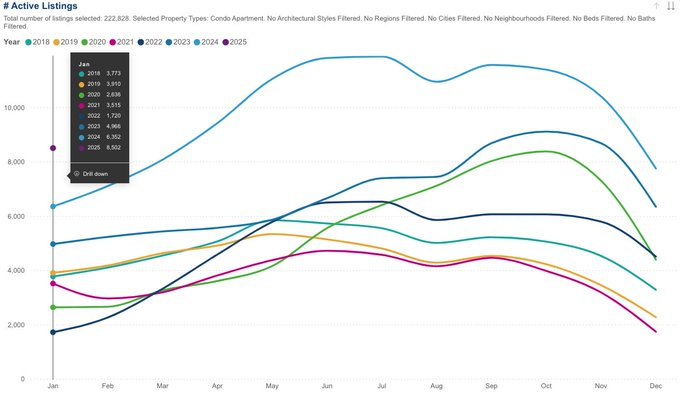

I think January 2025’s supply story is one of those data points. This could be the biggest year-over-year jump up in new listings we’ve ever seen, and the majority of it was driven by condos. In 2024, we started with 6,300 active condo listings and almost hit 12,000. In 2025, we started with 8,500 active condo listings and could hit 15,000, should historic growth trends hold.

Source: TRREB/TheHabistat.com

I will caveat that the Toronto Regional Real Estate Board added a few new local boards, so I’m still trying to see if that’s had an impact on the data, but based on the fact that condominiums are dominating supply on TRREB right now, my guess would be no.

Source: TRREB/TheHabistat.com

The GTA real estate market started 2025 with a mix of surprises and challenges. Significantly more listings, slightly fewer sales, and shifting buyer behaviour are shaping the early months of what is expected to be a year of transition.

So… what’s happening? Let’s break it down into three key trends:

- Pent-up supply is finally hitting the market.

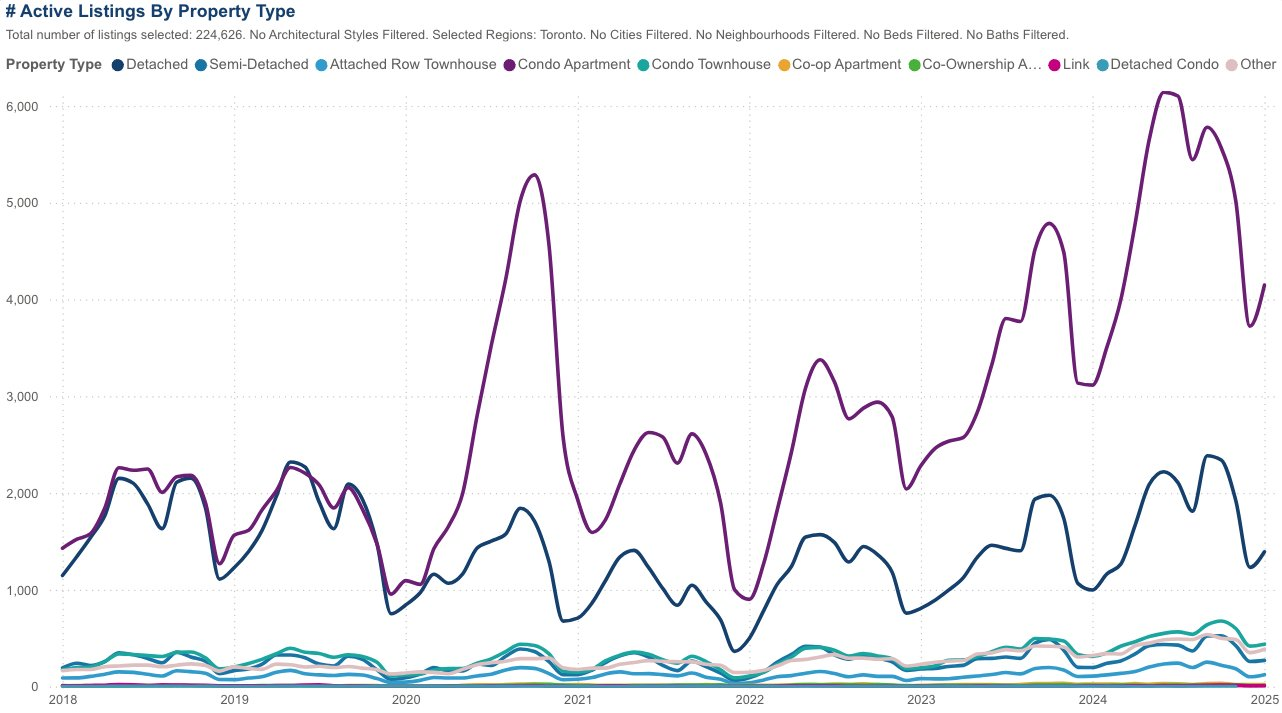

- Condos are struggling more than any other asset class.

