Housing affordability is a hot-button issue for Canadians as sky-high interest rates coupled with limited inventory make owning a home unattainable for so many.

According to CREA, the benchmark price for a home in Canada reached $757,600 in August, compared to $543,000 in August 2018, a 40 per cent increase in five years. In that same time period, Canada’s months of inventory plummeted from 5.4 to 3.4 months, amplifying the affordability crisis.

While home prices have seemingly flatlined since the Bank of Canada began its rate-hiking cycle 17 months ago, a severe housing shortage leaves doubt that affordability will restored.

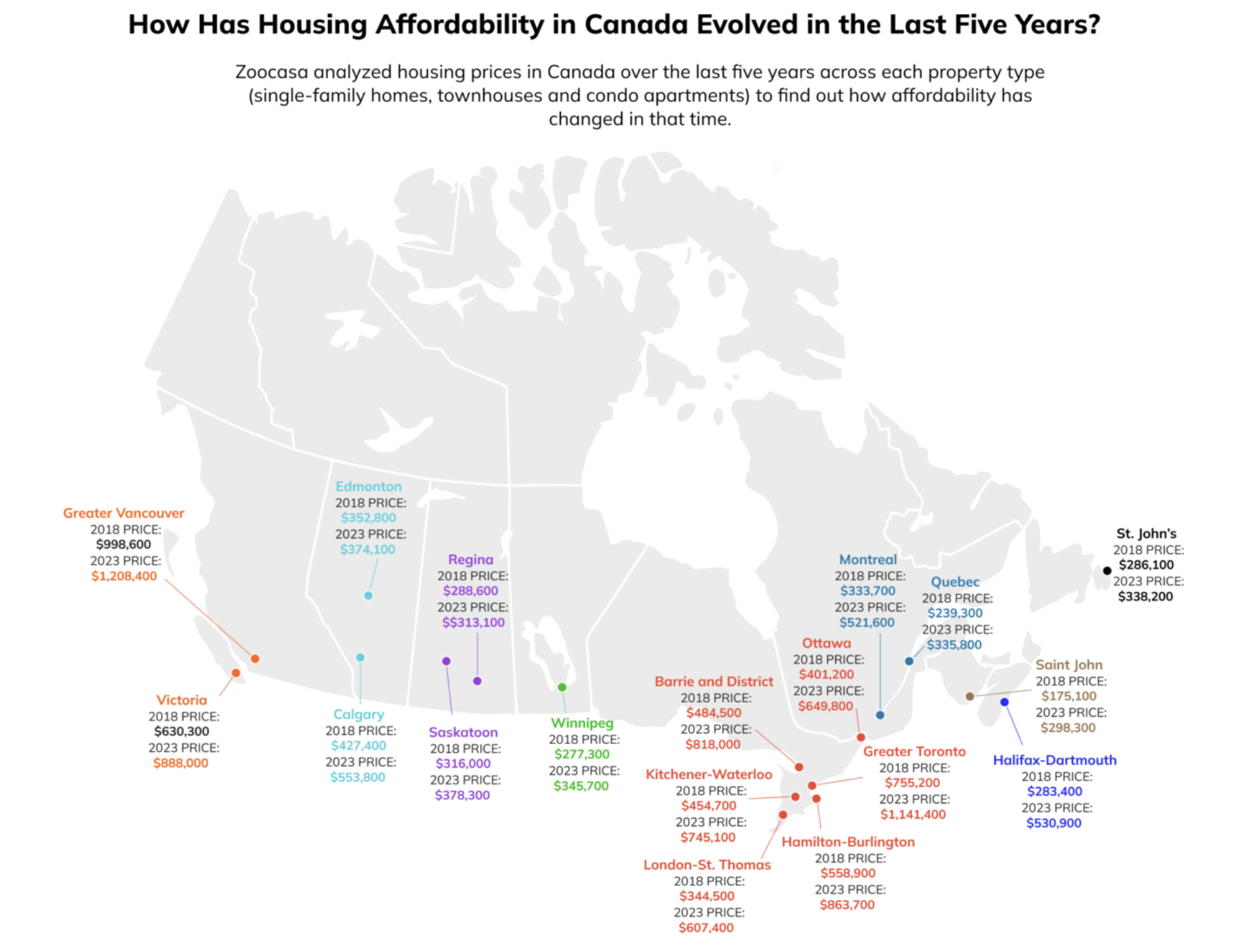

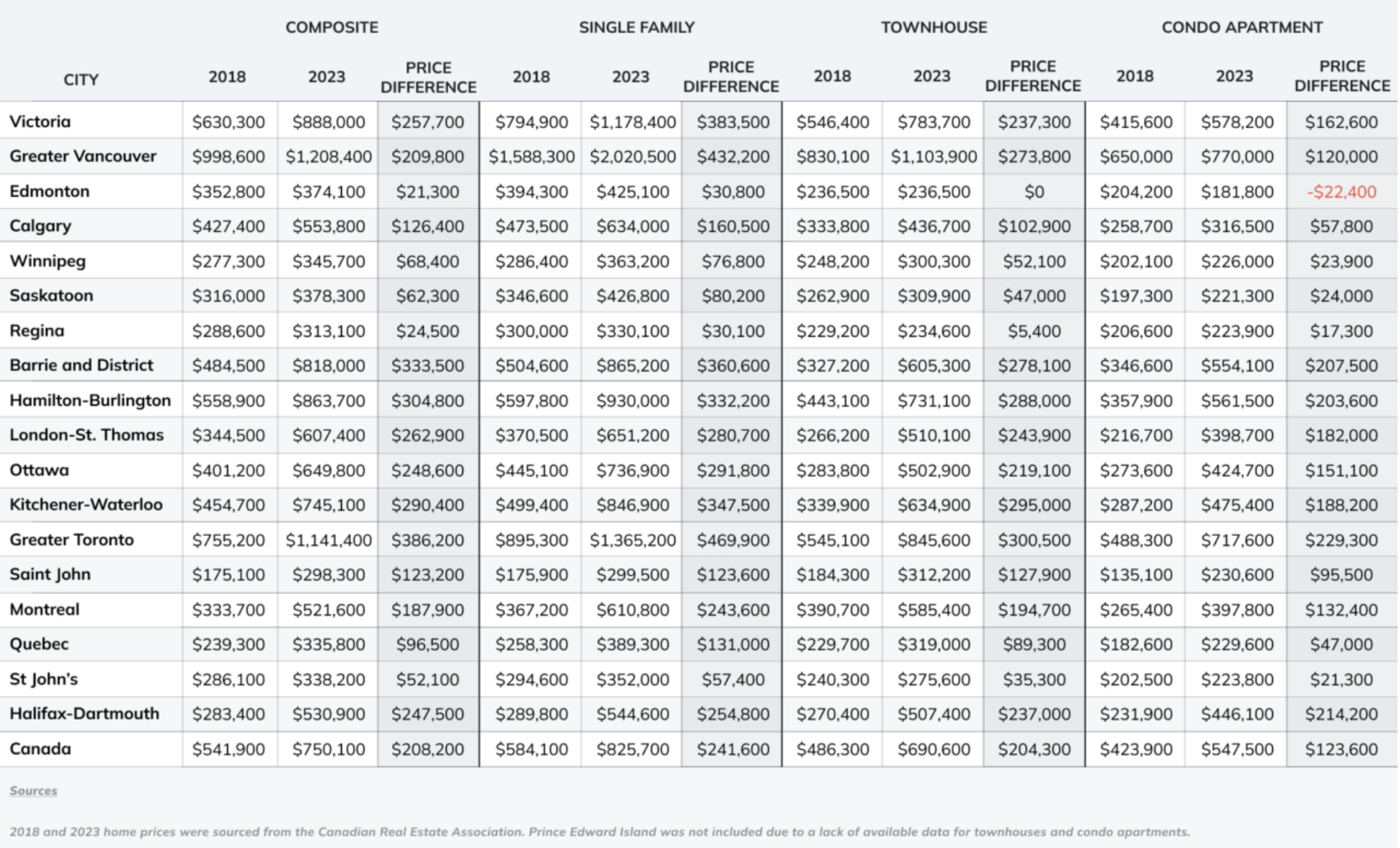

In a recent analysis, Zoocasa looked at how the change in supply has impacted affordability, comparing home prices from August 2018 to August 2023 and dissecting the data by property type — single-family homes, townhouses and condo apartments.

Soaring prices across Canada

Across the country, home prices have increased in nearly every city analyzed, regardless of property type. The biggest increase was seen in Toronto, where the composite home price across all property types jumped by $386,200, skyrocketing from $755,200 to $1.14 million.

