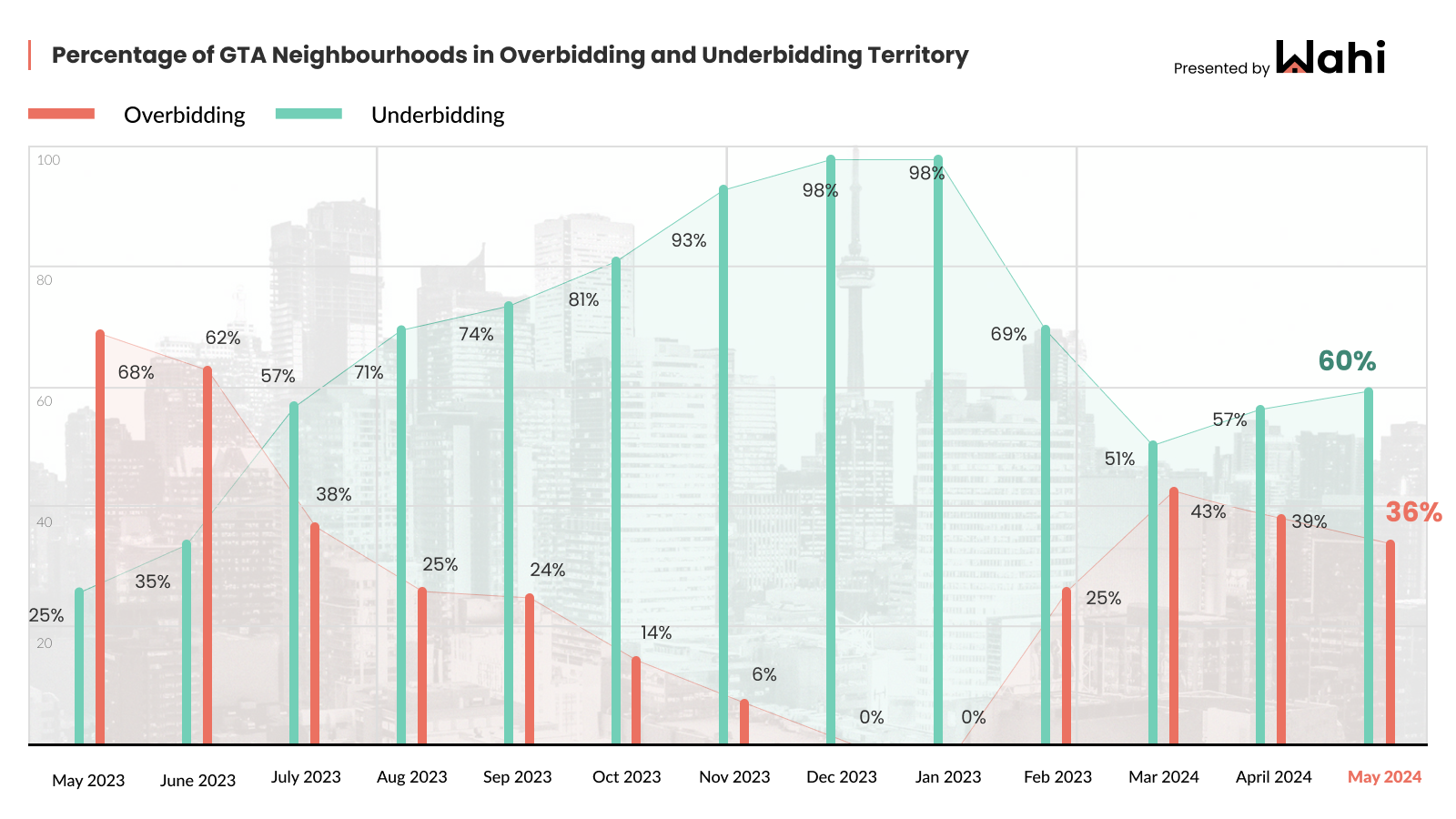

Last month, 36 per cent of Greater Toronto Area (GTA)’s neighbourhoods were in overbidding territory, which declined for the second month in a row, after being at 39 per cent in April and 43 per cent in March, Wahi reports. A year ago, it was significantly higher at 68 per cent.

About 60 per cent of GTA neighbourhoods were in underbidding territory last month and the remaining four per cent of homes sold for asking price. It’s expected that more buyers will look to enter the market with the Bank of Canada’s recent interest rate cut.

“This week’s rate cut from the Bank of Canada will likely change consumer psychology thereby giving homebuyers the confidence to bid on properties,” says Wahi CEO Benjy Katchen.

Wahi has seen a correlation between interest rate expectations and bidding activity. After consecutive rate pauses in March and April 2023, neighbourhoods in overbidding conditions rose by 11 per cent in May 2023 to 68 per cent. Then, when rate hikes commenced in June, this pattern reversed — with the share of neighbourhoods dropping from 62 per cent to 38 per cent between June and July.

Different trends in single-family homes and condominiums

Another finding Wahi made was the difference in bidding activity by property type. Lately, there are some opposing forces at work in the GTA market.

