The Canada Mortgage and Housing Corporation (CMHC) mortgage loan insurance program is a government-backed initiative that allows homebuyers to purchase properties with less than a 20 per cent down payment.

Initially designed to help Canadians without significant savings enter the housing market, CMHC insurance has since become the single greatest catalyst of real estate demand in the federal government’s arsenal.

Perhaps unsurprisingly then, as this dying government seeks any avenue to revive its political fortunes in advance of next year’s election, CMHC has recently announced that it is increasing its coverage on homes from $1-million to $1.5-million to permit for “greater affordability.” However, our collective fiscal interests demand the opposite: CMHC insurance should be gradually phased out.

“Over the past 40 years, its effect on the market has been disastrous; incomes have become seriously misaligned from today’s house prices.”

The dynamics of Canadian housing boil down to basic Economics 101: supply and demand. The more demand there is for homes, the more the price goes up but, critically and somewhat un-intuitively in this case, the demand in question is borne of monetary availability and not people.

During the pandemic, the government increased the monetary supply by 25 per cent in a single year. That was what fuelled runaway housing prices; with more money in hand, even with roughly the same number of people, more houses were purchased than ever before. When quantitative tightening took place in the years following the pandemic, demand fell.

CMHC insurance functions as a form of monetary stimulus, artificially inflating housing demand. Over the past 40 years, its effect on the market has been disastrous; incomes have become seriously misaligned from today’s house prices.

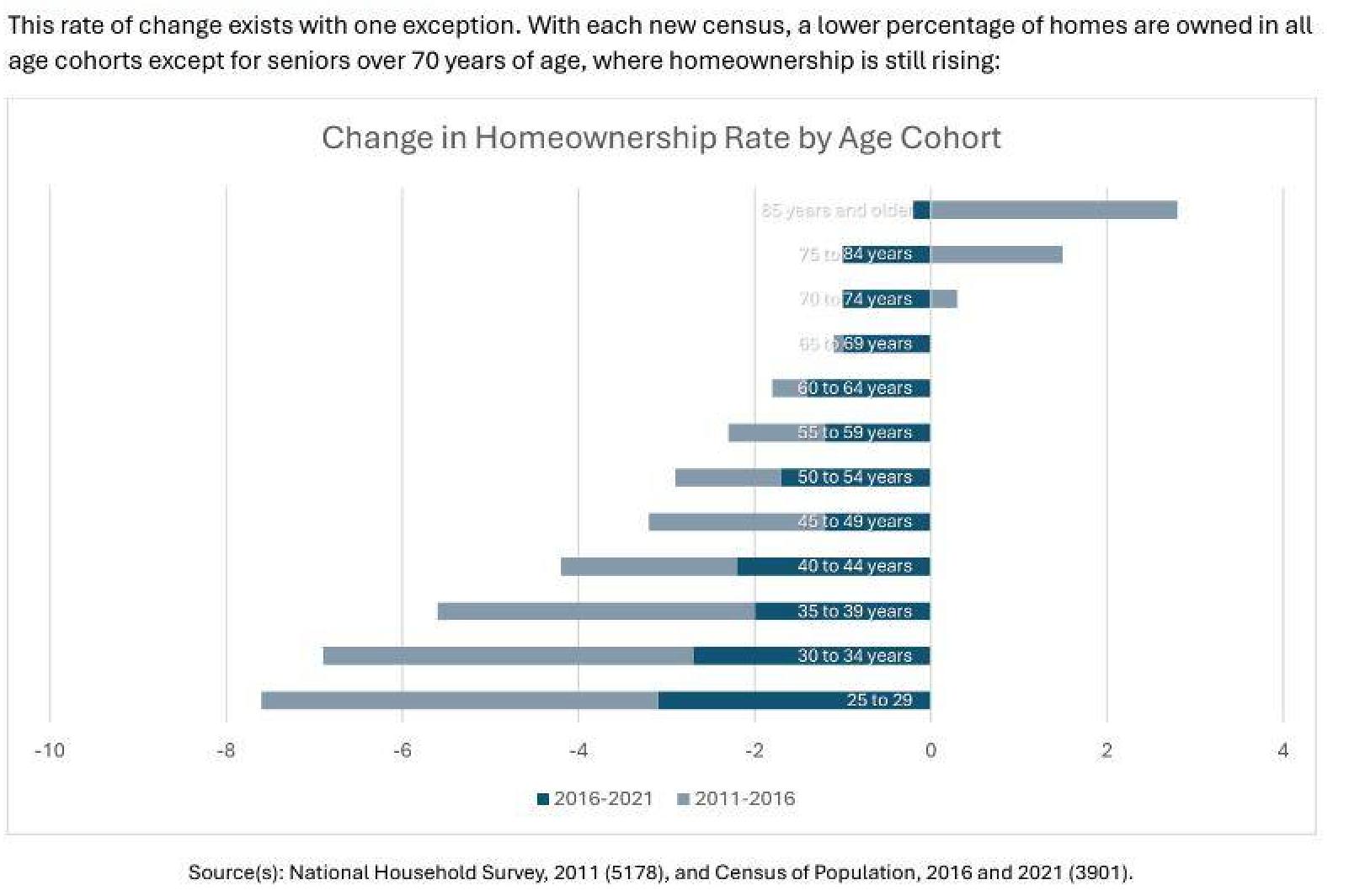

The result is clear; young people cannot afford homes and the dream of home ownership is a reality now restricted to those 75 years and older. Meanwhile, those who are fortunate enough to afford CMHC-insured mortgages often face crushing debt burdens that deprive them and their young families of savings, life experiences and the superior quality of life that Canadians have enjoyed in the past.

