Toronto’s real estate landscape has been nothing short of tumultuous, as Desjardins economists shed light on the rollercoaster ride of housing prices in Canada’s largest city and where we could go from here.

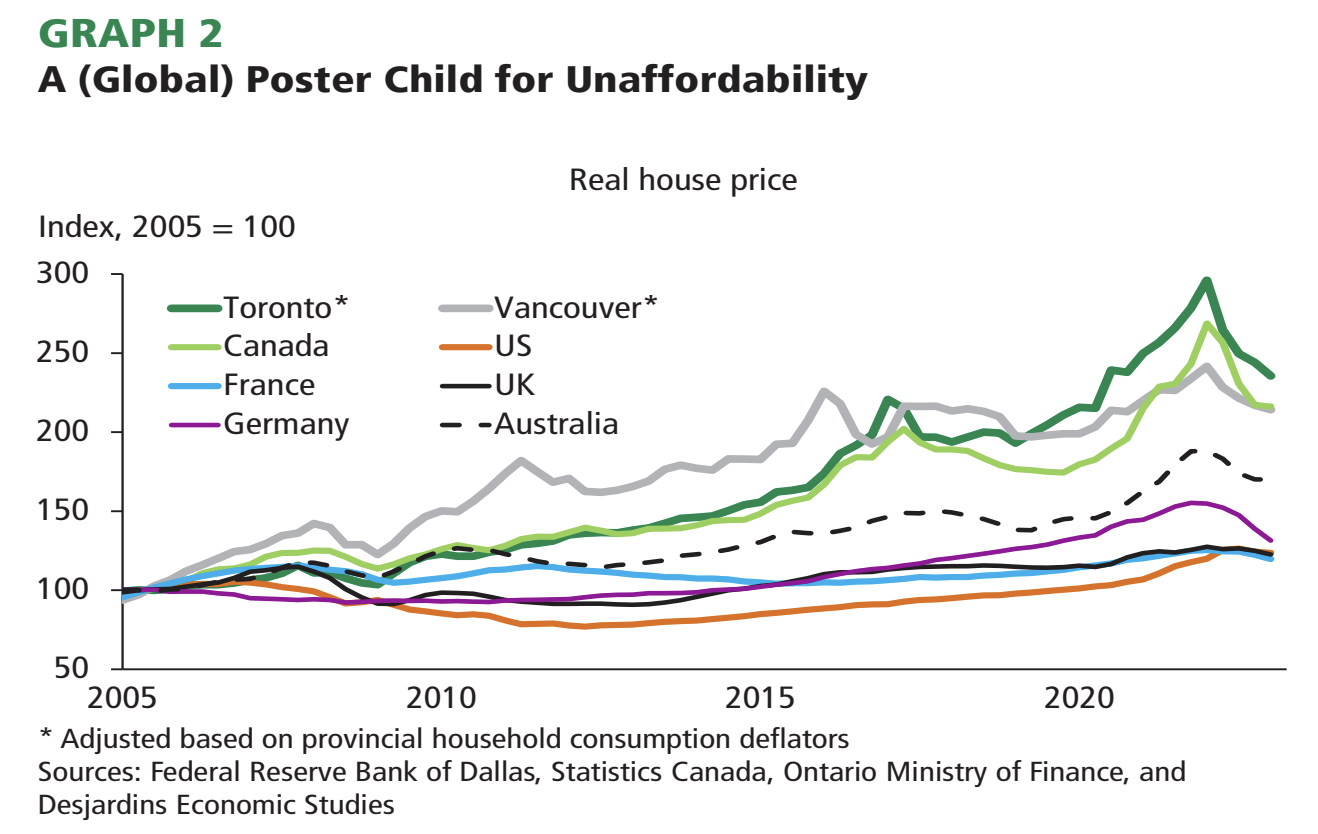

With soaring home prices during the pandemic and a subsequent drop, a recent report from the financial institution underscores the exceptional nature of Toronto’s housing market within the broader context of the country’s nearly uninterrupted two-decade surge in home prices.

