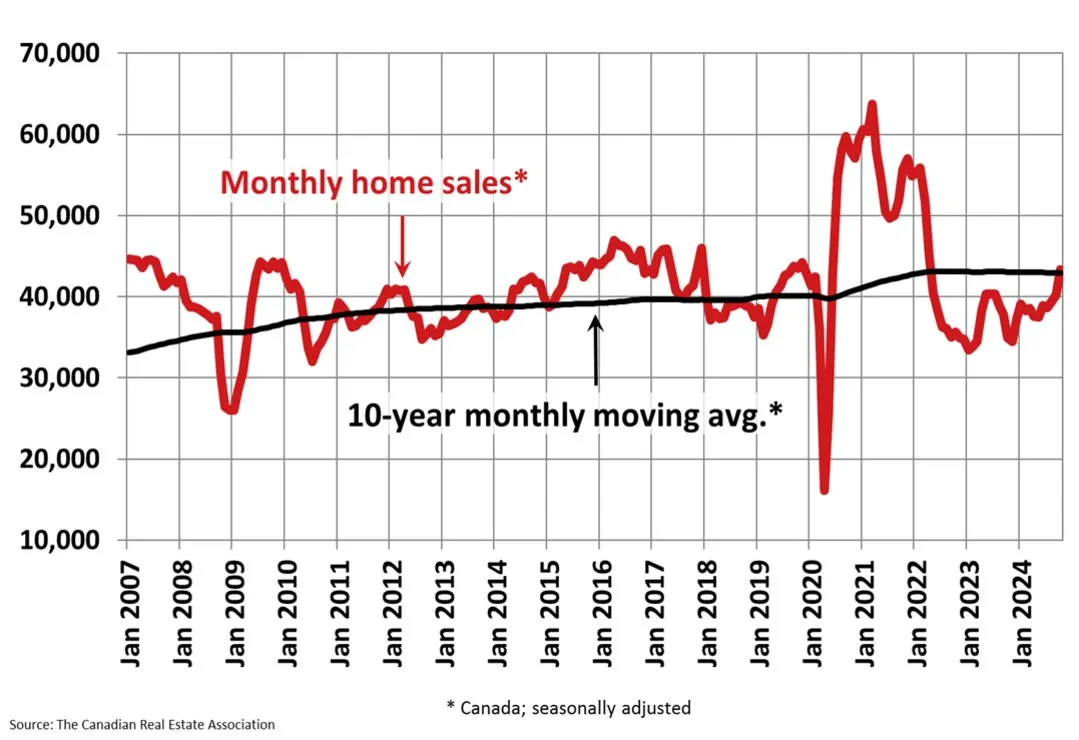

The 7.7 per cent month-over-month increase in home sales activity is a striking development, especially considering the more modest gains of 1.9 and 1.3 per cent in September and August, respectively.

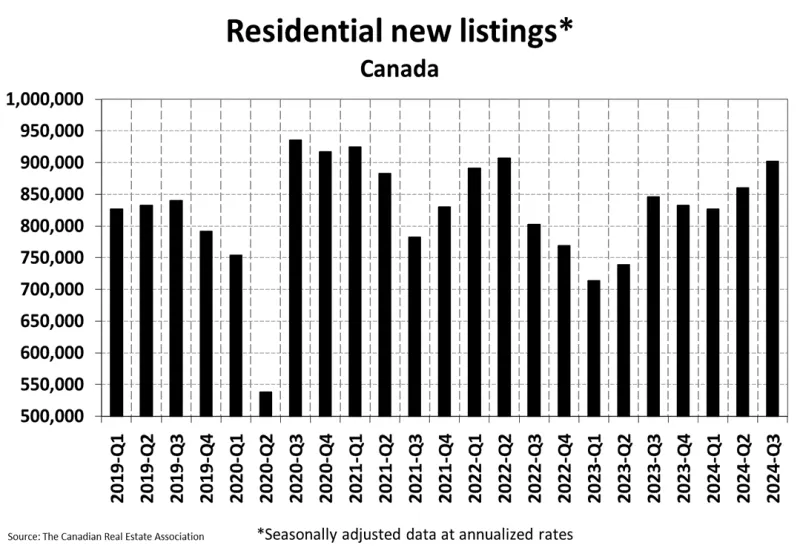

This surge in activity presents a complex landscape with both opportunities and challenges for buyers, sellers and real estate professionals. While we’re seeing a significant increase in demand (measured by sales) we’ve also observed an equally large jump in supply (measured by new listings).

