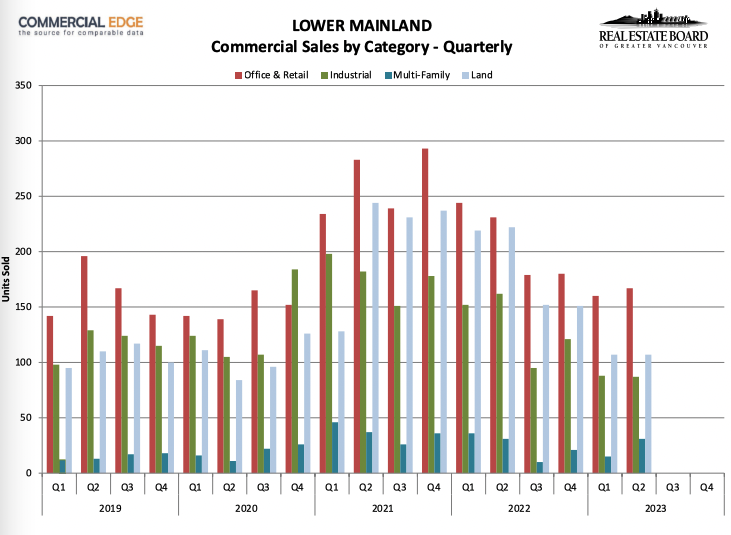

Sales plummet by over 50%

In Q2 2023, there were only 280 commercial real estate sales, marking a staggering 56.5 per cent decrease from the 644 sales recorded in the same period in 2022.

The total dollar value of commercial real estate sales in the Lower Mainland also took a hit, plummeting by 54 per cent from $3.831 billion in Q2 2022 to $1.763 billion in Q2 2023. This substantial drop in dollar volume underlines the subdued market conditions.

Borrowing costs impact transactions

Andrew Lis, REBGV’s director of economics and data analytics, pointed out that the high borrowing costs have been a major factor affecting transactions across the Lower Mainland, stating, “With the landscape for monetary policy looking set where it is for at least the near-term, it’s likely we’ll see the commercial real estate market continue along this trajectory for the rest of 2023.”

Q2 2023 activity by category

Land: The land category saw 83 commercial land sales in Q2 2023, reflecting a sharp 62.6 per cent decrease from the 222 land sales in the same period in 2022. The dollar value of land sales also dropped significantly, falling by 57.6 per cent to $789 million in Q2 2023, down from $1.863 billion in Q2 2022.

Office and retail: Q2 2023 witnessed 112 office and retail sales, marking a 51.3 per cent decrease from the 230 sales in Q2 2022. The dollar value of these sales declined by a substantial 63.4 per cent, from $767 million in Q2 2022 to $281 million in Q2 2023.

Industrial: The industrial sector recorded 66 land sales in Q2 2023, a 59 per cent decrease from the 161 sales reported in the same period in the previous year. The dollar value of industrial sales decreased by 32.4 per cent, falling from $633 million in Q2 2022 to $428 million in Q2 2023.

Multi-family: Multi-family land sales also saw a decline, with only 19 sales in Q2 2023, down 38.7 per cent from the 31 sales in Q2 2022. The dollar value of multi-family sales dropped by 53.2 per cent, decreasing from $568 million in Q2 2022 to $266 million in Q2 2023.

Source: REBGV