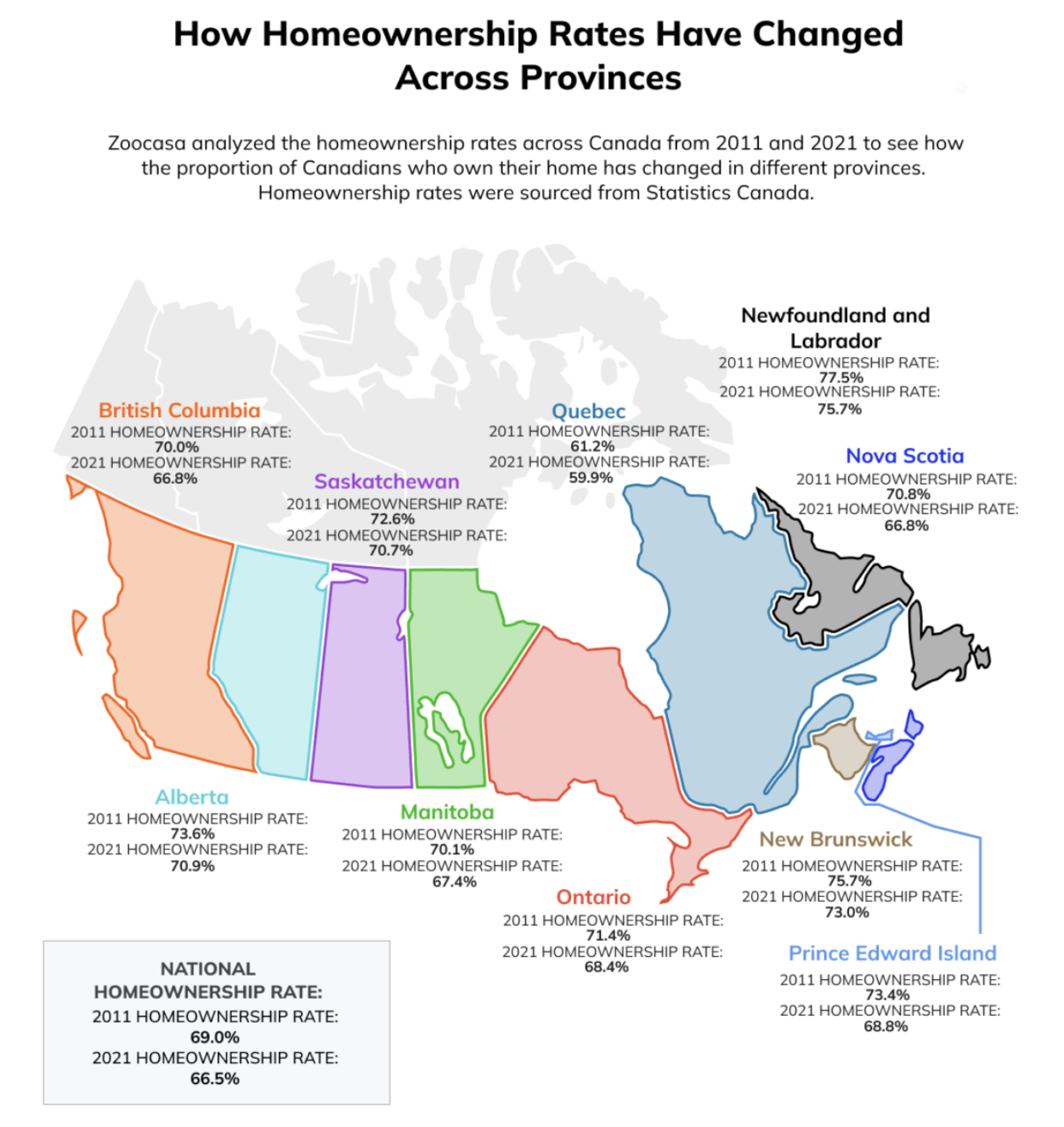

Canada’s homeownership rate dropped from 69 per cent in 2011 to 66.5 per cent in 2021, Statistics Canada reports. However, homeownership rates in several provinces are higher than that.

From personal preferences, age or generation to market conditions and available dwelling options, many factors play a role in whether people own a home of their own. Here’s how the rate has changed across the country and generations of Canadians, as analyzed by Zoocasa.

Source: Zoocasa

Higher homeownership rates preside in more affordable provinces

With 2021’s lowest average home price of $239,900, New Brunswick held the second-highest homeownership rate in Canada, coming in at 73 per cent. This province was the country’s most affordable in September of this year, as its average home price was $292,600. Since prices grew at a whopping 22 per cent from September 2021 to September 2023, demand will likely keep growing.

Newfoundland and Labrador is home to the country’s biggest group of homeowners, at 77.5 per cent in 2011 and 75.7 per cent in 2021. Not coincidentally, in 2021 the province also had the second-lowest average home price in Canada, at $263,900.

This represented a modest 9.3 per cent price increase since 2011, which was the smallest jump of any province. What’s more, since 2021, the province’s average home price didn’t climb as aggressively as it did elsewhere, reaching $295,400 in September 2023.

The only other provinces with 2021 homeownership rates above 70 per cent were Saskatchewan and Alberta, at 70.7 per cent and 70.9 per cent, respectively. Compared to 2011, Saskatchewan’s rate went down in 2021 by 1.9 per cent, while Alberta’s decreased by 2.7 per cent. Although Alberta’s demand is high, with many Ontarians and British Columbians migrating there, the low inventory is keeping residents in home rentals.

Major Canadian markets squeezing out prospective buyers

By far, the largest jump in average home price from 2011 to 2021 was in Ontario, which experienced a massive 135.4 per cent increase. On top of this, average incomes haven’t risen proportionately, creating the perfect storm for the province’s 3.1 per cent drop in homeownership over the decade.

Although Quebec’s home prices are relatively low for the country, its homeownership rate is also relatively low – at just under 60 per cent. The province also had the smallest change in homeownership from 2011 to 2021. It went down by 1.3 per cent.

The second-lowest homeownership rates came up in both Nova Scotia and British Columbia. These provinces experienced large drops since 2011, of 4 per cent and 3.2 per cent, respectively. A large factor playing into this is the steep price jumps, particularly in B.C. This province’s average home price was $506,100 in 2011 and $910,800 in 2021 – an increase of 80 per cent. In September of this year, it rose further to $988,300.

Those having the toughest time buying a home: Millennials

As for demographic groups, millennials (those born from 1981 to 1996) have the lowest homeownership rate – to the point that only the homeownership rate of those under 40 is below Canada’s average of 66.5 per cent.

This group also went through the largest drop in homeownership. This is especially true for younger millennials who can’t enter the market, as those in the 25-29 age group dropped from 44.1 per cent to 36.5 per cent.