For single-family homes (including detached and semi-detached properties), row homes and townhouses last month, 53 per cent of neighbourhoods were overbid which was down from 58 per cent in April. On the other hand, condominiums in just 11 per cent of the neighbourhoods analyzed were selling at over-asking prices, which was two per cent higher than in April.

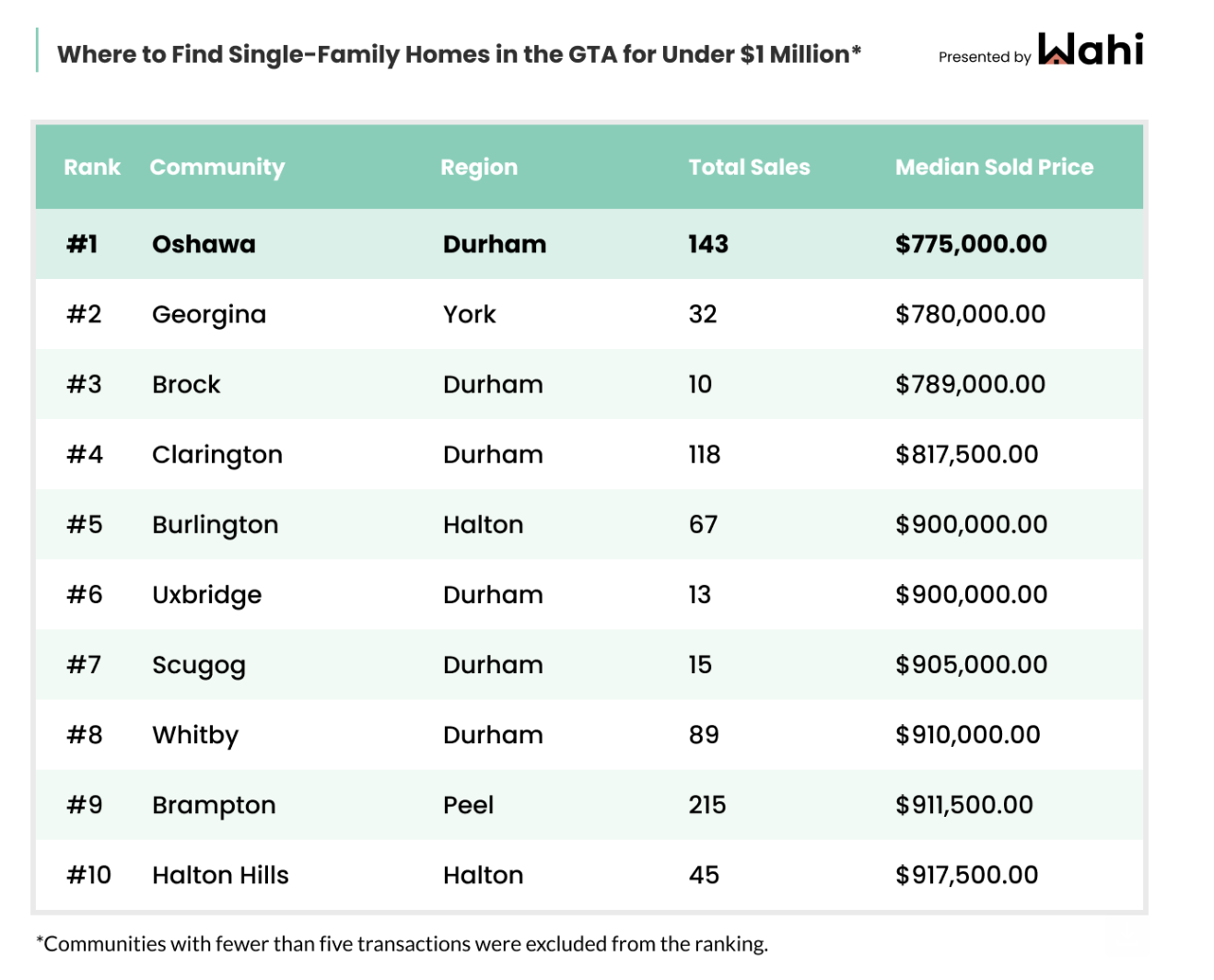

Where buyers can find GTA properties for under $1 million

Amid the competition, buyers often need to be strategic and quick in their home search. This can include knowing which neighbourhoods are experiencing overbidding, even when they’re on the less expensive end of the spectrum.

Wahi found that most communities where houses sold for a median price of under $1 million were in overbidding territory recently, though four areas had homes selling below-asking.

Regardless of over- or under-bidding status, Oshawa was the most affordable area, with a median sold price of $775,000, while Halton Hills was the least, with a median sold price of $917,500.

Review the full analysis here.

Comparison of district median list prices vs (same) district median sold price.

I suppose that’s what I would do… IF … I wanted a statistical measure about something in an area that I did not know, did not think I would ever work and wanted to use readily available (and perhaps seasonally-adjusted) CREA stats to obtain my back-data.

It always depends on asking price when it comes to multiple offer or “bidding” in most districts/neighbourhoods. Median price can be a bit misleading based on number of sales and property types sold that month. So far I do not see any significant change in market conditions due to interest rate cuts.