Canadian housing prices are past a pivotal point and it is time we addressed the source of the contagion in a head-on, direct manner. Reducing CMHC insurance availability will impact the buying abilities of Canadians but, if we are honest with one another, we are at a point where the average person cannot afford homes even with that assistance.

The average home price in Toronto is more than $1.1-million. To afford a property in that price range, a person requires $263,300 in gross income and, within such a pricing matrix, CMHC has seen its role reversed from the great enabler of home ownership to the source of pain for most Canadians whose housing markets CMHC infused-pricing pushes ever higher with every passing year.

“We need to gradually phase out CMHC insurance and, in the process, lessen the monetary demand for housing.”

It’s time to confront this issue directly. We need to gradually phase out CMHC insurance and, in the process, lessen the monetary demand for housing. Over time, this correction would restore the long-term balance between incomes and house prices, making homeownership attainable again for the average Canadian.

Though once borne of good intentions, CMHC is now hurting our markets, our youth and our collective future. We owe it to the next generation to chart a new course. The elimination of CMHC insurance must become a priority for the next federal government. It’s time to pull the trigger on reform and rebuild a housing market that serves Canadians.

Mark Morris is a Real Estate Lawyer in Ontario with over 20 years of experience who has run some of Ontario’s largest conveyance law firms. Mark presently operates legalclosing.ca Professional Corporation, teaches at Ontario Law Schools and administers the Ontario Real Estate Legal Discussion Group (For Professionals) on Facebook.

In the USA, government backed programs allow buyers to purchase with as little as 1% or 3% down. Why do you think their affordability any home prices have remained more closely tied to incomes?

In the U.S real estate upon a sale are subject to taxes. Cannot compare the two systems.

Eliminate the 20% restriction and let banks decide who and what they want to lend.

I wonder how many homes are purchased every year using CMHC. Maybe lower the max sale price so that people in other markets can still buy homes. Removing the CMHC option will make it even more impossible for first time home buyers to enter the market. Quite frankly I think it would do the exact opposite if CMHC was removed. The market would tank, new home sales would plummet and prices would drop so much that people couldn’t afford to “upgrade”. There’s more to the Canadian Real Estate Market than Toronto you know.

If you eliiminate cmhc insurance then how about the private insurers. If you think banks are going to lend over 80% without insurance then you are badly mistaken. Cmhc policy in my opinion has not done anything to inflate prices. This was done by mass immigration over a short period.. Vacancy rates have plummeted across Canada and rent price have soared. As well after the pandemic every government job demanded a large increase in wages due to the cost of living. In a lot of countries owning a home is luzury but in the west we have made it a necessity. We are now buying vehicles that cost $80-$100K and you say that home prices are too high.

Wow, I must confess, I’m afraid I have to disagree with pretty much all of your opinions. High Raitio Default Insurance is an intricate part of Real Estate financing.

You did not mention that CMHC insurance is also a product to ensure the bank does not lose out when default occurs. Well written article. I agree this issue needs to be addressed. This has just created inflation of real estate values. One challenge is the other financial products associated with a property. Such as lines of credit. This is the “I want it now era.” No thought about how to really pay for it. Just increase my debt load. Just like the Trudeau Liberals. Increase deficits, print more money thinking they can create an economy. We now see what a disaster that has become. The only way out of this situation is a recession or depression. They are integral parts of the economy of checks and balances based on a natural economic cycle. This cycle is disrupted when governments step in to try and control the natural economy.

Great article and a topic that definitely needs to be discussed more

I agree with Nick, mass immigration was the factor in the cost of homes. Supply and demand. No homes, the prices go up. Also, the interest rates were too low for too long!

They were basically giving away money for years and years and the wealthy folks buying up multiple properties, with alot of them just sitting empty. Again this created a house shortage and the rise in prices.

I feel so bad for the younger generation, owning a home is out of reach now even with both husband and wife working hard. Which creates latch key kids which isn’t ideal either.

The real issues are climate change and a lack of affordable supply of housing for a growing population.

People in countries where the impacts of climate change are felt to the point of no return – food shortages, civil/political strife, war – they must leave their home countries to survive and move to more stable areas where the possibility of a future life worth living appeals. Canada, the US and Western Europe fall into those regions where they want to go. Who can blame them?

Better minds than mine need to come up with answers…especially how to address climate change – whether we agree it is natural or manmade is irrelvant, because it is happening! And that is causing global migration, at a scale we have never witnessed before

Maybe we need to address the cost to build through reductions in service taxes on lots and all building supplies?

And people need to understand that larger lot sizes are a luxury, not a need.

“I’m from the government and I’m here to help…”

Great article on a very relevant issue. Easing down payment requirements, however it is done, artificially increases demand, creating a higher equilibrium price. As more generous programs came into being, this really aggravated the situation. This is not more people becoming better qualified to buy a home, it is lowering the standard to purchase to the point where thousands of people are using programs for investment buying and selling.

Is the solution ending CMHC? I don’t know if it is that simple, economics never is. Properly used, this can be of real benefit.

As a few commenters have noted, other factors are (as always) at play. For example, the time frame chose for comparison will always affect the results and from 2011 to 2021, many other factors were involved, including immigration and crazy government spending. These two factors alone probably account for a large portion of the problem.

So, what about possible mitigating efforts? One very salient aggravating factor is the carrot without the stick. CMHC has continually given out more candy but never asked for anything in return. Perhaps a trade-off involving some personal sacrifice or initiative to ensure seriousness of intent might help mitigate things?

Another thought that comes to mind is expectations. Our first home was 700 square feet with 2 bedrooms. Are more young people feeling a “right” to start at the top and work up?

A good article with some great food for thought, though I am not personally ready to arrive at the same conclusion as the author.