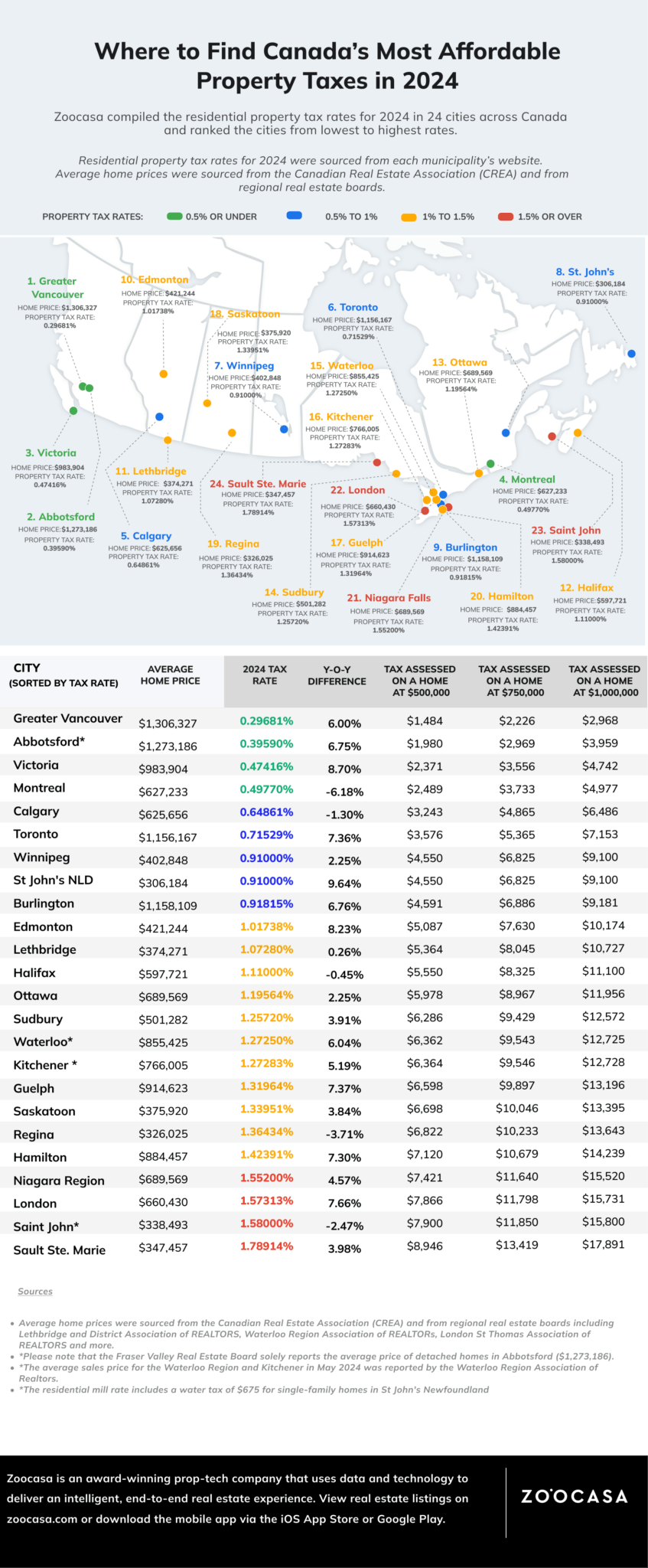

In 2024, property tax rates in Canadian cities have fluctuated significantly, with St. John’s, Newfoundland, experiencing the highest increase at 9.64 per cent year-over-year, according to a study by Zoocasa. Meanwhile, Montreal saw the largest decrease, with property taxes dropping by 6.18 per cent. The pause in rate adjustments during the pandemic has led to substantial increases as cities compensate for that period.

Following St. John’s lead, Victoria had the second highest tax increase, of 8.70 per cent. Despite this, Victoria still maintains some of the lowest tax rates in the country. London, Ontario, experienced a 7.66 per cent increase and now has one of Canada’s highest property tax rates.

On the flip side, Montreal’s large decrease offers substantial relief to property owners, followed by Regina with a 3.71 per cent reduction and Saint John, New Brunswick, with a 2.47 per cent decrease.

The median year-over-year property tax change for the 24 cities analyzed is 4.88 per cent.

Cities with the lowest and highest property taxes

Despite its high cost of living, British Columbia has some of the lowest property taxes in Canada. Greater Vancouver has the lowest property tax rate at 0.29681 per cent, which is $2,968 for a home assessed at $1,000,000. Abbotsford’s rate is the second lowest at 0.39590 per cent, equating to $3,959 in annual taxes for a similarly valued home. Victoria also offers affordable property taxes at 0.47416 per cent, resulting in $4,742 annually for a home assessed at $1,000,000.

Saint John, New Brunswick, remains one of Canada’s most expensive areas for property taxes, even after a 2.47 per cent decrease. Homeowners pay significant amounts, such as $7,900 for a $500,000 home and $15,800 for a $1,000,000 home. Sault Ste. Marie, Ontario, has an even higher tax rate of 1.78914 per cent, leading to $8,946 in taxes for a $500,000 home and $17,891 for a $1,000,000 home. This means that Vancouver homeowners pay less than half in property taxes for a $1,000,000 home compared to Sault Ste. Marie homeowners for a $500,000 home.

Ontario’s 2024 property tax rates

In Ontario, property tax rates vary widely. Toronto has a relatively low tax rate of 0.71529 per cent, while Burlington, with a similar average property price (about $1.16 million), has a higher rate of 0.91815 per cent. Ottawa, known for its affordable cost of living, has a higher tax rate of 1.19564 per cent, leading to $11,956 in taxes for a $1,000,000 home, compared to Toronto’s $7,153.

Rates exceed 1.25 per cent in cities like Sudbury, Waterloo, Kitchener and Guelph. Sudbury’s annual taxes for a $1,000,000 home amount to $12,572. However, this city remains affordable with an average home price of $501,282, meaning few residents face such high assessments.

Niagara Falls saw a 4.57 per cent increase in property tax rates, now at 1.552 per cent. London has the second highest rate in Ontario at 1.57313 per cent, followed by Sault Ste. Marie at 1.78914 per cent, which has the highest tax rate despite the lowest property prices.

Review the full report here.

I find it strange that you made an effort to create a chart outlining property tax rates across the country. You included a column for average house price in a city but did not show a column for the average property tax that a citizen would pay. This appears to be the most important part of your entire storey and it was left out.

Thanks for the feedback, Steve. We were reporting on Zoocasa’s analysis which is where the chart came from. I interpret this as the last three columns to the right are what a homeowner would pay, based on the value of their home.

According to MPAC in Ontario, the year 2024 property tax payable is equal to the 2024 municipal tax rate times the property assessed value of January 1, 2016, not the current market value.

Support the legal Mafia. Pay your taxes 😊

Dawson Creek BC – property tax assessed at 6.8%. NB has nothing on the fiscal irresponsibilty of the previous council here. And the current one is not much better. Seems the sense of entirlement in BC Government is not isolated to Victoria.

I am wrong! Sorry. Mayor said 6.8% – but he maent 0.68 – My bad!

sorry i was mistaken. 0.68 – the mayor said 6.8 % – he mispoke and I didn’t fact check b4 I commented.

I guess not all places are accounted for. In Dubreuilville, Ontario, Tax rates for residential are 3.49%

$392K house = $13,700.00 tax