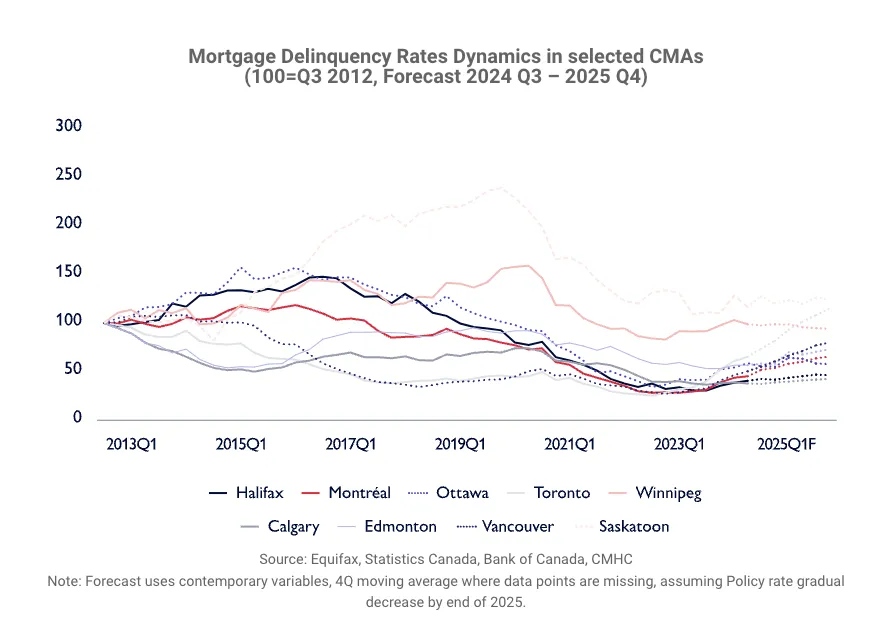

For sellers, this surge in activity is undoubtedly positive news. The increased demand could lead to quicker sales and price growth in the absence of supply. However, the opposite could be true, if a “pent-up supply” scenario is pending among CMHC’s recent reports that mortgage delinquencies will be rising in most cities across Canada.

Real estate professionals may also benefit from this uptick, with more transactions likely leading to increased commissions and business opportunities.

However, buyers face a more challenging landscape. While lower interest rates have improved affordability, the sudden increase in market activity could lead to increased competition and diminishing affordability.

Against the backdrop of rising unemployment, the market may be quick to exhaust any potential gains from cheaper interest rates, 30-year amortizations and $1.5-million insured mortgages coming in December. This situation underscores the importance of being well-prepared and acting decisively in a more active market.

