Many factors contribute to what homeowners can afford month to month, including condominium fees.

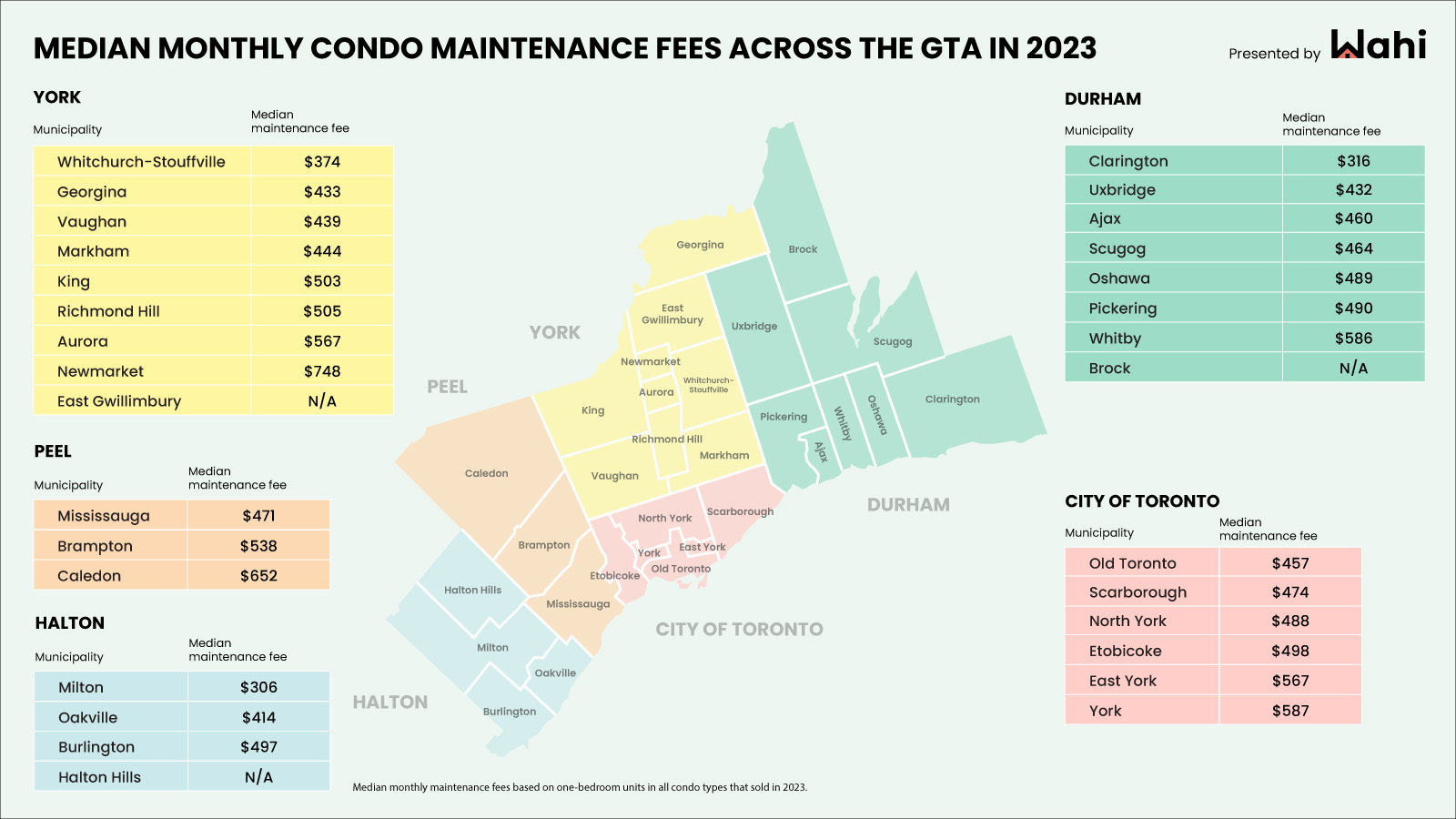

These fees tend to vary quite widely. To explore this further, Wahi analyzed the 10 Greater Toronto Area (GTA) condominium buildings with the highest and lowest median monthly condominium fee (of sold one-bedroom units).

Condominium fees cover things like building insurance, common area maintenance, amenities and reserve fund contributions. They’re typically based on a unit’s size and its proportionate share of the condominium corporation’s expenses.

“For homebuyers who are considering buying a condo, maintenance fees are an important factor to consider when figuring out their budgets,” says Wahi CEO Benjy Katchen. “Wahi’s latest study provides a ballpark estimate of what condo owners can expect to pay at different price points in the GTA market,” he adds.

What impacts condominium fees?

The age of a building and its amenities can impact maintenance fees. For example, older buildings often have larger floor plans and heat and hydro included, which can skew fees higher. Luxury buildings with upscale amenities cost more to maintain.

Highest fees found in GTA’s older luxury buildings

Wahi found that 13 GTA condominium buildings had a median monthly maintenance fee of over $1,000 per month, with the 10 most expensive buildings for fees predominantly being older luxury buildings in downtown Toronto (just one is located outside of the city’s limits, in Oakville).

Lowest fees found in recently completed suburban buildings

Condominium buildings in the GTA with the lowest maintenance fees were mostly built between 2018 and 2022 and found to be beyond the city’s core, in areas like Oakville, Milton and Toronto suburbs like North York and Scarborough.

Where condominium fees landed across the GTA last year

Milton was found to have the lowest median local maintenance fee for 2023, while Newmarket had the highest.

Review the full analysis here.