Canadians invested almost US$10 billion in direct investments in U.S. commercial real estate in 2014 – more than Norway, China, Japan and Germany, says CBRE.

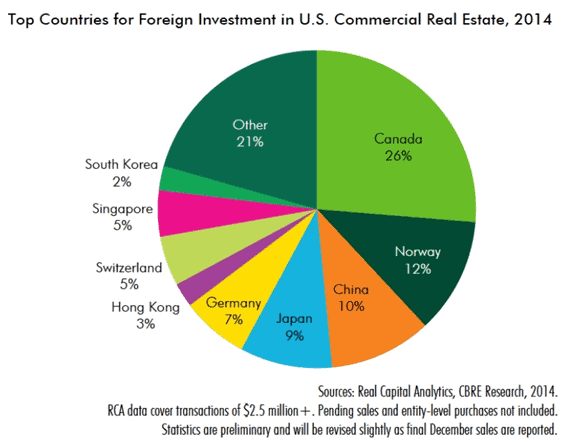

Foreign direct investment in U.S. real estate totaled US$41 billion in 2014, the company says. Canadian investors accounted for 26 per cent of direct foreign investment into the U.S. last year. Canadian investors have already transacted $2.75 billion in U.S. real estate as of mid-January 2015.

CBRE says Canadian real estate investment in the U.S. was one of the largest cross-border capital flows in the world in 2014. The Canada-to-U.S. real estate capital flow was the third largest, after U.S.-to-United Kingdom and Hong Kong-to-China capital flows.

“Canadian investors find U.S. real estate attractive for many of the same reasons that other countries do. The U.S. offers opportunities for value creation, healthy cash flows and favourable risk-adjusted returns,” says Ross Moore, CBRE’s director of research for Canada. “The level of Canadian investment is highly correlated with the health of the American economy and exchange rates, but the overriding motivation is that Canadian institutional investors need to look beyond their borders to find product and achieve greater diversification.”

Norway was the second largest global investor in U.S. real estate in 2014 at $4.4 billion, or 11 per cent – less than half that of Canada. China and Japan reached total investment levels in the U.S. of $3.8 and $3.5 billion respectively, each representing nine per cent of the global total.

German buyers transacted $2.9 billion in U.S. real estate, representing seven per cent of the total.

The U.S. is by far the largest destination for Canadian global capital, says CBRE. Of the $22 billion that Canada invested outside of its borders in 2014, 44 per cent went to the U.S. The next highest shares – 17 per cent and 14 per cent – went to Australia and the U.K., respectively. The company says it should be noted that the U.S. market share of Canadian global investment dropped below its 2007-14 average of 48 per cent in 2014.

“While we have seen rapidly rising Chinese global investment and oil-rich countries in the Middle East or Norway increasing their allocations to global real estate, Canadian buyers continue to dominate foreign investment in the U.S. and should remain on the radar screens of American investors and owners of U.S. real estate,” says Chris Ludeman, global president, CBRE Capital Markets. “Canadians, other global investors and Americans share the same challenge – finding attractive opportunities with reasonable pricing that can produce a favourable risk-adjusted return. That said, we expect the investment climate to remain brisk and U.S. volumes will continue rising in 2015.”

Canadian investment is more geographically widespread across the U.S. than other global capital. CBRE says this should not be surprising given the magnitude of Canadian investment, its high degree of familiarity with U.S. markets beyond the gateway cities, and the relatively low cost and time commitment for Canadian investment professionals to travel to U.S. markets.

For all property types combined, as with total global capital flows into the U.S., New York is the leading destination for Canadian real estate capital, followed by Boston and Broward County in Florida, which made the list due to a significant hotel acquisition. Seattle is somewhat unusual for global capital, but not unusual for Canadian capital given its proximity to Vancouver, the company says.