In the face of unexpected challenges such as rising interest rates, the provincial association notes the market has “been more resilient than expected,” with both sales and prices defying expectations.

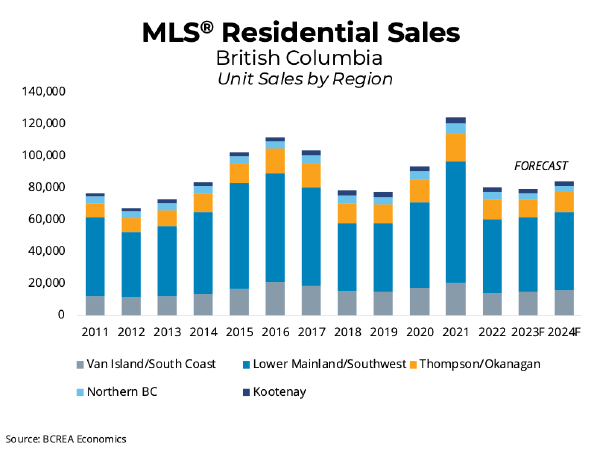

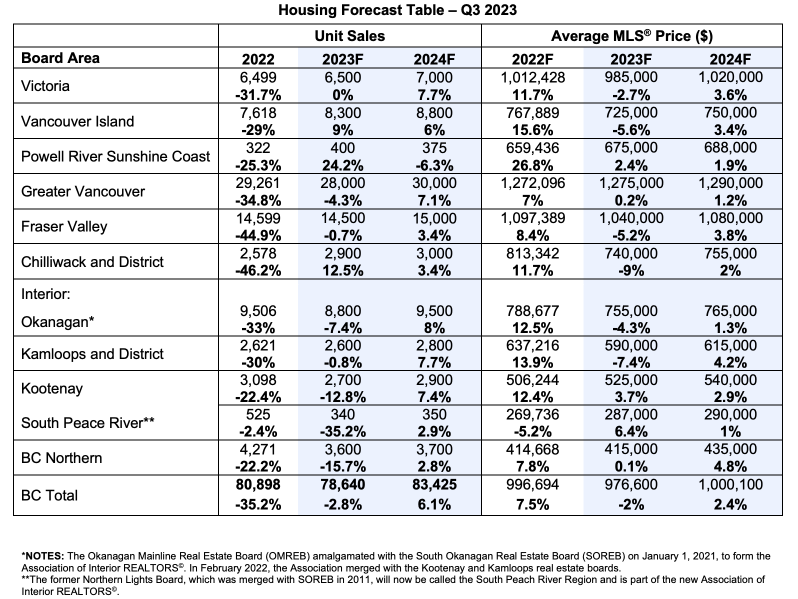

The report projects a 2.8 per cent decline in MLS residential sales to 78,640 units in 2023. However, BCREA’s Chief Economist, Brendon Ogmundson, expects “sales to cool as the result of renewed Bank of Canada tightening and a delay in expectations regarding the timing of future Bank of Canada rate cuts from early next year to perhaps the end of 2024 or even mid2025.”

Price dynamics

One of the defining characteristics of the 2023 housing market has been the persistence of remarkably low inventory. Despite lower-than-average sales, this scarcity has driven prices upward throughout the year. The average price in B.C. started the year below $900,000, reaching just over $1 million in May due to surging sales in higher-end markets and dwindling supply.

Projected price trends

Looking ahead to 2024, the forecast paints a nuanced picture of the B.C. housing market. According to the report, if the average price remains close to the current level of around $970,000 over the latter half of the year, it would result in an annual average price of $976,000 for 2023, indicating a 2.0 per cent decline year-over-year. MLS residential sales are forecast to post a modest rebound, rising 6.1 per cent to more than 83,000 units next year.

Assuming home sales return to “normal levels” next year, BCREA anticipates a 2.4 per cent increase in prices, with an annual average price once again exceeding the $1 million mark.

While the forecast offers insights into potential price trends, BCREA acknowledges that housing supply remains a crucial factor that could significantly impact the market’s trajectory.

Newsletter

Subscribe to our e-newsletters to receive regular updates on what’s happening in the real estate industry in Canada. Delivered every Tuesday, Friday and Sunday.