As a mortgage agent, I like to keep up-to-date on the fluctuations and ever-changing nature of the real estate market. On one show I recently watched in my living room, the panel of real estate professionals made repeated references to current interest rates being quite low in comparison to historical interest rates from the 1980s and 1990s.

I am sure that some homeowners were comforted by these sentiments.

Yet, a nagging voice in my head begs to ask a question: is there vital information left out of this comparison? Doesn’t it sound like I am being comforted a bit too much? Is the reality of actual market analytics a bit less snuggly?

Conveniently, my mom—Sukhraj Atwal of HPA Financial Services Inc. (who has lots of mortgage experience)—was sitting next to me on the living room couch and told me I was on the right track.

How are the TV real estate professionals right?

Firstly, the TV real estate professionals are technically correct. For instance, in 1981, the Bank of Canada’s (BoC) overnight interest rate was 21 per cent (making the prime rate 22.75 per cent, which is offered by lending institutions to borrower clients). This is huge in comparison to the BoC’s interest rate being 4.5 per cent as of January 2023 (making the prime rate 6.7 per cent).

However, the difference starts to matter less when you factor in that average home prices were much lower in the 1980s (approx. $75,000) than in January 2023 (approx. $625,000). In the former case, the annual interest using the prime rate would be $17,062.50, whereas the latter case would lead to $41,875 in interest.

Thus, the cost of borrowing—the sum of the principal amount of your loan, the interest, and other mortgage fees—is much higher nowadays. Of course, one could say the higher amount of annual interest on homes is offset by the fact that the average income of Canadians has increased by about $40,000 to $50,000 since the 1980s as well (which also helps balance out higher fuel, food, and other costs of living expenses).

Does this matter to people born after 1981?

Yet, Millennials (or Generation Y individuals born after 1981) and Zoomers (or Generation Z individuals born after 1997) are probably still shocked.

The change in average income over the last 40+ years does not explain why the cost of borrowing has increased so much in a one-year period.

In January 2022, the BoC’s interest rate was 0.25 per cent (making the prime rate 2.45 per cent). At the time, the average Canadian home price was $750,000, so the annual interest for such a property was $18,500.

Thus, even though housing prices decreased by about $125,000 as interest rates rose by 4.25 per cent from Jan. 2022 to Jan. 2023, the cost of borrowing more than doubled over the year with an increase of about $23,500 (from $18,500 in Jan. 2022 to $42,000 in Jan. 2023).

