QUICK HITS

- According to a new report by RBC Economics, Canadian housing affordability has reached its worst-ever levels in six cities across the country due to interest rate hikes.

- While the market is close to a cyclical bottom, affordability is still a challenge for buyers.

- However, RBC predicts an improvement in 2023.

Canadian housing affordability has reached its worst-ever levels in six cities across the country, according to a report from RBC Economics and Assistant Chief Economist Robert Hogue.

The report found that affordability has fallen as interest rate hikes pushed ownership costs to record levels. However, the downturn has moderated since the fall, with RBC predicting that the housing market was close to a cyclical bottom.

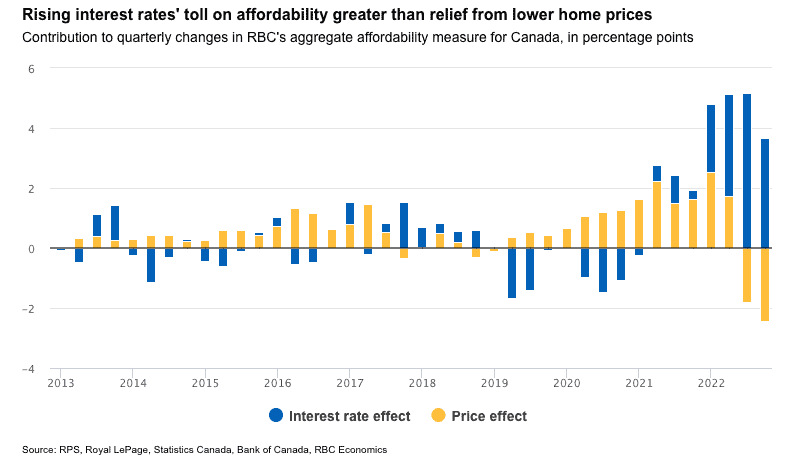

Lower property values have already helped affordability improve in the past two quarters, but the impact has so far been insufficient to offset the rise caused by higher rates. RBC predicts a material overall improvement in 2023 as long as the Bank of Canada keeps rates stable

.

Self-correction mechanism in motion

The report by RBC Economics has shown that interest rate hikes dominated the Canadian housing market in 2022, which caused ownership costs to reach record highs.

RBC notes the higher rates alone added 3.7 percentage points to its aggregate affordability measure in Q4 2022. However, the good news is that the dramatic loss of affordability since mid-2021 has set off self-correcting forces that will “soon turn the situation around.”

The considerably harsher buying conditions have depressed home resale activity and sent prices on a downward trajectory. Lower property values have already had a beneficial impact on affordability in the past two quarters.

So far, RBC says the impact has been insufficient to offset the toll caused by higher rates, but with the Bank of Canada likely done with its rate hike campaign, any further price drops are expected to make a more tangible difference for buyers.

Affordability challenges for buyers continue

For now, buyers continue to face a very challenging environment in most of Canada.

Affordability is at its worst-ever level in Victoria, Vancouver, Toronto, Ottawa, Montreal and Halifax in the fourth quarter, where RBC’s aggregate measures reached all-time highs in Q4 2022.

Ownership costs are also higher than usual in virtually every other market except possibly Edmonton. The situation again deteriorated across the board in Q4 2022 with RBC’s measures increasing the most in Saint John, Vancouver, Victoria and Montreal.

The national aggregate measure is now up an astounding 21.5 basis points since late-2021.

Housing market close to a cyclical bottom

The year-long market downturn has moderated significantly since the fall as activity has reached deeply depressed levels, leaving little downside left, according to RBC.

Home resales have never been so low since the 2008-09 global financial crisis (excluding the lockdown period). RBC sees a bottom forming this spring, with some markets potentially ahead of the pack (e.g. in Ontario and possibly Atlantic Canada) while others (e.g. in the Prairies and Quebec) may lag somewhat.

Prices are expected to level out a few months later, provided the Bank of Canada indeed keeps its fingers off the trigger (as RBC predicts).

Housing affordability poised to improve in 2023

RBC’s report shows that homeownership costs as a percentage of household income have reached new heights in recent quarters, but it also predicts an improvement in 2023.

The report expects a long process to reverse the deterioration since 2021, but lower interest rates and steady, solid income growth will be needed to move the needle in a meaningful way.

Read the full report, including regional breakdowns, here.

In my experience “cyclical” corrections never transpire over a couple years. Rather it is a slow decline anywhere from 4 to 5 years. Guess time will tell this go around.

As a Realtor in London ON, we have seen a 10% increas in the prices since January 2023. Our client was thinking of putting an offer on a condominium until they were informed of 9 offers the lusting Realtor had in hand. Just listed a property yesterday and have received 11 showings requests im less then 24 hours. Hopefully, the trend is our friend

As a holder of 3 houses I say the multiple offers it’s not good for long term, we need healthy steady rise of the house price, multiple offer it’s wrong specially when u have blind bid, partial fault in these crazy prices I blame greedy realtors who found a loop in the system!

And inflation will return -making tangible assets (real property is one) an appreciating class. Plus ii provides a place to live. Buy quality now with short-term financing – refinance in 2-3 yrs at favourable rates.

Affordability not related with interest rate since house price went up 300% in the last two yrs while interest rate increased only 4%.

300 % ??

This outlook seem a little optimistic. Just because BoC paused last meeting doesn’t mean we’ve cured inflation. The recent active market may well be a bank-run fear ( cash vs. brick ) . In my opinion!!