Supply and demand balance

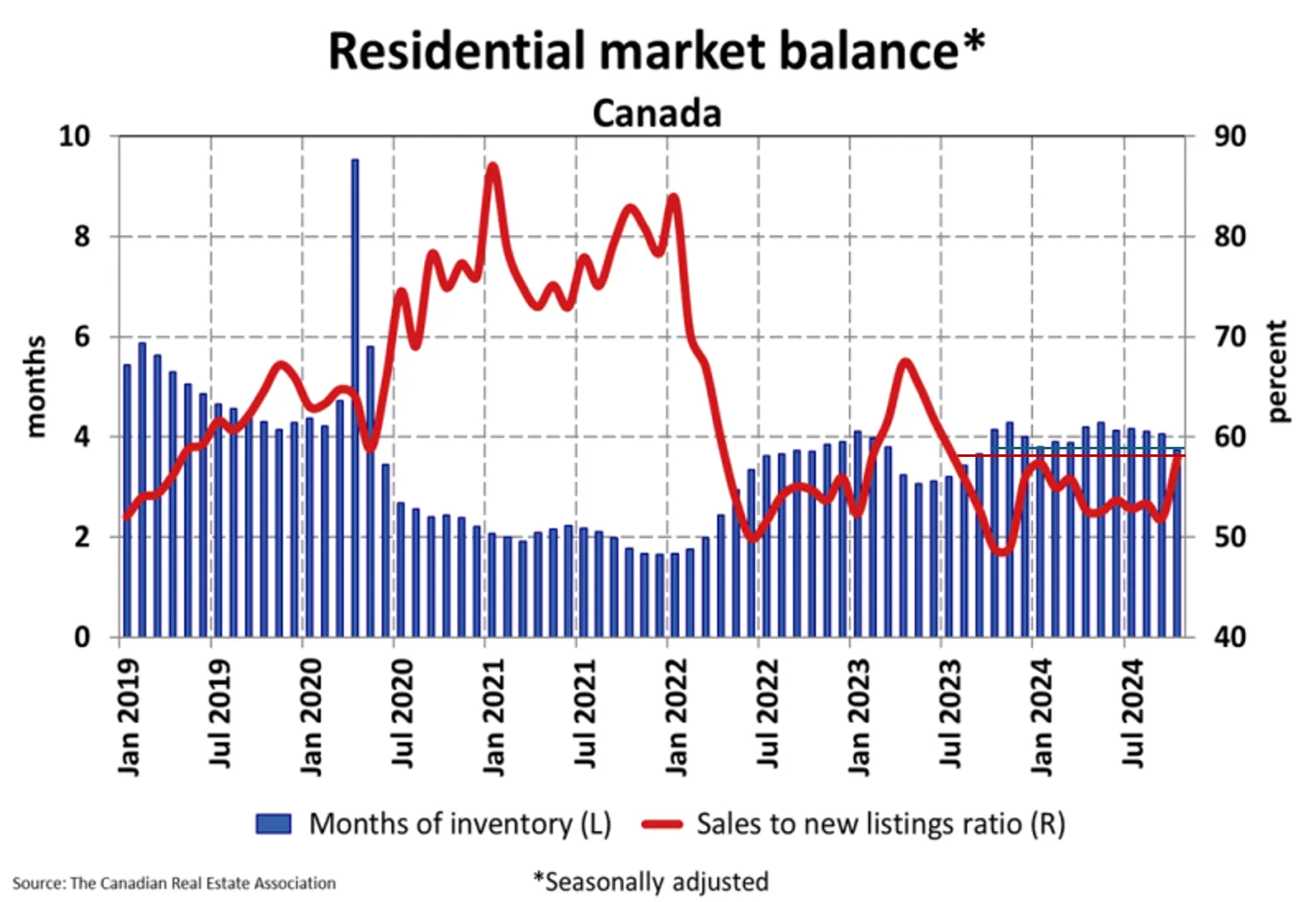

This balanced growth in both supply and demand has caused the market to present in a somewhat unpredictable fashion. We have a sales-to-new-listings ratio rising rapidly, and months of inventory falling to levels not seen since summer 2023.

The interplay between supply and demand is crucial in understanding the market’s direction. Despite the 3.5 per cent month-over-month decline in new listings in October, the quarterly trend is up, and the number of active listings remains 11.4 per cent higher than last year. This increase in supply is a positive factor for buyers, offering more choices and potentially tempering price growth.

The tightening of the sales-to-new listings ratio to 58 per cent indicates a shift towards a more balanced market. This equilibrium could benefit both buyers and sellers, creating a more stable environment for transactions. However, with inventory levels at 3.7 months—the lowest in over a year and approaching seller’s market territory—we may see upward pressure on prices if this trend continues into the spring market.

