The Bank of Canada’s decision to pause interest rate hikes after a series of increases throughout 2022 significantly impacted the Canadian real estate market.

With interest rates reaching 4.5 per cent in January 2023 and remaining steady since then, Zoocasa has analyzed data to assess how home prices have changed in cities across Canada.

Source: Zoocasa

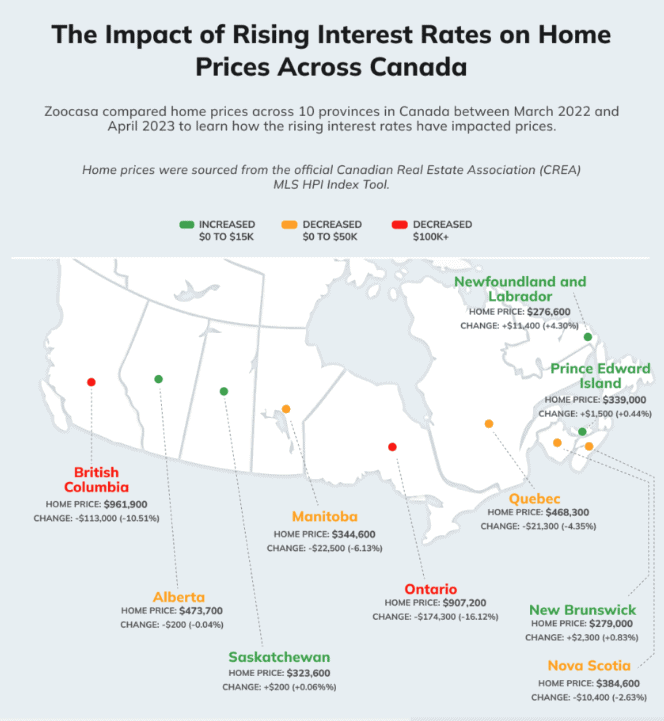

Changes in home prices across Canada’s provinces

The provinces with the highest average home prices, such as British Columbia and Ontario, have experienced significant price dips since the rate hikes began. British Columbia saw a decline of $113,000 (10.51 per cent), while Ontario suffered the largest dip of $174,300 (16.12 per cent).

On the other hand, the more affordable provinces have seen price increases, with Newfoundland and Labrador experiencing a 4.3 per cent increase ($11,400) and Alberta remaining relatively flat with a minimal $200 difference in average price ($473,700).

The impact of rising interest rates on cities/regions across Canada, source: Zoocasa

Major cities experience varying price trends

According to data from the Canadian Real Estate Association (CREA), the top five cities with the greatest declines are all located in Ontario, including Toronto and Hamilton–Burlington, which saw prices fall by $189,300 and $191,900, respectively.

London-St. Thomas experienced the highest percentage decline of 21.51 per cent ($166,400). In contrast, Calgary has seen increased popularity and more affordable housing, resulting in price increases of $15,100 since February 2022, while St. John’s, one of Canada’s most affordable cities, witnessed price increases of $10,600.

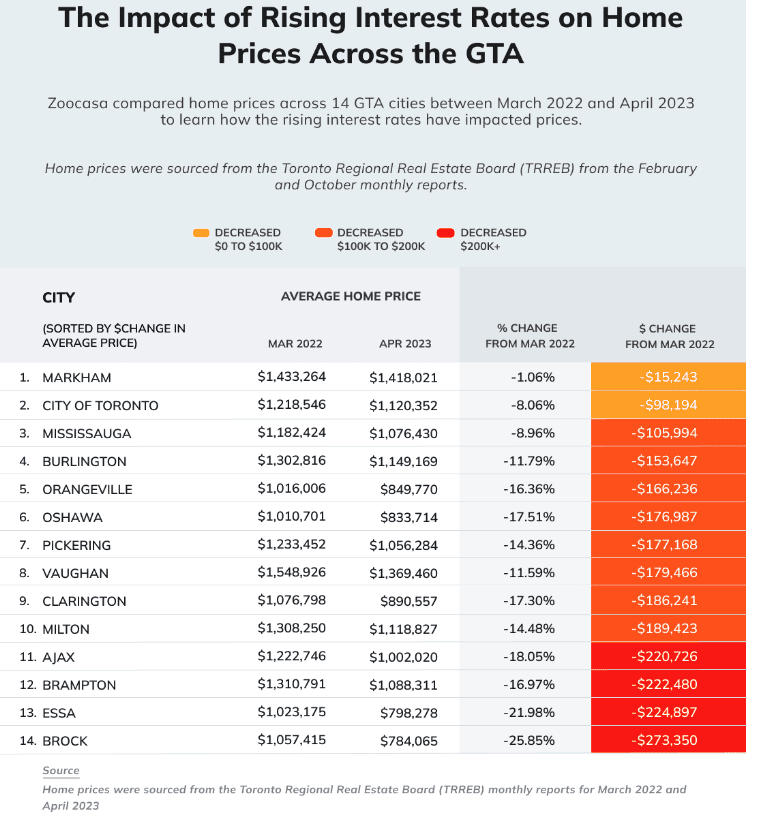

A closer look at prices in the GTA

Examining major markets in the GTA using data from the Toronto Regional Real Estate Board (TRREB), every city in the region has experienced some form of price decline.

Markham and Toronto were the least impacted, with declines of $15,243 (1.06 per cent) and $98,194, respectively. However, cities like Ajax, Brampton, Essa and Brock saw declines of over $200,000, with Brock being the most affected, experiencing a decline of $273,350 (25.85 per cent).

Despite the declines since the rate hikes began, the Toronto real estate market has shown signs of recovery in 2023. Home prices increased by 4.0 per cent on a monthly basis from March to April, indicating a positive trend. As the market stabilizes and buyers and sellers adjust to the impact of interest rates, the limited supply of homes has led to increased demand, resulting in a steady rise in prices.

Explain one more time who/what is Zoocasa these days and what person created/stands behind the accuracy of the comparisons

The interest rate increases do not cause house prices or decreases. If it did affect prices they would all go down or all go up.

The reason prices go up or down is due to the number of listings and the number of buyers at different price ranges.

The BOC is interfering in Canada’s largest industry in their misguided belief they can reverse inflation by robbing the middle classes via charging more interest on existing consumer loans and mortgages, which only increase bank profits and liquidity.

In fact, they are forcing seniors on fixed incomes with mortgages to downsize again and to cash in their equity at lower amounts.

Inflation is not driven by the real estate market. It is driven by oligopolistic control over prices in most of Canada’s other industries.

Also, there is no problem to grow GDP 3 to 5% via full employment and increasing productivity and more wealth distribution to the middle classes.

The BOC and Bank (Cabal?) are foolishly funneling massive wealth from borrowers to rich and overly-powerful lenders.

Most Canadians know all this is TRUTH and Common Sense.