- Regional trends are diverging, creating both opportunities and risks.

Biggest supply surge in years

For months, I have felt our market could see a surge in supply due to record new condominium supply delivery. January’s numbers confirm it in a big way—the GTA housing market is seeing one of the largest influxes of new listings in recent history, but demand isn’t keeping up.

New listings exploded by 48.6 per cent year-over-year, jumping from 8,337 in January 2024 to 12,392 this year. Active listings skyrocketed 70.2 per cent, bringing total available inventory to 17,157 homes, up from 10,083 last year. However, sales dropped 7.9 per cent year-over-year (from 4,177 to 3,847), despite this flood of supply.

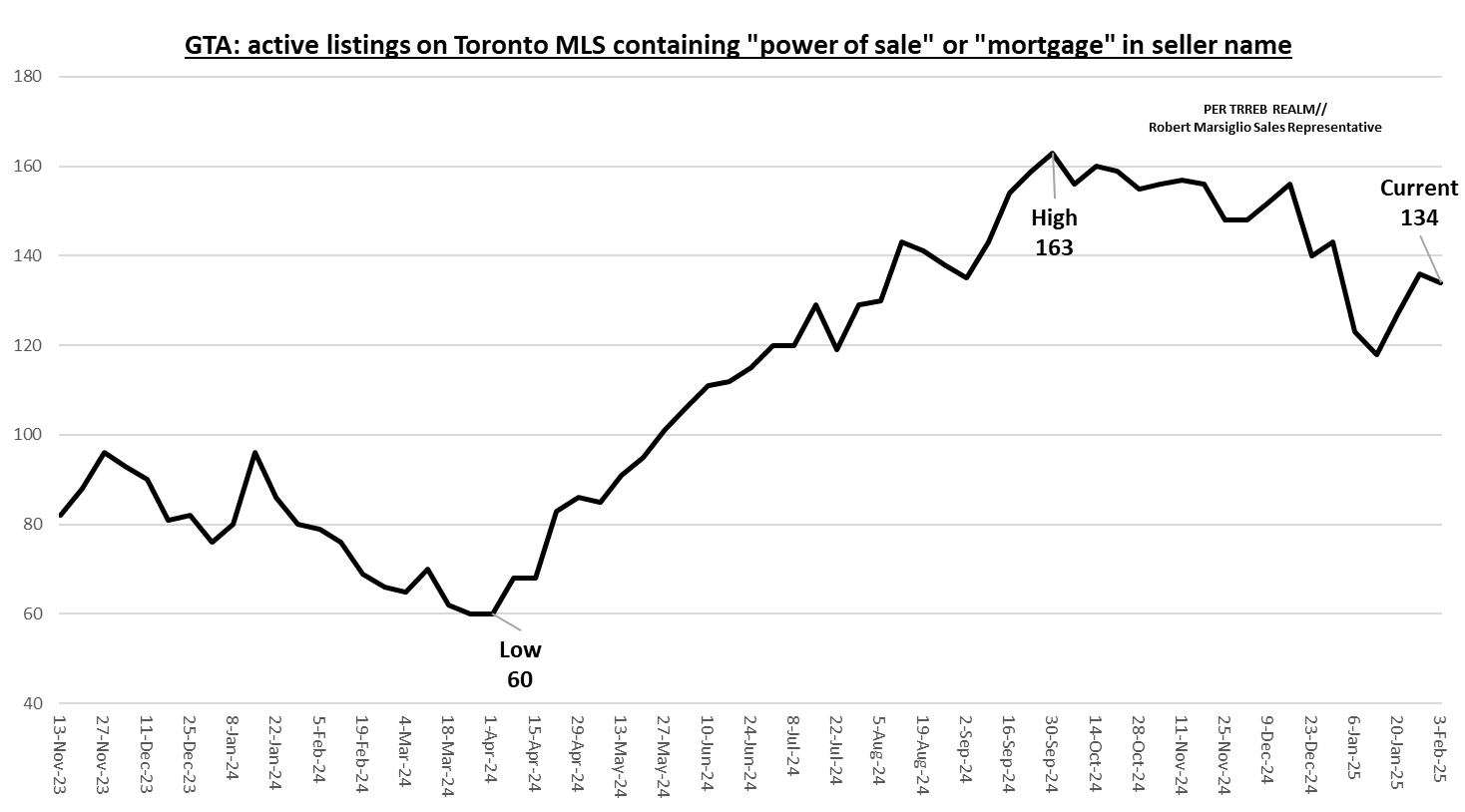

What this tells us is that sellers are rushing back to the market, and if they continue to outpace supply, the GTA will be comfortably in a buyer’s market in spring 2025. While the vast majority of sellers are listing their properties voluntarily, a small but growing number are being forced to sell due to financial distress, as indicated by the rise in power of sale listings in the chart below, observed by realtors Robert Marsiglio and Peter Kiriouzoupoulos.

