A report released by Re/Max Canada shows recent economic indicators suggesting that Canadian homebuyers may face more interest rate increases. This will slow the condominium markets in major Canadian centres.

Nearly 100 communities in seven major markets were assessed in the Re/Max Canada 2023 National Condominium Report, including Greater Toronto Area, Ottawa, Halifax-Dartmouth, Greater Vancouver, the Fraser Valley, Edmonton, and Calgary.

Overall sales and price declines

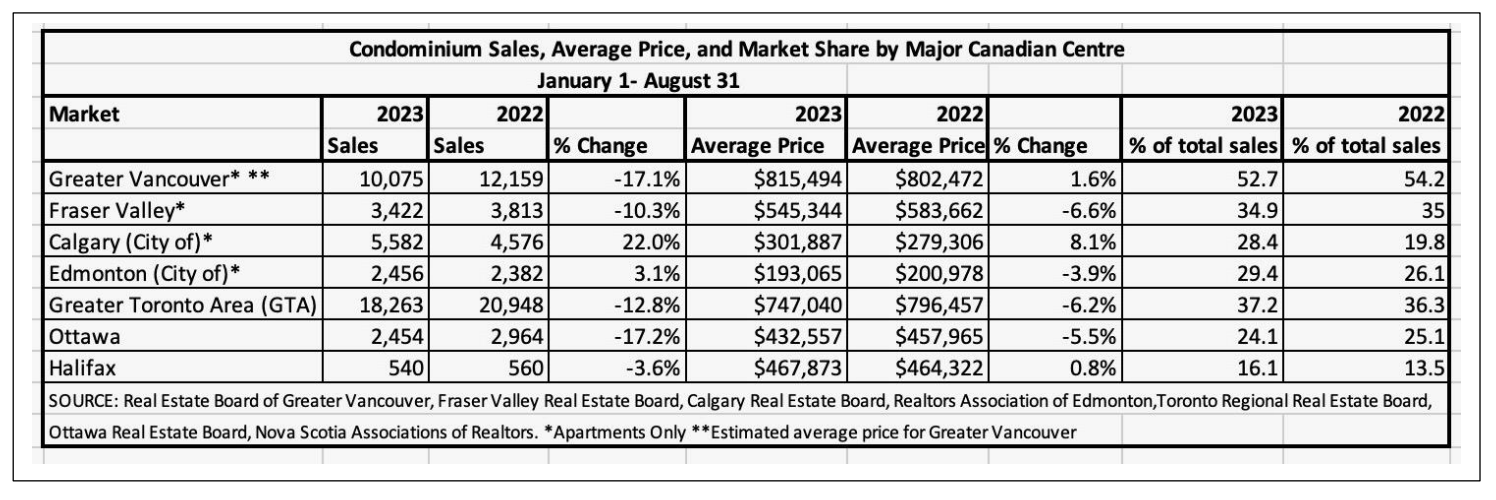

Condominium sales made from May through August, while strong, still didn’t compare to 2022’s year-to-date sales. Over the first eight months of this year, the segment’s overall sales declined in each market except two – Calgary rose over 20 per cent and Edmonton three per cent year-over-year.

As for the average price, it stayed consistent in Halifax-Dartmouth, Calgary, and Greater Vancouver, and went down in Edmonton, the Fraser Valley, Ottawa, and Greater Toronto Area. Three markets – Ottawa, Fraser Valley, and Greater Vancouver – experienced a lower condominium market share, thanks to increased borrowing costs and the stress test’s two per cent addition to the minimum qualifying rate.

Source: Re/Max Canada

Jumps in inventory

Toronto, Canada’s largest condominium market, experienced a huge apartment inventory increase of almost 24 per cent year-over-year and a 7.5 per cent boost in townhome listings. The Fraser Valley’s apartment stock went up nearly 28 per cent in August compared to the same month last year, while Calgary experienced a near-37 per cent listing boost, albeit with an August sales-to-new-listings ratio of 98 per cent. Ottawa and Greater Vancouver saw declines in condominium inventory.

Christopher Alexander, President of Re/Max Canada, weighs in: “While there was some momentum in the market early in September that dovetailed with the Bank of Canada’s announcement to pause interest rate hikes, the most recent inflation numbers extinguished the flame. Lifecycle sales will continue to contribute to steady activity, but a comeback similar to that of the second quarter is likely out of the question.”

Interprovincial migration – a huge driver

One of the biggest factors in Alberta’s condominium market changes was interprovincial migration, as affordability and a lower cost of living were huge attractors to buyers from more expensive markets like British Columbia and Ontario. Both of these provinces saw less interprovincial migration during quarter one of this year, according to Statistics Canada Quarterly Demographic Estimates, Provinces, and Territories.

Alexander isn’t surprised buyers are seeking more affordable markets like those in Alberta or Nova Scotia: “The cost of living is out of control in larger centres and even the most affordable housing now carries a pretty substantial sticker price.”

“Earnings have not kept pace with housing costs and inflation continues to stretch household budgets thin. Taxation is also an issue, with the City of Toronto gearing up to introduce an even more punitive Municipal Land Transfer Tax in January of 2024,” he points out.

Market trends

The report mentions some key takeaways when it comes to condominium market trends. For one, many buyers are lowering their expectations, and seeking better value or no land transfer taxes farther away, with expanded search parameters. The luxury condominium market stayed strong in Toronto and Calgary, mainly thanks to downsizing buyers, and slowed at higher prices in Halifax, the Fraser Valley, and Greater Vancouver.

As well, condominium board strength and maintenance fees are important factors in buying decisions, within many markets. Buyers don’t want surprise expenses and more are doing due diligence when it comes to boards and maintenance.

Construction of new condominiums has slowed, delayed, or cancelled in most markets sometimes due to city approvals but mostly due to financial viability. Finally, assignments are great opportunities in Greater Toronto Area, the Fraser Valley, and Greater Vancouver. Presale buyers from three or so years ago don’t qualify for mortgages at current rates and many need to sell or assign their properties.

Read the full Re/Max report for more information.