The Canadian housing market is wrapping up 2024 with unexpected momentum. A significant upswing in home sales growth during the fourth quarter has shifted expectations, pointing to a more optimistic trajectory for 2025, according to the latest report from TD Economist Rishi Sondhi.

A Q4 surge

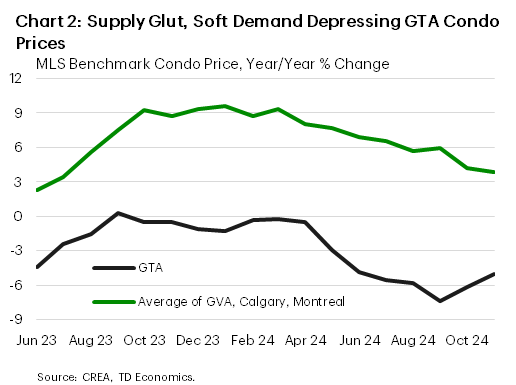

TD Economics estimates Canadian home sales have risen approximately 12 per cent quarter-over-quarter in Q4 of 2024, with the strongest gains coming from British Columbia and Ontario—“a major change relative to our September projection,” Sondhi writes. “Given the upgrade to the starting point, we now see sales reaching (and surpassing) their pre-pandemic level in 2024Q4.” TD Economics initially projected this would happen in the first quarter of 2025.

What’s driving growth?

Several factors are driving the Q4 breakout:

- Falling borrowing costs: Easing interest rates are bolstering buyer activity.

- Economic growth: Sustained economic expansion provides a favourable backdrop for housing demand.

- Mortgage rule changes: New regulations implemented in December are anticipated to drive both demand and prices.

Regional trends

While nationwide trends indicate a “sunnier” outlook, regional nuances are shaping the forecast:

British Columbia and Ontario

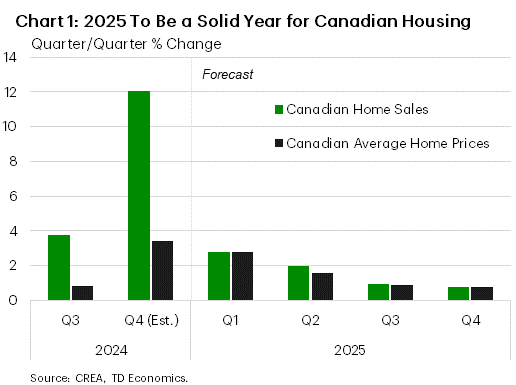

These provinces are set to lead in sales growth in 2025, fueled by pent-up demand. However, affordability challenges in both regions may temper price increases. In Ontario, for instance, the Toronto area’s condo market faces oversupply issues, likely resulting in continued price declines next year. That said, Sondhi notes, “This condo market weakness should make it easier for more expensive types of housing, like detached units, to outperform, delivering some offsetting upside for average prices.”

The Prairies

Alberta and its Prairie neighbours are expected to remain relatively stable due to their better affordability and slower population growth deceleration compared to other regions. “Our forecast for Alberta’s home price growth suggests that by the end of 2026, average home prices will have expanded for 7 straight years in the province.”

Quebec

Quebec’s housing market is projected to experience solid price gains in 2025, buoyed by tight market conditions and supportive federal policies.

Atlantic Canada

While prices in the Atlantic provinces are likely to rise in the short term, a marked slowdown in interprovincial migration is reducing ownership demand. Consequently, the region may face significantly slower price growth in 2026.

Risks to the Outlook

Despite the positive trajectory, Sondhi notes risks remain. Tariff threats pose a significant challenge. “Full or partial implementation will damage the economy and, therefore, housing more than we’ve built into our baseline. On the upside, falling borrowing costs could upwardly pressure sales and prices by more than we expect.”

Read the full report from TD Economics.

It seems like everyone likes house price will go up with interest go down and put buyers in difficult situation. House price already gained 200% during pandemic and destroyed the affordability permanently. Banks are speculating the marks towards interest of the seller.