The Canadian housing market has experienced a “huge” second quarter (Q2), surpassing expectations with soaring home sales and average prices. However, economists at TD Economics are cautioning for a potential decline in sales during the latter half of 2023, which could reverse part of the market’s recent strength.

Rishi Sondhi, an economist at TD Economics, sheds light on the impact of this robust performance in the Provincial Housing Market Outlook.

Previous projections had suggested that sales were falling short of levels aligned with underlying fundamentals like income and population growth. However, the surge in recent sales has bridged this gap. Nevertheless, the sharp rise in prices raises concerns about affordability, which could potentially dampen future market activity.

Bank of Canada’s influence

The Bank of Canada has recently raised its policy rate after a four-month pause, driven by resilient housing and consumer spending data. TD economists now project another 25 basis points hike, injecting a total of 50 basis points of tightening by the end of July—deviating from earlier expectations.

This higher policy rate directly impacts affordability, and a more hawkish stance from the central bank is likely to cool buyer sentiment.

Anticipated decline in home sales and prices in the second half of 2023

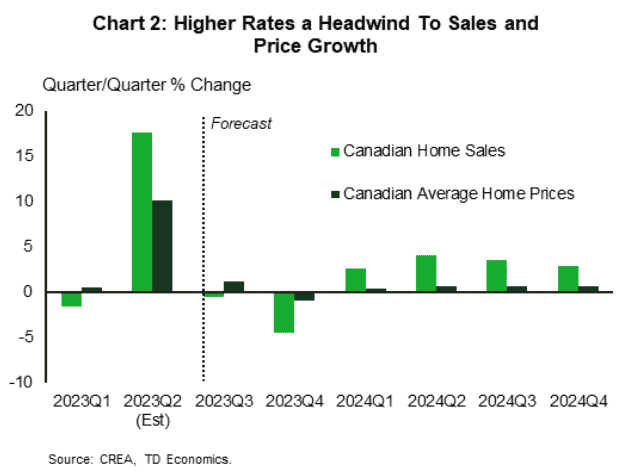

TD Economics predicts a decline in Canadian home sales during the latter half of 2023. Moreover, the pace of purchase growth in 2024 is expected to be slower than previously anticipated. Due to tight markets and restrained supply, Sondhi expects average price growth to remain positive in the third quarter; however, a slight drop in prices is forecasted for the fourth quarter. As a result, the quarterly growth profile for both sales and prices in 2024 has been adjusted downward compared to the earlier March forecast.

Factors shaping the outlook: Central bank policy, bond yields, and population growth

In light of the challenges mentioned above, Sondhi raises an important question: “Given the headwinds, why are we still forecasting growth in sales and prices next year?”

The economist points to the expected reduction in rates by the Bank of Canada in the second quarter of 2024, which, coupled with lower bond yields, is likely to stimulate the market. Furthermore, rapid population growth and positive income gains are anticipated to persist, despite potential increases in the unemployment rate.

The resale market in Canada is currently grappling with low supply, with new listings in May around 16 per cent below the post-GFC average. Sondhi explains that healthy job markets and the ability to extend amortizations have prevented forced selling. However, poor affordability may be discouraging move-up buyers.

On a positive note, an increase in listings is expected in the near term as homeowners respond to improving price conditions. Looking ahead, the economist foresees a sustained rise in resale supply next year, with continued resilience in employment levels mitigating the risk of excessive forced selling.

Regional variations in sales and price growth

TD Economics’ projections indicate that Ontario and British Columbia are poised to outperform other provinces in terms of sales growth in both 2023 and 2024. However, this primarily reflects a return to more “normal” sales levels following a significant decline in the previous year.

While comparatively cooler price growth is expected in these regions due to increased sensitivity to higher interest rates, compositional forces, such as higher growth in detached prices, may provide some short-term upside to average prices.

Conversely, the Prairies are forecasted to experience stronger quarterly price growth moving forward, marking a reversal from earlier underperformance. This trend is expected to be supported by decent affordability conditions and relatively firm economic growth.

In Alberta, slightly slower sales growth is expected due to its higher starting point.

In the Atlantic region, solid population gains and tight markets are anticipated to maintain elevated prices in the second half of this year and drive further increases in 2024. However, severe affordability challenges may constrain the pace of growth.

Quebec’s housing market is projected to be impacted by modest population expansion, resulting in lower demand compared to other regions. Relatively looser markets in Quebec may also contribute to slower price growth.

Downside risks and upside potential

Tighter mortgage lending rules pose a significant downside risk to the housing market outlook, although TD Economics has not factored them into their forecast due to a lack of clear visibility.

Sondhi highlights that if a more hawkish stance from the central bank significantly disrupts buyer psychology, sales could weaken beyond expectations. Weaker-than-expected economic growth could also exert downward pressure on prices through reduced demand and a higher likelihood of forced selling by financially strained homeowners. On the upside, compositional forces driving prices up in Ontario and British Columbia could persist longer than anticipated, and housing shortages resulting from strong population growth may further propel prices upward.

Read the full outlook from Rishi Sondhi here.

The latest GNOTF report (as of end 2nd wk June) stated Sales were on still on track to decline nationally in Q2 for the 8th consecutive quarter. I have no idea how this can be framed as being a huge gain by anyone.

Commission earnings through to the end of May were down in the first 2/3rds of the quarter vs Q2 last year and obviously way down from Q2 2021.

It is important membership questions reports like this as clearly they are not produced with the raw data others use.

That said get down to work prospecting for Sellers and if you know anyone who will need to liquidate real estate the sooner the better as summer is here.