These lender-driven sales, though still a fraction of total listings, highlight increasing mortgage defaults, adding a layer of distressed inventory to an already supply-heavy market. Should we see continued supply come from distressed inventory, price discovery could be expedited by prudent lenders looking to find liquidity in an illiquid market.

Source: TRREB/TheHabistat.com

Contrary to sellers, buyers appear to be in no hurry. Even with significantly more inventory, buyers are taking their time, negotiating harder, and waiting for potential rate cuts before making a move. This is most clearly indicated by the days on market being virtually unchanged in 2025 compared to last year, after jumping up from 2023 to 2024.

More supply equals more pressure on prices. With inventory growth vastly outpacing sales, buyers now hold significantly more leverage in negotiations in certain product categories, forcing sellers to price more competitively—especially in weaker segments.

If this trend continues, expect longer days on market, more price reductions, and a potential buyer’s market in certain segments. While demand may rebound once borrowing costs ease further in 2025, for now, this massive surge in supply is tilting the market in favour of buyers—creating opportunities for those who are ready to make a move.

Condos are feeling the pressure

If there’s one part of the market showing real weakness, it’s condo apartments.

- Condo sales dropped 12.1 per cent year-over-year.

- In Toronto (416), condo sales fell 14.5 per cent, a sharper decline than in the 905 (-7.4 per cent).

- Condo sale prices declined 1.6 per cent across the GTA—the only housing segment to record a price drop.

Why are condos underperforming?

Oversupply is becoming a major factor in the GTA condo market as a wave of pre-construction completions is set to hit in 2025. According to Urbanation, approximately 31,000 new condo units are expected to be completed this year, significantly increasing inventory. Many of these units were purchased years ago when borrowing costs were lower.

Affordability challenges are also weighing on condo demand. Current mortgage rates have pushed carrying costs to new highs, making ownership less attainable for first-time buyers who traditionally enter the market through condos. At the same time, the rental market, while still strong, has not kept pace with rising ownership costs, making it harder for investors to achieve positive cash flow on newly completed units.

What’s next?

Expect condo inventory to continue rising in the first half of 2025, which could keep prices under pressure unless demand catches up. Investors may need to adjust rental expectations or rethink short-term exit strategies.

Not all markets are created equal

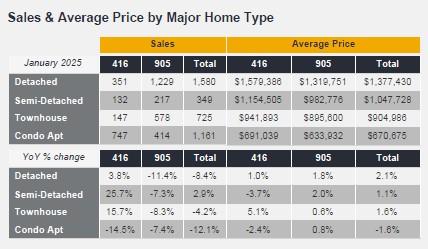

One of the biggest takeaways from January’s TRREB report is that not all parts of the GTA are experiencing the same market conditions. Here are the most interesting trends shaping the market:

Semi-detached homes in Toronto (416) are leading sales growth. Semi-detached home sales surged 25.7 per cent year-over-year in the city, making them the strongest-performing housing type in the 416. This signals that buyers are seeing value in semi-detached properties, which offer more space than condos but remain more affordable than detached homes.

Townhouses in Toronto (416) saw the strongest price growth of any housing type, increasing 5.1 per cent year-over-year. However, townhouse price growth in the 905 was minimal at just 0.6 per cent, bringing the overall GTA increase to 1.6 per cent, indicating that demand for this housing type is more concentrated in Toronto rather than in the suburbs.

Condo sales are struggling the most. While all other home types saw some level of resilience in either price or sales, condo transactions fell 12.1 per cent year-over-year across the GTA. Toronto condos saw a sharp 14.5 per cent drop in sales, while ones in the 905 region declined 7.4 per cent. At the same time, condo prices dipped 1.6 per cent overall, with Toronto condos experiencing a steeper decline.

Source: TRREB

What this means for 2025

TRREB’s outlook suggests that the GTA housing market will see moderate price growth, in line with inflation. However, the trajectory of the market will depend on several key factors.

Interest rates are expected to decline, with forecasts ranging from 2% to 2.75% by late 2025, which could help boost demand as borrowing costs become more manageable. Inventory levels will also play a crucial role. If the current supply surge continues to outpace sales, the market could remain soft for an extended period, putting downward pressure on prices. Finally, buyer sentiment remains a wildcard. Many prospective buyers are still on the sidelines, waiting for clearer signs of rate cuts and economic stability. If affordability improves and confidence returns, demand could rebound quickly, shifting the market dynamics once again.

If you’re buying, this is an opportunity to shop around, negotiate, and wait for the right deal. If you’re selling, pricing realistically is key—overpricing in a shifting market will only lead to longer days on market.

The spring market will be the real test—will buyers come back, or will supply keep rising? Let’s see how this plays out in Q2.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.