor is the increasing immigration rate, as Canada plans to welcome 465,000 new residents in 2023. This influx of newcomers adds to the demand for rental properties, putting upward pressure on rents.

Another factor driving the rental market is the increasing cost of homeownership. With average home prices on the rise again and the Bank of Canada raising interest rates to a 22-year high of 4.75 per cent, buying a home is becoming less affordable for many Canadians. As a result, more people are turning to the rental market, further intensifying competition and driving up rents.

Implications for renters

“Higher rents are on the horizon with interest rates at a 22-year high, rising home prices and record immigration,” said Matt Danison, CEO of Rentals.ca Network.

“Gen Z could become the ‘boomerang generation’ moving back in with the parents or the ‘roommate generation’ splitting rent as it’s unaffordable for many Canadians to pay rent on their own. Governments at all levels need to come up with creative solutions to increase housing supply.”