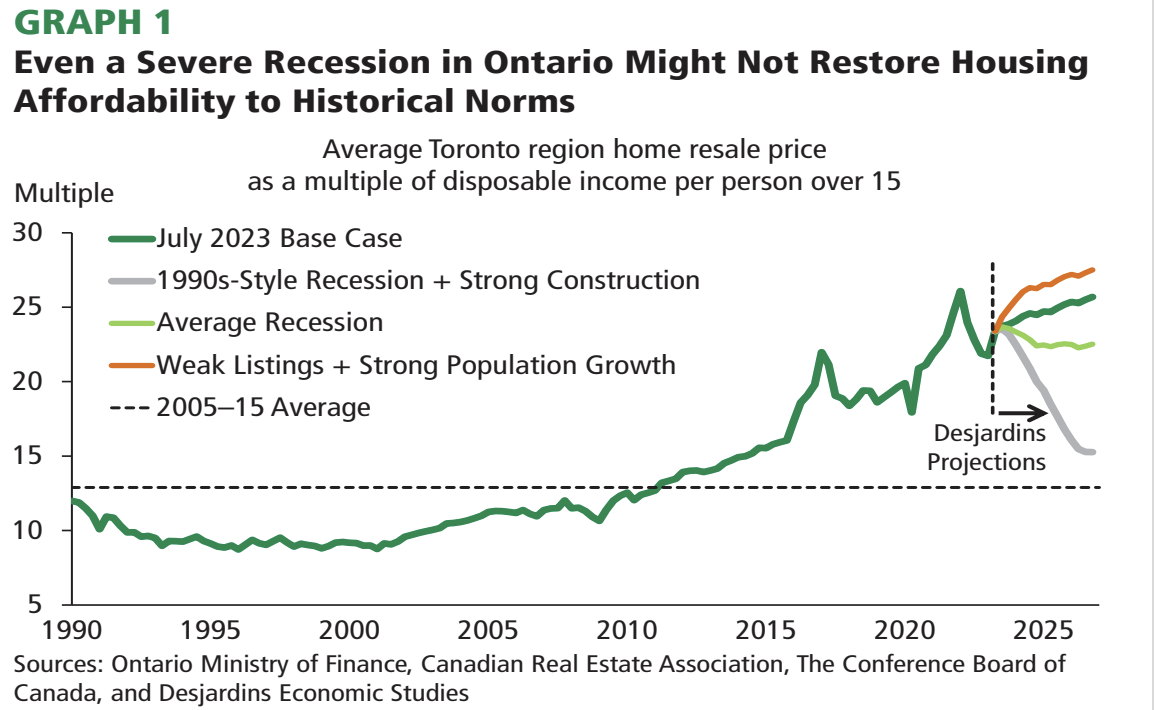

The report looks at three scenarios of where prices and affordability could go in Toronto with the caveat that “even in the direst of economic scenarios,” economists don’t see affordability returning any time soon.

