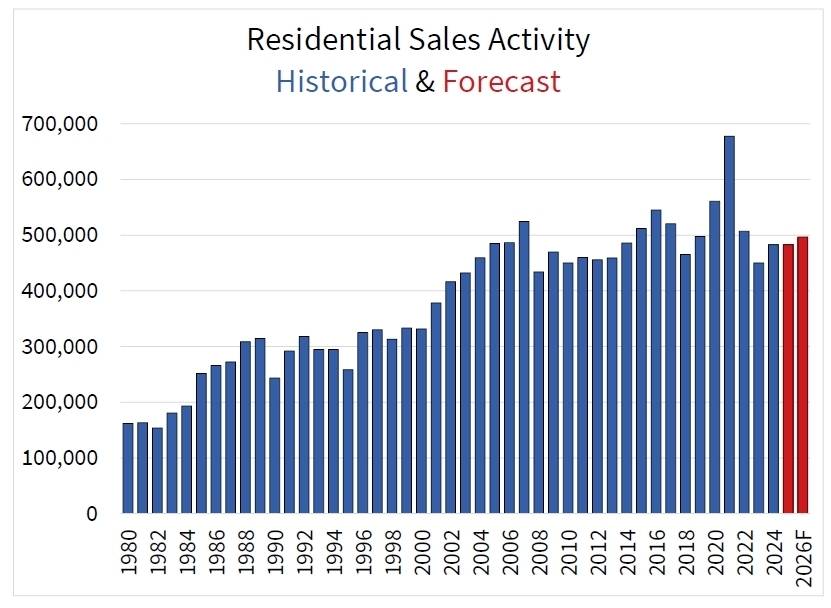

The Canadian Real Estate Association has significantly downgraded its forecast for home sales activity and average prices for 2025 and 2026, citing mounting economic uncertainties and trade tensions.

In its latest quarterly report, CREA says this is the association’s “largest revision in between quarterly forecasts on record going back to the 2008-2009 financial crisis.” Concerns about tariffs and economic instability have notably impacted market confidence, pushing potential buyers to remain cautious or delay home purchases.

Home sales expected to remain flat in 2025

CREA now forecasts that approximately 482,673 homes will be sold in 2025, effectively unchanged (down just 0.02 per cent) compared to 2024. This contrasts with CREA’s January prediction, which projected an 8.6 per cent sales increase.

The anticipated stagnation reflects ongoing worries around the potential impacts of tariffs, stagflation risks, and uncertain interest rate movements throughout the year.

Average home prices see downward adjustment

The national average home price is expected to see a slight decline of 0.3 per cent, settling at $687,898 in 2025—around $30,000 lower than earlier forecasts. Price reductions are expected in British Columbia and Ontario while other provinces, still projected to see moderate price growth, have also had their expectations scaled back significantly to a modest 3 per cent to 5 per cent increase.

Mild recovery expected next year

CREA anticipates a cautious recovery in 2026, forecasting home sales will increase by 2.9 per cent and reach 496,487 units.

Still, the report notes, “sales would fail to crack the half-million mark for the fourth straight year. Historically, since 2007, national home sales have surpassed 500,000 units seven times.”

The national average price is forecast to increase slightly by 1.2 per cent over 2025, reaching $696,074.

CREA’s next forecast update is scheduled for Jul. 15.