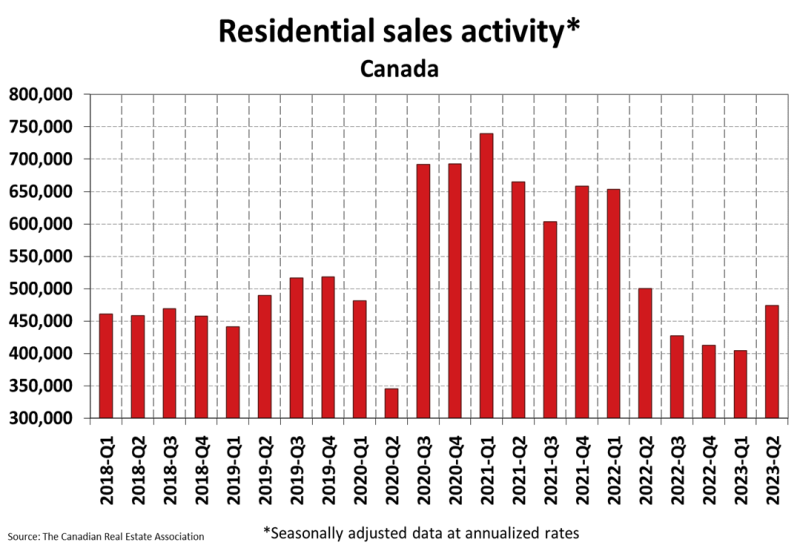

The quarterly number of homes sold in Canada just increased for the first time since 2021. Transactions in June 2023 came in 4.7 per cent above June 2022 — the largest jump in two years, according to CREA’s June data.

Perhaps the resurrection in volume means the recession is over for realtors. On the other hand, it could be just the beginning for property owners, who seem to be at their wit’s end against heightened interest rates.

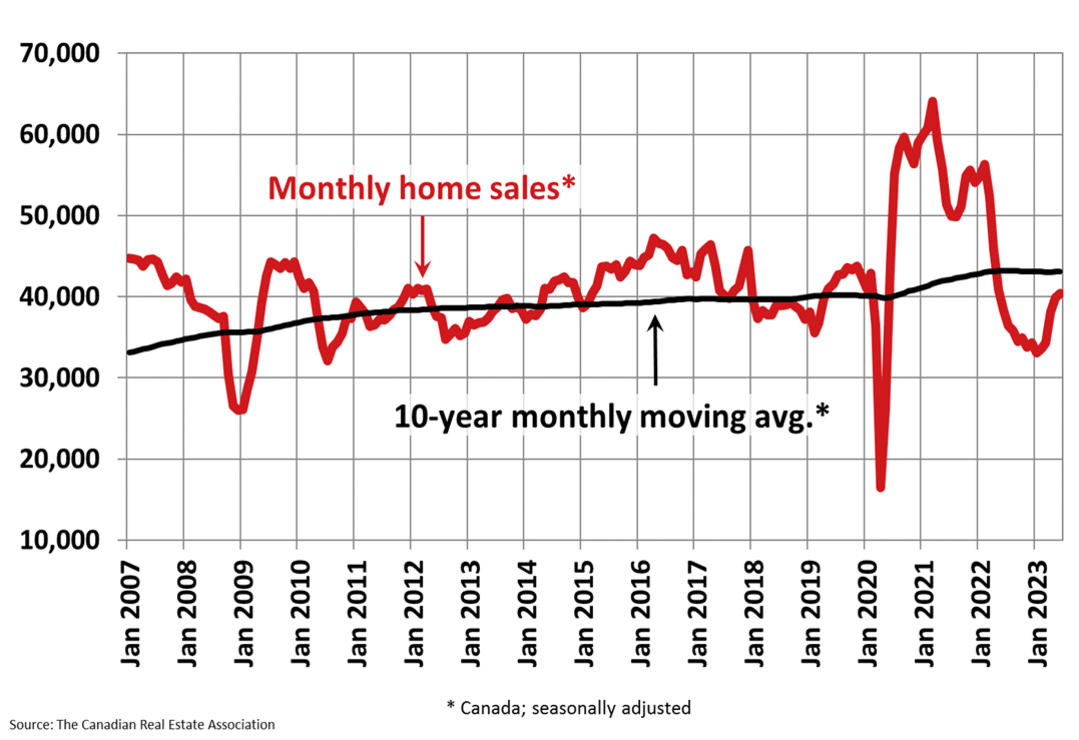

I’ve been writing these briefs for a while now, and my thought was that we’d see volume recover toward the 10-year average trendline after spending some time below it. My assumption was that as prices moved down, affordability would bring more buyers back to the market. It appears to have done just that. You see this recovery happen against other major drops in volume seen in 1981, 1989, and 2008, against recession and rate hikes.

It’s important to remember that volume is what pays real estate professionals — not price. I’ve always been fascinated by realtors who hope house prices will increase. Price increases reduce affordability. Unaffordable housing reduces homeownership. Low-homeownership economies see reduced property transactions.

This is the primary reason volume was suppressed for 12 months and why it’s returning to normal now. CREA accounts for the market-squandering unaffordability with a forecasted 6.8 per cent decline in home sales this year compared to last year.

There is a chance that we see seasonal or secular deceleration in volume as a result of prices growing again, but I expect that year-to-date rally to be short-lived.