Scenario 1: A throwback to the 1990s

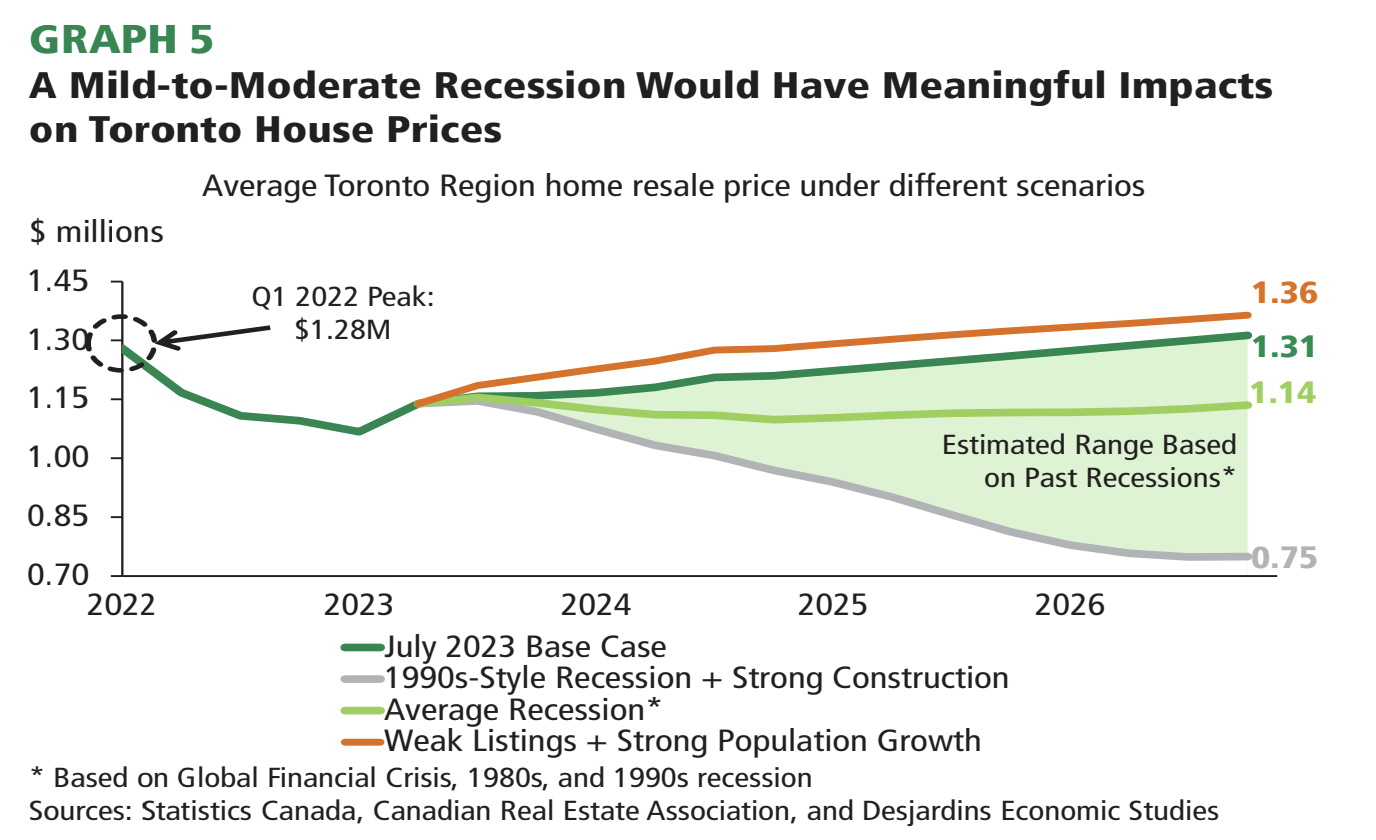

In a stark scenario reminiscent of the 1990s recession, the report explores a potential downturn in Toronto’s housing market, painting a picture of a significant drop in home prices. While possible, it’s improbable and there would be implications for both for buyers and sellers.

If this severe recession scenario were to occur, Toronto home prices could fall by a staggering $185,000 (16 per cent) from current levels by the end of the next year. By Q4 2025, prices could be as much as $340,000 (30 per cent) below the levels seen in July 2023. Despite this plunge and even under such extreme circumstances, the home price-to-per capita disposable income ratio would only return to levels last seen in late 2015.

“Such a significant price decline could likely only come at a massive economic and social cost. Compared to our base‑case Ontario forecast, a 1990s‑style recession would result in a more than $35B reduction in employment income and almost half a million total job losses by Q4 2025.”

Scenario 2: A moderate slump

The second scenario envisions a more moderate economic recession and its effects on Toronto’s housing market. It examines how this scenario could lead to a dip in home prices while assessing its impact on housing supply and demand.

Under this scenario, Toronto house prices would bottom out by the end of the next year, roughly 5.0 per cent below the levels seen in July 2023. Despite this decline, the report anticipates a slight improvement in affordability compared to current levels, though it would still only bring the price-to-disposable income ratio per person over age 15 back to early 2021 levels.

Scenario 3: Population growth vs. new listings

The report’s third scenario offers an optimistic outlook for current homeowners, focusing on sustained, record population growth and limited new listings.

In this scenario, Toronto home prices could increase by about 6% higher than in the base case. This would push prices past the February 2022 peak by early 2025. While this might be seen as positive news for property owners, it would be less favourable for prospective buyers, as “the sales price‑to‑disposable income ratio per working-aged person would exceed its pandemic‑era peak by mid‑decade.”

Complex challenges

Desjardins’ economists underscore the exceptionally challenging starting position for both prospective first-time home buyers and policymakers seeking to improve housing affordability: “Striking as these results may be, we’ve always known that restoring housing affordability was a long‑run process. Our analysis reinforces that view, as well as the need to successfully implement ambitious plans to boost the housing supply.”

Good Work!

Three scenarios show how issue of how to SOLVE AFFORDABILITY has been conflated with the NUMBER of UNITS in the supply pipeline.

WHO will finally say something about the (apparently un-thought-of implications of) huge increases in DEMAND that were created by HUGE increases in immigration?

So… you’d apparently rather blame this on immigration, and not the commodification and corpoatization of something that should be a basic human right. Commodification and corporatization of housing has been going on for years now. That’s the real problem. But hey, it’s sure nice to have a convenient scapegoat in the form of the immigration bogeyman to cover up the real problem isn’t it.

Why is this, is it because we let in huge amounts of immigrants..not bad just the amount correct me if I’m wrong but almost three times the 20 yr average

A complicated situation made worse by the economics of immigration. More people means we should have the infrastructure in place before the people arrive. Our health care system, education, housing, and transportation (public and private) are not able to adequately support the number of people already here. Colleges and universities are drawing foreign students as they put more money into the schools (but of course they are not providing housing for all of these students). We need more doctors, nurses, and beds to support the existing population and forget about getting around as the government throws money at Metrolinx to build the LRT system but it continually falls behind schedule and over budget. Add to this the government hasn’t kept up with roads and last I checked the City of Toronto is predicting a $1.5B budget shortfall. Lastly, we have a lack of supply, and yet we increase the demand.

So should we blame the government for bringing more people into an area that’s already struggling or should we blame the fact we live in a capitalist society?

Retired 25 year real estate broker trying to do 3rd downsize. BoC market freeze interest rate hit by April 2023.

April local market value was at $1.9m. By June $1.8m. By Aug. 1.7m. By Sept. $1.6m. Avg. 3 showings per week.

Fixed Income Seniors losing major home equity, due to foolish BoC policies.

Senior Baby Boomer peak birth rate in 1955, turn 70 in 2025. No government of any party has prepared for this obvious social mix change, never mind growth rates of 1st time buyers. Both Seniors and Juniors need 1600 -2600 s.f. housing, not under 1000 s.f. box in sky.

Cities growing due to global migrations. Property values will increase and wages will increase due to loss of competitive markets during past 50 years.

BoC is causing middle class seniors to become wards of the state by temporarily driving housing prices artificially lower.

Best remedy will be mid-sized in-fill modular housing creating modest density increases in post war small house areas.