Veteran real estate agent Thomas Park is on a quest to give people who have been shut out of real estate the opportunity to invest in the market with as little as $100.

Park is the CEO and co-founder of Reitium Technologies, which has developed a technology platform that will allow fractional ownership of real estate using a crowdfunding platform.

“The mission is to allow everyday people to invest in real estate,” says Park, an agent in Vancouver for 19 years, the last 12 with Re/Max City Realty. He describes the new platform as a Kickstarter for real estate that is compliant with securities regulations.

Lightbulb moment

Reitium CEO, Thomas Park

The lightbulb moment for Reitium came five or six years ago during a family dinner when Park described how some affluent clients in Vancouver had made a fortune flipping properties.

“My mom leans over and says, ‘I saved $30,000. Can you make me the same return as your clients?’ It was disheartening telling my mom that $30,000 is not enough to buy real estate, especially in markets like Vancouver.”

That’s when he realized fractional ownership would give people priced out of real estate the opportunity to get into the market, build diversified portfolios and share in the rental income and appreciation.

“We’re opening up a new way, using technology, for people to raise capital from retail investors to be able to participate into offerings that have generally only been open to (high-net-worth) accredited investors.”

Open to retail investors

On the crowdfunding side of the platform, known as the Crowdfunding Marketplace, retail investors (or the general public) can invest from $100 to $2,500.

To date, Reitium’s Crowdfunding Marketplace has been approved by regulators in B.C., Manitoba and Ontario. A compliance engine on the platform will ensure each investment is compliant with security regulations.

Issuers will display everything from legal documents to potential expected returns to allow potential investors to make informed decisions. Capital that is raised will be held in escrow until the deals are funded.

Issuers promote their own deals and are charged a three to five per cent fee to raise capital on the crowdfunding platform. Individual investors are not charged fees to invest in deals.

“We’re just the technology that provides the vehicle for (issuers) to raise capital compliantly on our platform,” Park says. “We don’t participate in any of the deals that are on the platform. You are investing into the issuer on the platform and their backgrounds and their experience.”

Expansion into the U.S.

Reitium has developed another platform for exempt market products that will allow larger deals for accredited investors. It will accept TFSAs and RRSPs.

The company is also awaiting regulatory approval to set up shop in the U.S, potentially by the second quarter of the year.

There are plans to open a U.S. office to manage the issuers that want to raise capital for the platform. “We think that having a presence in the U.S. is very important,” Park says.

So far, Reitium has raised $1.7 million U.S. in a pre-seed round and $500,000 U.S. through friends and family. It’s now raising an additional $5 million in a seed round.

Influential advisors

It has also brought in several high-powered advisors, including David Meltzer (the sports agent who was the inspiration for the movie Jerry Maguire), Solme Kim, former head of product at TikTok, and Jacky Chan, a top-selling agent and CEO of BakerWest in Vancouver.

The 11-employee firm held a mid-January friends and family launch party in Vancouver that was attended by more than 220 people.

The crowdfunding platform opened to retail investors on Tuesday; Park says the response has been positive, with more than 7,000 people.

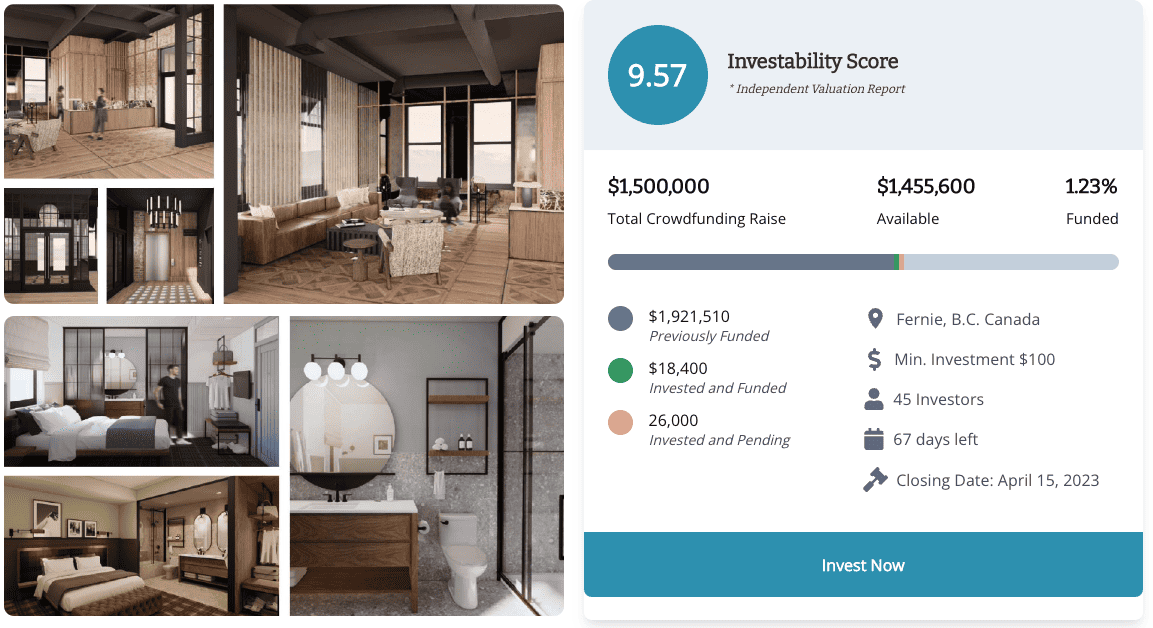

The first opportunity? An issuer is raising $1.5 million to renovate a 28-room boutique hotel in a heritage building in Fernie, B.C. Investors will potentially get to share in rental income and the potential appreciation of the property when it’s resold, he says.

Source: Reitium.fund

Opportunity for diversified real estate portfolios

Park expects there will be 10 to 12 properties on the crowdfunding platform by the end of the year.

Deals for student housing, senior housing, multi-family properties, short-term rentals, self-storage, hotels, motels and mobile home parks will be on the platform, he says, giving retail investors the opportunity to obtain diversified real estate portfolios.

Park adds that many of his realtor and mortgage broker friends are investing in Reitium because “they see the pain points. The people that they talk to have been priced out of the real estate market.”

Danny Kucharsky is a contributing writer for REM.

Syndication for Everyone!!

We all should be pursuing the idea of Selling/Buying /TRADING “less-than-100%-interest” in real estate.

It’s already approved for listings on the TRREB — Look up the MLS Rules and Regs/Policies.

Imagine your seller offering a 50% interest in his house to a Buyer (for ?55-60% of the CMV )& becoming a J/V partner (yes a case-by-case partnership agreement) with the buyer for a finite period of time.

Both enjoy the appreciation-proportionately.

Overcomes Price ‘objections’ on BOTH sides

Good idea !!

No EMD required ?

How is it different or similar to addyinvest.ca out of Vancouver ?