As we reflect on 2024’s market, I can’t help but draw parallels to another pivotal moment in Toronto’s real estate history: the dramatic correction of the early 1990s. Back then, Toronto experienced what many considered unthinkable: a six-year decline that saw average home prices plummet by 28 per cent from their 1989 peak. The catalyst? A perfect storm of rising interest rates, recession and overbuilding that burst what was then considered Toronto’s first major housing bubble.

That correction fundamentally reshaped the market. Properties that had been snapped up for $500,000 in 1989 were selling for $350,000 by 1996. Developers went bankrupt, leaving half-finished condominiums dotting the skyline. The term “negative equity” entered the everyday vocabulary of Toronto homeowners, as thousands found themselves underwater on their mortgages.

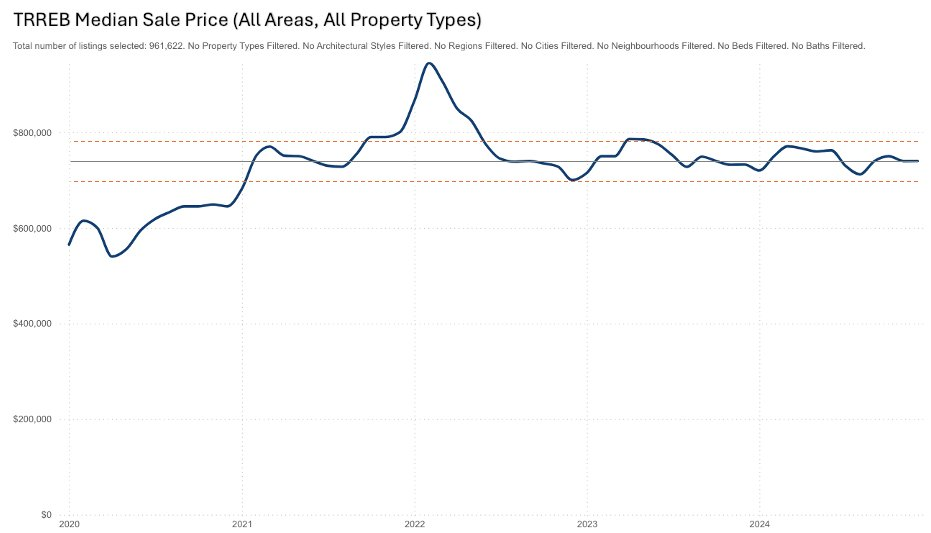

But if you look back on that period, the market appeared almost “flat” from about 1991 to 1996 after the steep drop. A similar trend can be observed in the chart above, which shows house prices since interest rate hikes started in 2022.

Where we’re at now

Today’s market might echo some aspects of that tumultuous period, with falling prices brought on by once-rising interest rates, perpetual affordability concerns, an election, changes to capital gains structure and more economic uncertainty, especially around unemployment.

So, it may come as a surprise to you that the market was warming up a bit in November (more sales, NOT higher prices). The reason we’re seeing more people buying houses in the Greater Toronto Area (GTA) is affordability.

