Canadian real estate is feeling the heat as the Bank of Canada, responding to spikes in inflation and a resurgent spring market, has pushed mortgage rates to a 15-year high. This shift in monetary policy direction has triggered ripple effects on home sales and the broader economy.

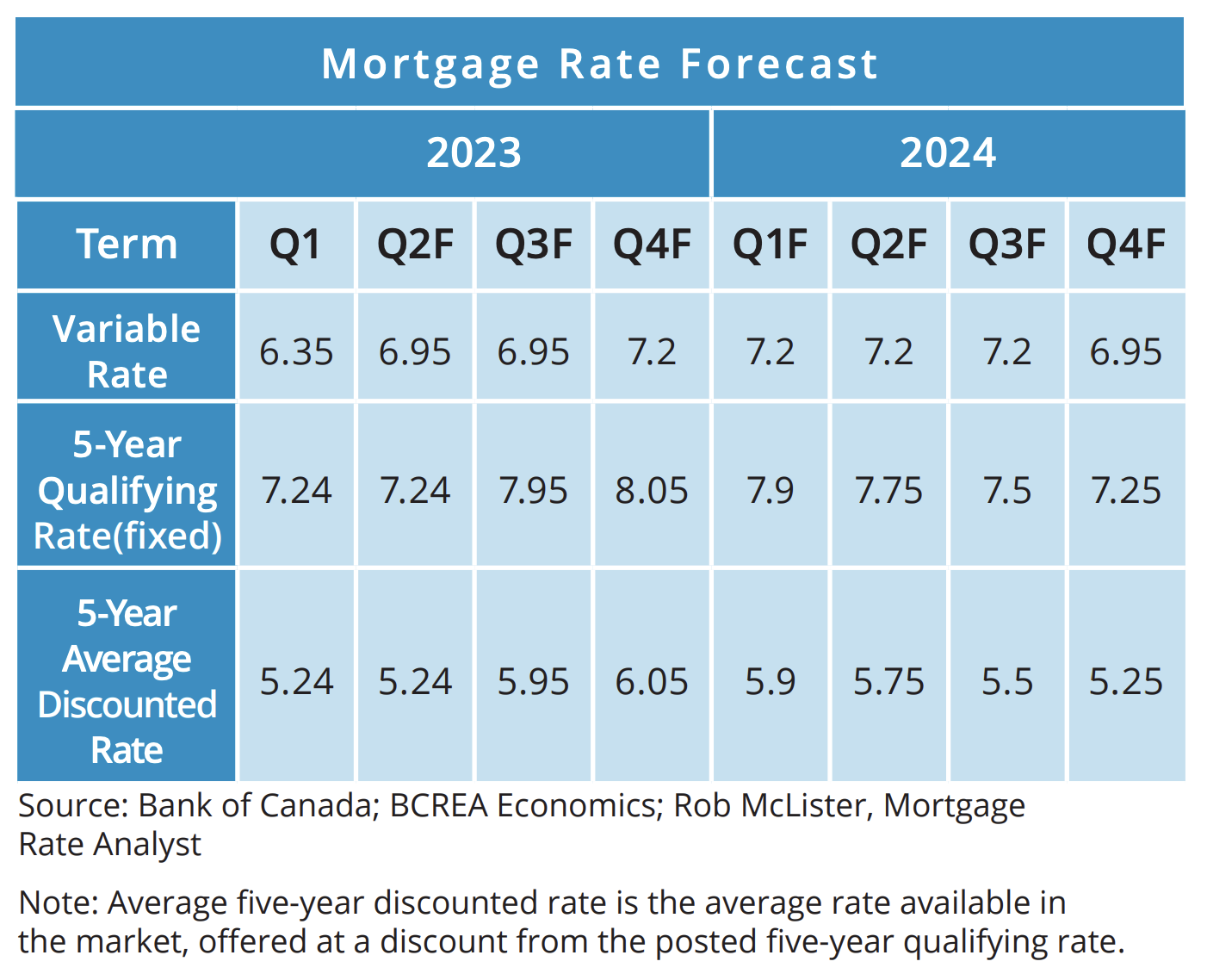

The BC Real Estate Association’s (BCREA) Chief Economist, Brendon Ogmundson, and Economist Ryan McLaughlin have released their September mortgage rate forecast and take a closer look at where rates might go over the next several quarters.

A murky outlook

The Bank of Canada’s response to economic conditions has been swift and decisive. The central bank raised its policy rate in June and July, resulting in an average variable mortgage rate of 6.95 per cent.

This upward trajectory has also led to a revision of future rate cut expectations, with projections now stretching to the end of 2024 or even mid-2025. The consequence? Long-term interest rates have surged, with yields on five-year Government of Canada bonds exceeding 4.0 per cent for the first time in 15 years. As a result, fixed mortgage rates are closing in on 6.0 per cent, further compounded by increasingly stringent stress tests.