Toronto also witnessed the most substantial individual property price increases in single-family homes, townhouses, and apartments, surging by $469,900, $300,500, and $229,300, respectively. Other Ontario regions, like Barrie and Hamilton–Burlington, also experienced substantial price hikes, with composite home prices jumping by $333,500 and $304,800, respectively.

In the single-family home segment outside of Toronto, Victoria claimed the top spot with a significant price climb of $383,500, rising from $794,900 to $1.18 million.

Source: Zoocasa

Edmonton, the outlier

One standout is Edmonton, where the average home price has increased by a relatively modest $21,300, the smallest among the cities analyzed. In Edmonton, townhouses and condo apartments either showed no price growth or declined. Townhouses in Edmonton maintained the same price point in August 2023 as they did in 2018, at $236,500. Condo apartments, however, recorded a rare decline, with prices dropping by $22,400 from $204,200 to $181,800.

Affordability exists in select cities

In contrast to the steep price increases seen in many cities, a few have seen more modest gains. Winnipeg’s composite home price rose by $68,400, Saskatoon’s by $62,300, St. John’s by $52,100, and Regina’s by $24,500. The most conservative increase was noted in Regina’s condo market, where prices rose by only $5,400.

Although Quebec’s home prices have also increased by five figures ($96,500), single-family homes in this province jumped $131,000 between August 2018 and August 2023.

Source: Zoocasa