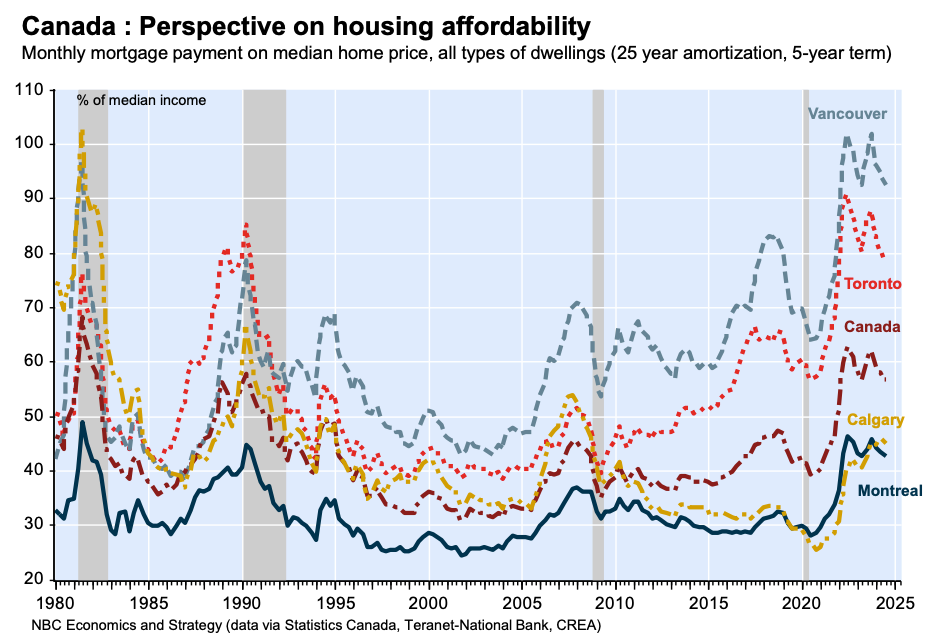

Affordability is improving in Canadian real estate, and the GTA is at the forefront. In fact, housing affordability in Toronto has corrected more than any other major city in Canada according to the National Bank’s Q3 Housing Affordability Monitor.

A correction means that mortgage payment costs are decreasing as a percentage of household income. When people can afford to buy houses, they do. This phenomenon gave 2024 a relatively strong market in October and November, but December was slowed.

The biggest support for the improvement in affordability could also be its greatest risk factor. RBC observed that growing household income significantly helped improve affordability in 2024’s third quarter. The challenge is the few key trends that could slow wage growth in 2025:

- The unemployment rate is rising

- The majority of job growth has come from government hiring

- The likely winner of our election is committed to reducing the number of government employees

So, future improvements to housing affordability may come from a reduction in interest rates or house prices. In a healthy market, Toronto’s housing costs 40-50 per cent of median household income, and I expect it will get back there in time.

GTA 2024: A buyer’s market with caveats

For years, the GTA housing market felt like a relentless bidding ground, with escalating prices and scarce supply fueling a sense of urgency. However, 2024’s home sales reached 67,610—up 2.6 per cent from 65,877 in 2023—while new listings surged by 16.4 per cent to 166,121. On paper, this provided buyers with a clear advantage and more choice than they’d seen in years, hinting at a possible market correction.

Yet beneath the surface, the so-called “buyer’s market” has been far from a bargain. Despite the uptick in listings, the average selling price dipped by less than 1.0 per cent year-over-year, settling at $1,117,600 compared to $1,126,263 in 2023. Detached homes continued to command lofty prices, while condominiums —though subject to more notable price declines—still struggled to attract cost-conscious first-time buyers, many of whom stayed on the sidelines in hopes of greater interest rate relief down the road.

Monthly, there were some significant data points. Sales decreased by 1.8 per cent, while new listings and active listings substantially increased by 20.2 and 48.5 per cent, respectively. The average price saw a slight decrease of 1.6 per cent compared to December 2023, and days on market increased by 12-15 per cent.

The 16.4 per cent jump in new listings might suggest an easing of supply constraints, yet many sellers appeared hesitant to lower asking prices. Although the balanced supply-to-demand ratio theoretically favoured buyers, the minimal price drop signals seller resistance to resetting expectations. The gap between buyer hopes and market realities remained stubbornly wide.

