The Canadian real estate market continues to tighten, with the number of home sales increasing in February while new listings declined.

This trend tells us that buyers were more active than sellers, pointing towards a spring market that could be turning in favour of the latter.

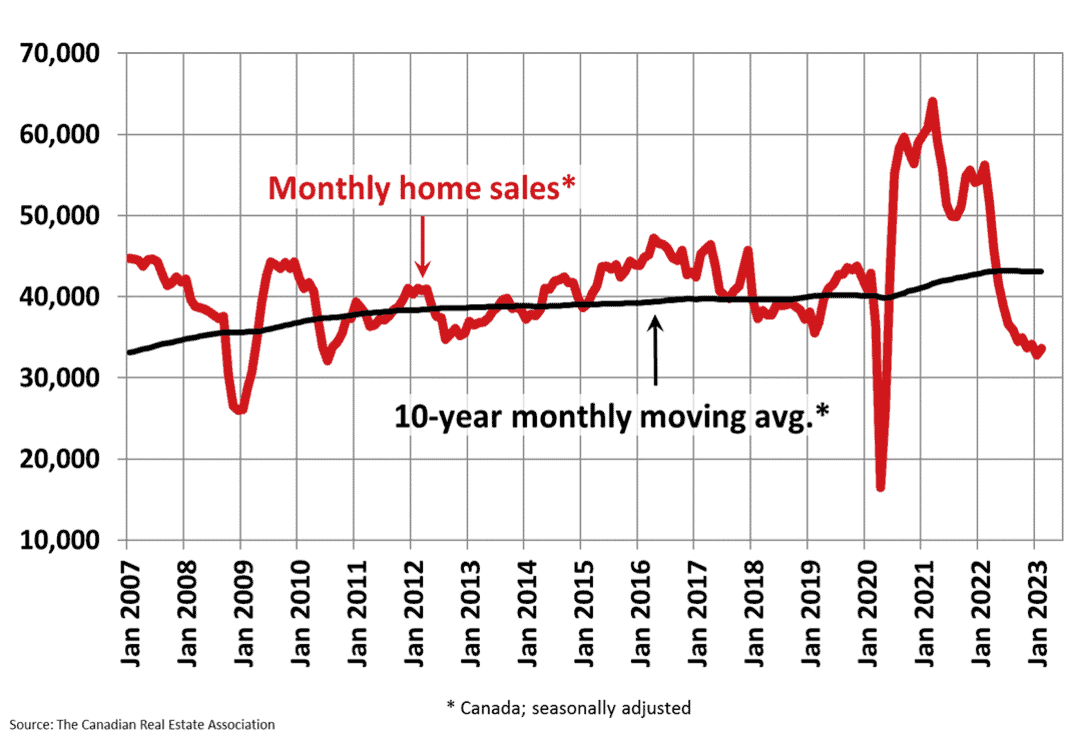

Despite the number of sales growing by 2.3 per cent from January to February, the transaction volume is still 40 per cent below February 2022. It is worth noting that February of 2022 was a very hot market and likely an outlier data point, but volume is still well below the 10-year average:

The key competitive advantage here for real estate professionals is to distinguish whether this uptrend indicates a recovery or return to spring-market seasonality.

In a typical year, composition mix and seasonality can drive price and volume up in February and March. The impact of these cycles on national trends is best understood on an individual market-by-market basis.

