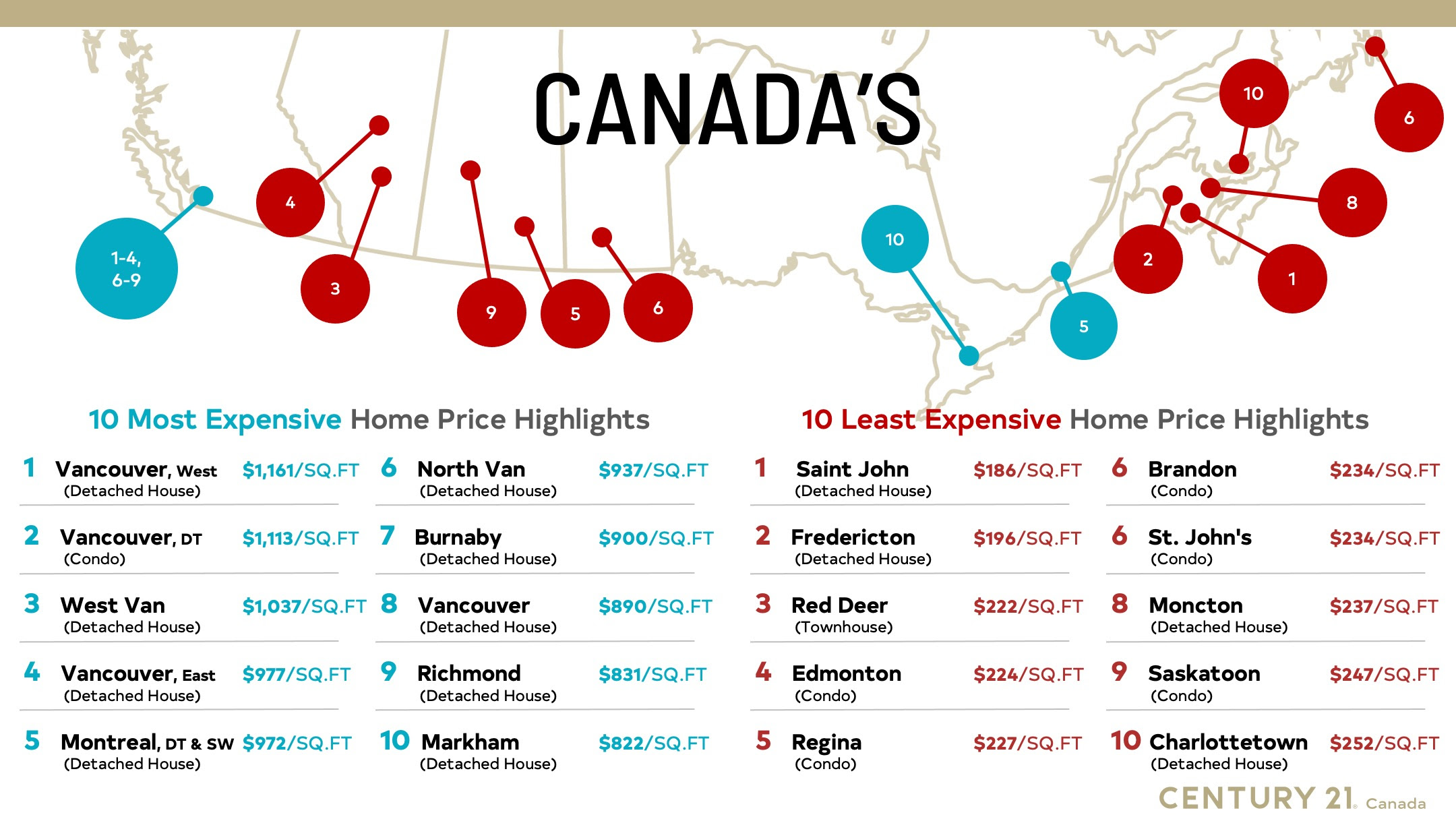

Canadian housing prices per square foot have generally remained stable in the first half of the year, with exceptions highlighting families are moving to more affordable communities, both close by and in other provinces, Century 21 Canada’s eighth annual Price per Square Foot survey found.

The survey compares prices in nearly 50 communities from January 1 to June 30, revealing data trends dating back to 2018 for both larger centres and smaller communities.

Regional insights

In Ontario, British Columbia and Atlantic Canada, prices remained steady, with some gains in smaller markets and suburbs. Downtown condominium prices declined, indicating continued migration away from metropolitan cores.

Significant price jumps were seen in Alberta markets including Calgary and Edmonton, though prices per square foot remain below those in B.C., Quebec and Ontario. Prairie provinces saw more moderate price increases.

Major condominium markets

In Alberta, Calgary condominium prices rose by over 17 per cent, and those in Edmonton by nearly 10 per cent. High River topped increases with more than 22 per cent, but remains affordable at $285 per square foot. Condominiums in Vancouver (the highest priced in Canada), Toronto and Montreal saw modest dips in price per square foot.

Historical pricing and sales levels

Even with some declines, pricing has not fallen below 2021 levels in any market. Sales volumes across Canada have declined from 2021 and 2022, particularly in larger cities.

“A number of our brokers are experiencing a slower market when compared to the conditions of just two years ago,” says Todd Shyiak, executive vice president of Century 21 Canada.

What’s next

“While across the Prairies and Atlantic provinces the market is quite active and balanced, increasing inventory and hesitant buyers in the GTA and the Lower Mainland (Vancouver and area) are resulting in a ‘wait and see’ market,” Shyiak notes. “With the next possible rate cut coming on July 24 buyers may be extending their ‘wait and see’ approach until the fall.”

He explains that inventory and interest rates will likely be major factors influencing future prices.

“Ultimately, we don’t know what the next six months holds for our housing prices, but it’s important not to get too focused on any single year and look at each data point within the larger context of ever-evolving trends. That’s why this survey becomes more valuable year-over-year, because it allows us to see the big picture of Canadian housing.”

Review the full report, including regional summaries, here.