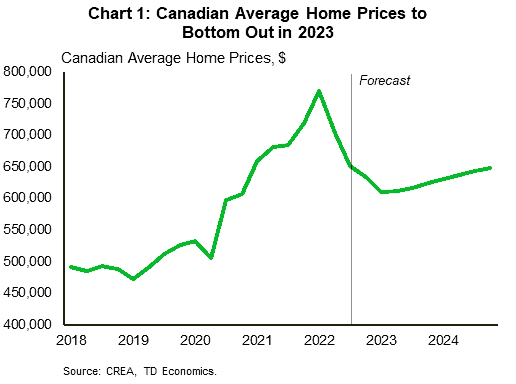

Home sales and prices should find their bottom this year– but don’t expect a massive rebound anytime soon, according to a new outlook from TD Economics.

Economists expect Canadian home sales will bottom “some time” in early 2023 with a peak-to-trough decline of around 20 per cent, reiterating their forecast for 2023 in the Provincial Housing Market Outlook.

Rishi Sondhi, an economist for TD Economics, says the timing of the trough is consistent with the Bank of Canada’s tightening cycle, which he expects to culminate with another “modest” rate hike in January.

Weakest sales since 2001

Sondhi is warning tougher times may still be ahead, noting 2023 is likely to mark the weakest sales year since 2001. He attributes the anticipated low sales volume to “…the poorest affordability backdrop since the late 80s/early 90s.”

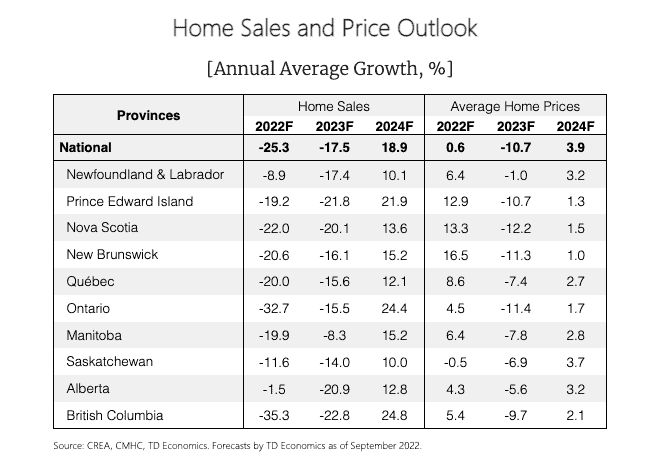

Steep annual average price declines are expected to occur in most of the Atlantic Region, Ontario, and B.C. in 2023. However, Sondhi says declines in Ontario and B.C. “will more than retrace the gains made in 2022, which is not the case for the Atlantic.”

Due to affordability conditions, smaller annual average price declines are forecast across the Prairies and Newfoundland and Labrador this year.

Looking ahead to 2024

Growth in sales and average prices should return to positive territory in 2024 on an annual average basis, as the economist anticipates inflation will be contained and the economy should begin to heal after a weak performance in 2023. The outlooks projects sales activity will increase, though at a pace that will continue to lag pre-pandemic levels for much of the year.

Sondhi says that improving housing demand will likely stoke renewed price growth, but a still-constrained affordability backdrop will be a limiting factor.

“Regionally, broad-based price gains are likely in 2024. However, we expect some mild outperformance in the Prairies and Newfoundland and Labrador as those markets continue to benefit from a favourable affordability gap,” the report states. “In contrast, tougher affordability conditions in Ontario, B.C. and across much of the Atlantic should restrain growth. “

Sondhi cautions, “If higher interest rates and economic weakness result in significant amounts of forced selling on the part of homebuyers, price growth could be weaker than we expect.”

Read TD’s Provincial Housing Outlook here.

Kindly include the link to the source document

Save us (your subscribers) a lot of searching on the TD economics site

oh — there it is — my mistake

ignore prior and

thanks for adjusting after my previous suggestion on same “link” topic

Many districts within TRREB’s map are off to a sputtering start. But then again so did 2021.

However similar to 6 or 7 years ago, it is Parts of Halton and York Region that’s holding up better than most.