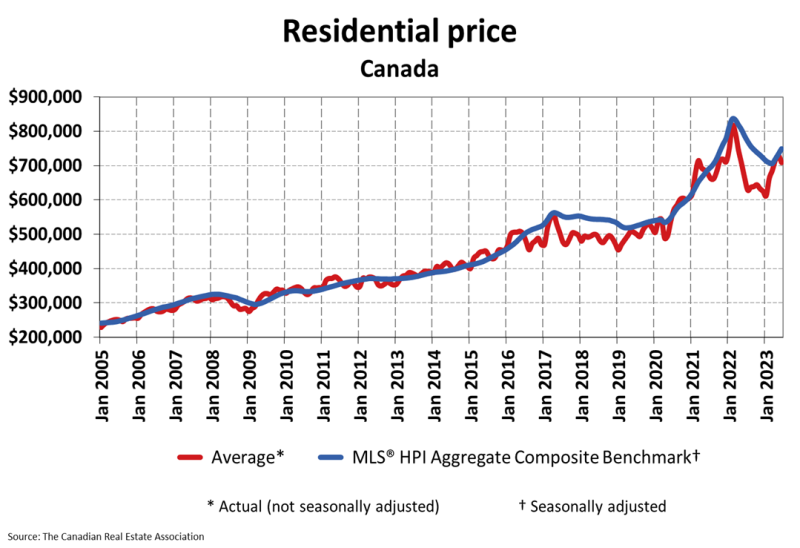

It appears that CREA also believes the rally will be short-lived. In CREA’s quarterly forecast, they expect the national average home price to fall this year and rise just 3.0 per cent from 2023 to 2024. Since national house prices have grown more than 3.0 per cent this year, growing 2.0 per cent monthly in June alone, house prices would need to stabilize and fall to fit within the prediction. CREA mentions this, stating that prices will “stabilize until interest rates start to come down.”

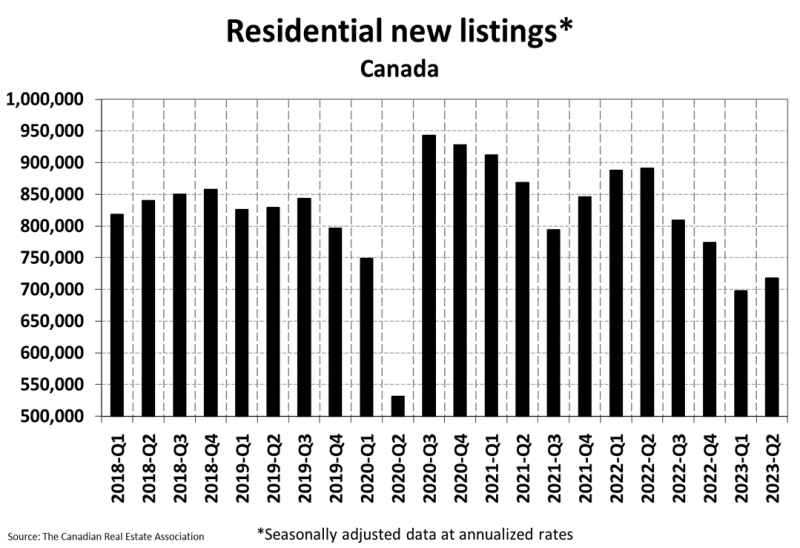

Similar to sales activity, new listings are trending up for the first time in over a year.

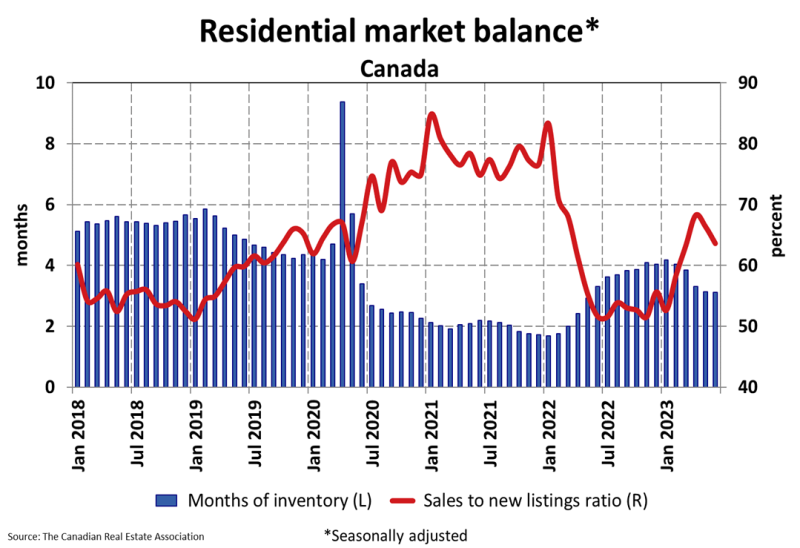

Interestingly, there is something missing from CREA’s data, and there is likely a trend evolving that is worth paying attention to. When analyzing CREA’s residential market balance metrics, we can see that both the sales-to-new-listings ratio and the months of inventory metrics are trending down. With listings trending up at the same time, there’s a reasonable chance that the practice of “re-listing” properties is skewing the sales-to-new-listings ratio down and skewing the active inventory metric down at the same time.

thanks for mentioning “the skew” due to “Do Overs”