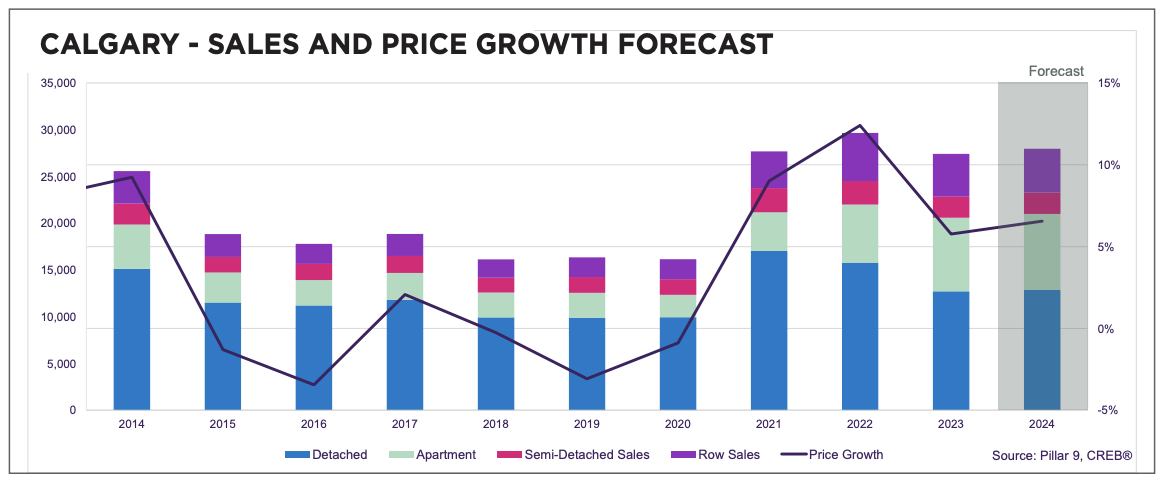

In its 2024 Forecast Calgary and Region Yearly Outlook Report, released today, the Calgary Real Estate Board (CREB) reports the region’s housing market has been strongly impacted by rising interest rates as buyers look at other options and sellers hold off on listing their homes.

The resulting low inventory at lower prices has slowed sales activity overall. That said, a strong labour market and solid migration growth have kept sales above long-term averages.

Sales growth despite challenges

In the face of raised lending rates, higher rents and investor demand have persisted thanks to international migration. At the same time, interprovincial migration from Ontario and British Columbia’s pricier markets has helped with sales growth in higher-priced market segments.

CREB’s chief economist, Ann-Marie Lurie, comments: “Despite higher rates, 2023 was a year of relatively strong sales thanks to a robust labour market and strong migration. The challenge was limited supply, especially for low-priced homes with the strongest demand. This resulted in significant price growth with the largest gains in our lowest-priced homes.”

What’s to come this year

As this year progresses, CREB anticipates more supply will be available. Buyers who were waiting for more options and lower lending rates will return to the market. Plus, with many mortgages up for renewal, resale listing gains could increase with homeowners looking to capitalize on rising prices in a sellers’ market.

That said, it will take time for higher supply levels to restore market balance since there is much demand based on the region’s strong job market and migration. So, CREB expects a seller’s market with more price growth to last throughout the spring, though at a slower rate than last year, particularly for higher-priced properties. Lower-priced properties are expected to stay in tight conditions.

“Conditions are not expected to be as tight as in 2023,” Lurie notes, “but supply growth takes time, and sellers’ market conditions are expected to persist through the spring, driving further price growth in 2024.”

Read the full report here.