The combination of an economy showing signs of slowing growth, coupled with inflation hovering between 3.0 to 4.0 per cent, creates an uncertain outlook for interest rates in the coming year.

BCREA economists predict that high-interest rates may push the economy “briefly” into negative territory. Consumer spending could also decelerate once excess savings are depleted. However, with inflation not anticipated to return to its target until 2025, homeowners may need to exercise patience in their wait for relief on variable rates. Five-year fixed rates, on the other hand, might see a decline in early 2024 as bond markets adjust to lower inflation expectations and potential future rate cuts by the Bank of Canada.

Impact on economic growth

“While the economy appears to be slowing, or perhaps even contracting, it is difficult to label it a recession without a weakening labour market,” the economists write.

Ogmundson and McLaughlin note that Canada’s labour market remains resilient. Despite mixed job growth in recent months and a slight uptick in unemployment rates from record lows, labour markets remain tight. Job vacancies, while decreasing, still hover above historical averages, and wages continue to rise at a rate of 4.0 to 5.0 per cent.

Though inflation has decreased from its peak in June 2022, when it exceeded 8.0 per cent, it remains in the 3.0 to 4.0 per cent range, which falls short of the Bank of Canada’s target. The BCREA economists emphasize that this persistent inflation trend could necessitate additional monetary tightening to bring the rate back down to 2.0 per cent.

Bank of Canada’s next moves

With inflation consistently above 3.0 per cent, the Bank of Canada’s recent decision to maintain its overnight rate at 5.0 per cent is deemed as the “right one” by BCREA’s experts.

It may take more time for previous rate hikes to have their intended impact in an economy flush with household savings; however, an uptick in core inflation observed in August is “more than likely” to prompt an additional 25 basis point rate increase by the Bank of Canada.

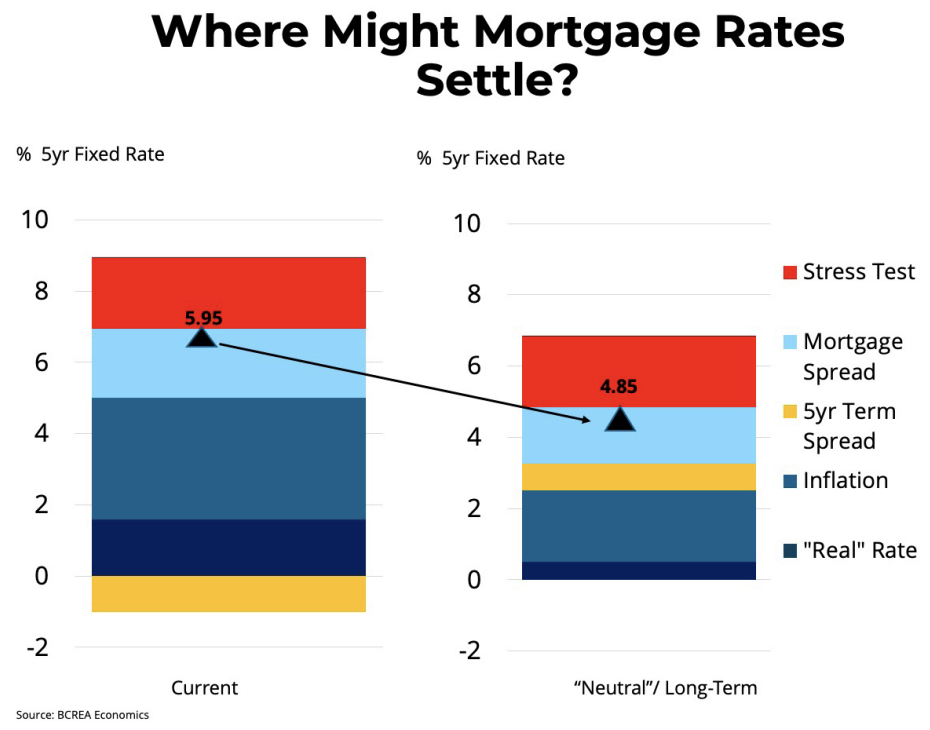

The challenge lies in the fact that the current policy rate, at 5.0 per cent, is significantly higher than what the Bank considers “neutral” for the economy.

“At some point, inflation will return to its target, and the economy will no longer be experiencing excess demand, prompting the Bank to bring its policy rate back to its neutral rate of between 2.0 and 3.0 per cent.”

BCREA economists estimate that a Bank of Canada overnight rate of 2.5 per cent could result in a five-year fixed rate of 4.85 per cent, meaning that future rate cuts might only lead to a 110 basis point drop in mortgage rates.

Read BCREA’s September 2023 mortgage rate forecast.