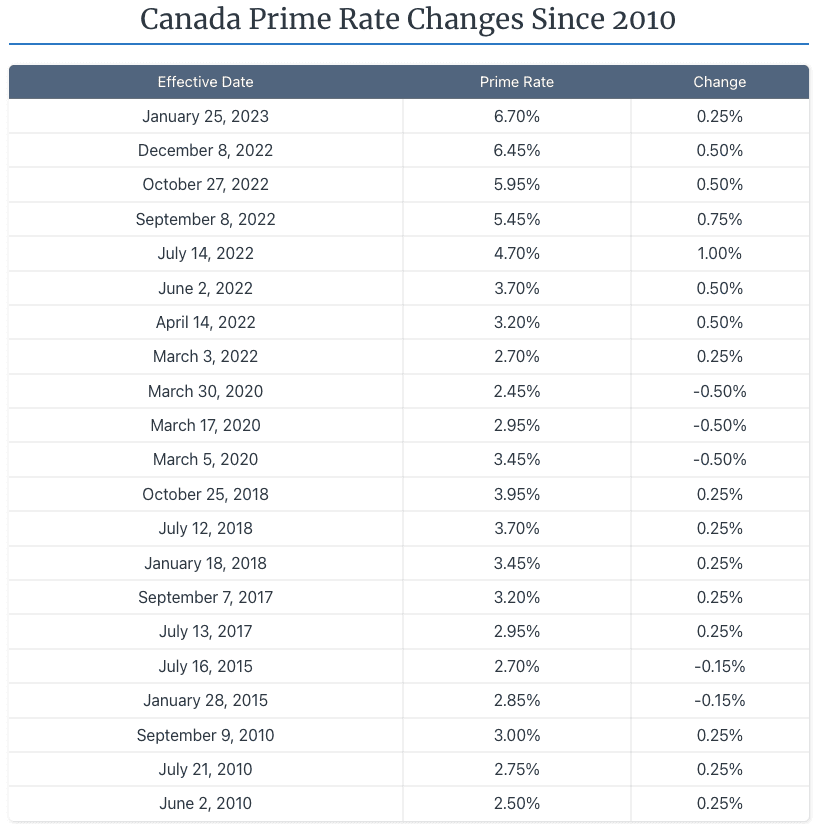

In the face of such a doubling, it is no wonder why Millennials and Zoomers are not wearing cheerful smiles. After all, between Jun. 2010 and Jun. 2022, as per the below chart, the highest the prime rate charged by lending institutions was 3.95 per cent, a far cry from its current level of 6.7.

Source: https://wowa.ca/banks/prime-rates-canada

So, why should we be cheerful?

In order to feel more optimistic, one should note the purpose of increasing the BoC overnight rate is to combat inflation, and the inflation rate is already starting to come down. Since the inflation rate reached a relative high of 8.1 per cent in Jun. 2022, it has now decreased to 5.9 per cent as of Jan. 2023.

Things are certainly moving in the right direction. Not only is this quite a bit lower than the 12.47 per cent inflation rate that occurred in 1981, but the unemployment rate now (5.0 per cent) is also drastically different than it was 40 years ago (12 per cent).

It should also be noted that, on Mar. 8, 2023, the BoC interest rate held steady at 4.5 per cent after eight consecutive rate increases. It remained the same on Apr. 12, 2023.

Further BoC interest rate increases have not been ruled out for the future, as it depends on whether inflation rates come further down and how the economy continues to perform. But, most economists expect the BoC to keep interest rates steady at 4.5 per cent for the balance of 2023, and they will hopefully start coming down in 2024.

How should we feel about this? It comes down to whether one sees a glass as half-empty or half-full. While pessimists will likely point to declining mortgage loan growth due to possible further interest rate hikes and weak housing affordability, the aforementioned economic indicators of decreasing inflation and unemployment rates can be interpreted as positive signs. It’s all in the eye of the beholder.

How does this practically affect borrowers?

Regardless of the direction one’s natural speculative impulse follows, the reality is mortgage interest rates are high right now. Thus, it seems wise to pursue mortgage loans with shorter terms (perhaps one or two years), which will allow borrowers to refinance at lower interest rates when the market again normalizes.

Depending on your client’s needs, it may also make sense to pursue options outside the big five banks. For instance, perhaps a borrower is particularly concerned with having higher prepayment privileges; in such cases, they will likely be best served by B-lenders, who generally allow prepayment of 20 per cent of the principal amount of the mortgage per year.

Even amongst B-lenders, your client may need to choose one offering a higher interest rate than others because their GDS/TDS ratios are closer to 50 per cent/50 per cent. On the other hand, the property may be located in a rural area, which may entirely dissuade B-lenders from even considering the transaction due to the inherent increased risks associated with remote locations.

As always, in addition to considering the borrower’s particular concerns and circumstances, a careful analysis of various features of available mortgage products will need to be done on a case-by-case basis.

While the market analytics surely are less snuggly than some may lead you to believe, careful students of past and present trends can also definitely determine creative solutions that anticipate future problems.

Harjot Atwal is a Mortgage Agent (Level 1) with Ontario Lending Solutions (FSRA #13063). He is also a real estate lawyer and has published articles for Law360 Canada, Real Estate Magazine, Canadian Lawyer Magazine, CondoVoice Magazine, and Suhaag Magazine. You can reach him via e-mail.