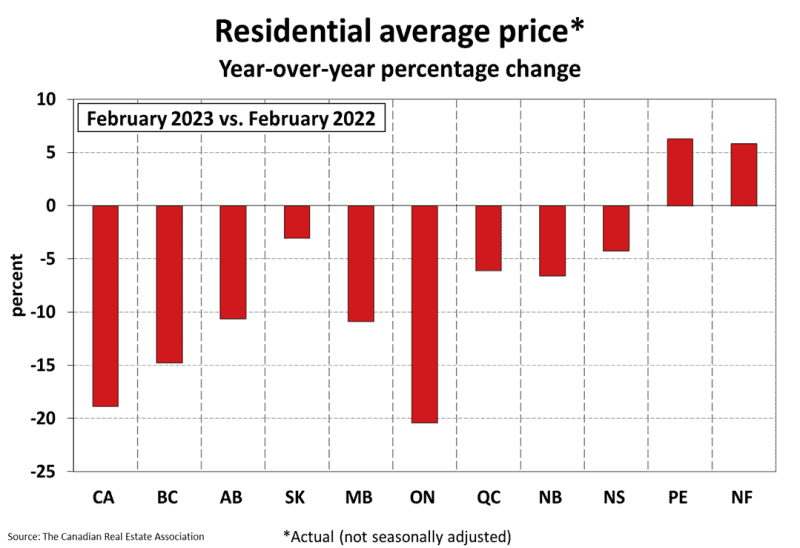

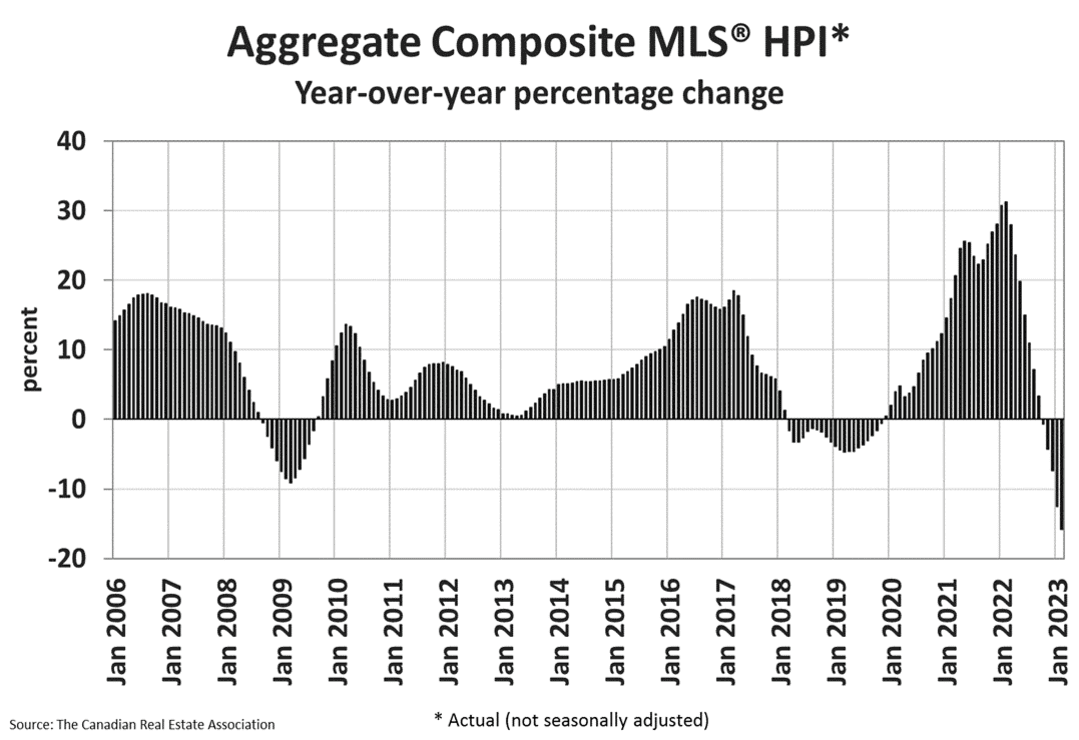

House prices have fallen the most on record

The actual (not seasonally adjusted) national average sale price posted an 18.9 per cent year-over-year decline in February.

This marks the largest drop in house prices on record, surpassing even the heights of the 1981 and 1989 markets. On the bright side, the worst is likely behind us, as most markets peaked in February 2022. Price data was especially skewed by Toronto and Vancouver, while some smaller markets peaked in March 2022.

There is likely one more month of shocking price-drop data ahead, but it is unlikely we will see a worse number next month. This reality greatly impacts consumer sentiment, as buyer activity tends to ramp up once economic uncertainty has subsided.

Economic uncertainty

With that being said, it appears we’re now approaching further economic uncertainty and turmoil with global banking crises; it is evident in CREA’s Chart A that Canadians respond to economic uncertainty with a marked slowdown in real estate transaction activity.

This uncertainty has manifested in a reduction of bond yields, the primary pricing mechanism for fixed-rate mortgages in Canada, so there could be some relief ahead for buyers who are restricted by interest rates.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.

Great informative read.

Yes – sellers’market in 2023.

But with $CDN inflation and savings deflating, 5% real estate fees (agent/broker/franchise) services appear greatly over-valued.

Us seniors must downsize again and expect to pay $125,000 to sell and buy a smaller home. Nowadays we can find a home from our living room, prep & market ourselves, get a form on-line for the deal, share a home inspection and law office for about $10k.

Is the real estate industry ready for PRIVATE DEALS and self-serve?

Jim

Retired R.E. Broker 1998 – 2017