Price trends and regional variations

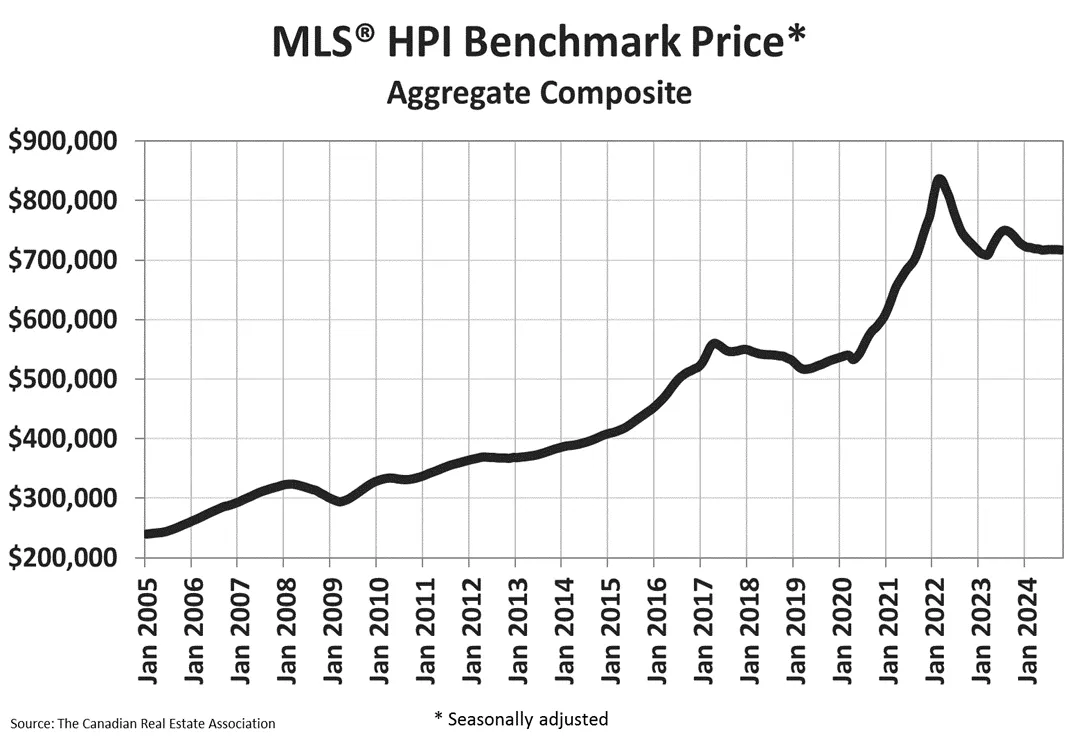

The national average home price of $696,166 in October, up 6 per cent year-over-year, reflects a market that is gaining momentum but not overheating. The marginal 0.1 per cent month-over-month decrease in the MLS Home Price Index suggests stability, which can be reassuring for buyers and sellers. The market has been basically trading sideways and grinding down slightly since the big drop after rate hiking started.

Economic implications and future outlook

The real estate market’s performance is closely tied to broader economic factors. The series of interest rate cuts by the Bank of Canada, totalling 125 basis points, has played a significant role in stimulating market activity.

This monetary policy approach aims to support economic growth, but it also raises questions about long-term inflation and housing affordability. At this point, unemployment is a greater risk to the housing market than mortgage renewals, according to RBC’s recent analysis.

Looking ahead, CREA Senior Economist Shaun Cathcart suggests that the October numbers might be a preview of what to expect in 2025. With mortgage rates potentially reaching their expected lows next spring, we could see sustained market activity. However, this projection comes with caveats:

- Supply constraints: The availability of new listings will be crucial in maintaining market momentum. A lack of supply could lead to price increases and affordability issues.

- Economic uncertainty: Factors such as employment rates, inflation and overall economic growth will continue to influence the housing market.

- Regional disparities: The varying performances across different regions of Canada highlight the need for localized strategies and policies.

For buyers, the current market presents a mixed picture. While increased activity might mean more competition, the still-elevated supply levels and potential for further interest rate cuts offer opportunities. Buyers should be prepared to act quickly but also remain cautious about overpaying in a potentially heating market.

Sellers are in a favourable position, with increased demand and stable prices. However, they should be mindful of supply trends, especially ahead of a year with a record number of mortgages renewing at higher interest rates – there is a real potential for pent-up supply to hit the market, increasing competition swiftly.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.

TRREB allows double-counting of appeox 30% of New Listings – examine the Re-List Share Comparison Report they issue monthly.

This distorts the SNLR leaving only Months of Inventory as reliable benchmarks

Less than 25% now, fewer re-lists in November than the last 4 years