Demand for the multi-suite residential rental and industrial sectors is expected to continue in 2023, according to a new report from Morguard.

The real estate investment company anticipates interest will remain high for both markets due to a lack of supply and high demand.

Morguard has released its 2023 Canadian Economic Outlook and Market Fundamentals Report, offering an analysis of the market in 2022 and trend predictions for 2023.

“Investor confidence will remain strong in the multi-suite residential and industrial segments given the sectors’ healthy performance track record during economic downturns,” said Keith Reading, director of research at Morguard. “That said, commercial property performance risk will remain elevated in 2023.”

Multi-suite residential real estate

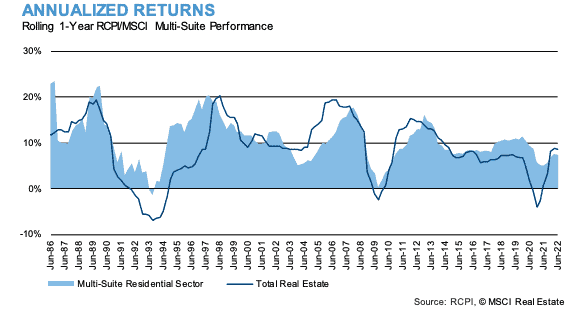

According to the report, several factors contributed to the increase in demand for purpose-built multi-suite residential rental units in 2022.

The primary causes, says Morguard, included Canada’s economic recovery, which boosted employment, and the loosening and subsequent removal of pandemic-related restrictions.

Young workers from the age of 15 to 24 were able to secure employment and transition into the rental market. Rental demand pressure also increased as international migration grew and in-person classes returned for post-secondary and international students.

As demand strengthened, availability became increasingly constrained in several markets.

Rents continued to increase steadily, with Rentals.ca reporting a nearly 12 per cent increase in rents year-over-year in October.

Rent growth and strong rental market fundamentals supported record-high investment sales activity in 2022.

In 2023, Morguard believes Canada’s multi-suite residential rental market will continue tightening as demand outpaces supply as many families will continue to rent, given the high cost of home ownership across the country.

The company says investors will continue exhibiting confidence in Canada’s multi-suite residential rental sector over the near term.

Commercial real estate

Industrial

In 2022, investors continued to target income-producing commercial properties with secure, long-term income streams in major urban centres or proximity to mass transit hubs, according to Morguard.

The company states that despite an increased level of sector risk, $5.5 billion in office property investment sales was recorded in the first half of the year, up 187 per cent year-over-year and was well ahead of the previous year’s pace.

In 2023, Morguard expects some office tenants will further delay long-term leasing commitments in the office sector.

Corporations, as well as government agencies and departments, will continue to adjust to changes in office space usage patterns.

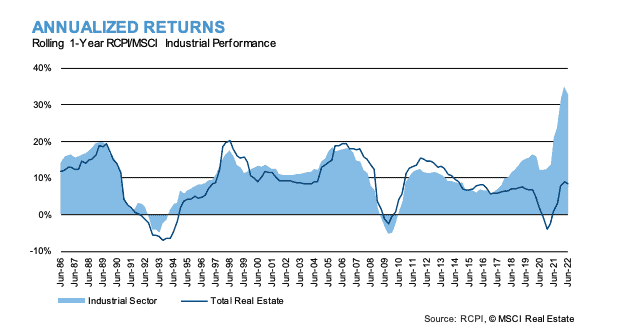

The industrial property sector investment market trends were generally positive in 2022, a trend that Morguard expects will persist in 2023.

A total of $11.7 billion of investment transaction volume was reported for the first six months of 2022, up 57.5 per cent over the same period a year earlier.

Industrial property and space supply remained historically low across Canada in 2022, with availability falling to an all-time low of 1.6 per cent at the midway mark of 2022.

According to Morguard, the generally positive leasing outlook for 2023 will continue to attract investment capital to the sector as investor confidence remains elevated.

Retail

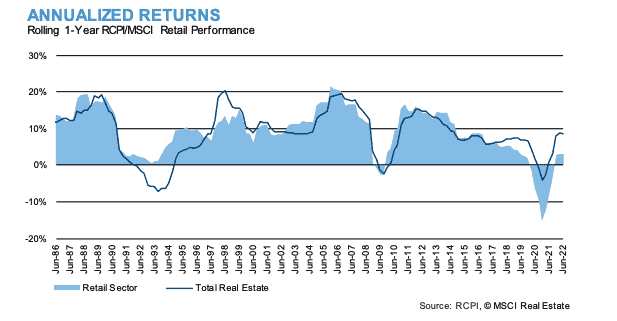

The retail leasing market experienced a rebound in 2022 following the removal of pandemic restrictions on brick-and-mortar store capacities.

Vacancies levelled off in certain market segments, having steadily climbed across much of the country over the past few years.

The leasing market rebound supported the moderately attractive 3.1 per cent total investment return reported for the retail properties contained in the MSCI Index for the year ending June 30, 2022, according to the report.

Looking ahead, Morguard expects Canada’s retail leasing market will continue to stabilize. However, the probability of an economic downturn in 2023 leaves the retail property investment market exposed to elevated risk over the near term.

Economic Factors

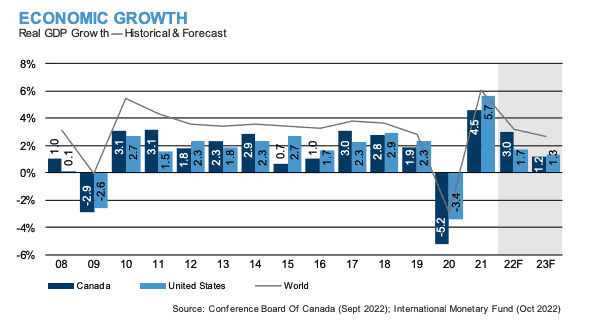

Morguard predicts Canadian economic growth will slow significantly in 2023 due to a combination of interest rate hikes implemented by the Bank of Canada, declining household wealth, and record-high inflation.

Consumer spending patterns will continue to slow through 2023, primarily driven by the erosion of disposable income as households pay more for necessities and discretionary items.

Residential investment will continue to moderate while shoppers delay big-ticket purchases such as appliances and renovations. The continued implementation of interest rate hikes will weigh on households and slow economic growth throughout the year.

During 2022, Mirguard notes labour shortages were common in most sectors of the Canadian economy, thereby limiting growth.

In August 2022, the unemployment rate rose 50 basis points to 5.4 per cent from the record low of 4.9 percent reported in July 2022.

The rate is expected to range at a more sustainable level in 2023 despite continued labour shortages. Canada’s labour market will remain tight over the near term, even with the rising unemployment rate trend.

Read Morguard’s full 2023 Canadian Economic Outlook and Market Fundamentals Report here.