Condominiums: A sector to watch in 2025

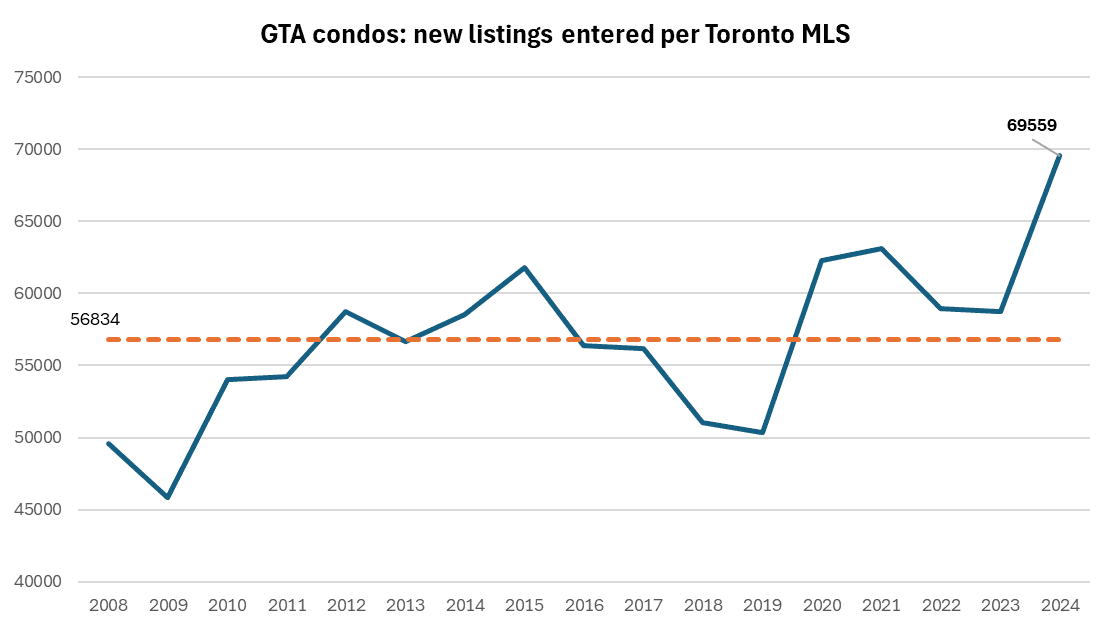

Of all the sectors in the GTA real estate market, the condominium sector is the one I’m really keeping my eye on. With more new condominium listings than ever before and record new supply added to the market in 2024, it shows no signs of letting up.

There are a few reasons for this. First, the Bank of Canada’s interest rate hikes made it more expensive for people to buy homes, causing some first-time buyers and investors to choose condominiums as a more affordable option. Second, the construction of new condominiums has been booming, which has added to supply on the market.

Despite the supply increase, condominium prices have not yet fallen as much as expected, probably not because demand remains strong but more because sellers have decided to lose money slowly rather than quickly. What I mean by this is the majority of new condominiums have been considered “cash flow negative” in the current market by Benjamin Tal and Urbanation. Based on my analysis, the majority are also “equity negative.”

Source: Valery.ca Special Report

So, many sellers have set a floor price—that is, a minimum price they’d accept. If they don’t get that price, they decide to rent the unit out rather than sell it at a loss, allowing them to spread out the burden across monthly mortgage payments rather than absorbing it in one shot.

Source: Robert Marsiglio, Realtor

2025 predictions: Hope or more of the same?

Looking ahead, optimism for 2025 hinges on continued interest rate cuts and stable or marginally lower home prices. TRREB President Elechia Barry-Sproule expects improved market conditions over the next year, but the GTA market has a remarkable knack for bouncing back swiftly. Prospective buyers banking on continued softness may find themselves outpaced if the market rebounds.

Meanwhile, structural problems remain—congestion, supply constraints and stubbornly high prices. TRREB’s chief market analyst, Jason Mercer, emphasized that government policy reforms must address these core issues. Otherwise, the GTA’s real estate rollercoaster will continue with fleeting windows of affordability that close as quickly as they appear.

Far from a buyer’s utopia, 2024 felt more like an intermission. Yes, deals were occasionally on the table, but “affordable” remained a moving target—especially for those entering the market for the first time. The question persists: as we edge into 2025, will this pause evolve into genuine relief, or is it merely the calm before the next wave of price hikes? Only time—and possibly more interest rate adjustments—will tell.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.

very much improved specificity!!

Congrats