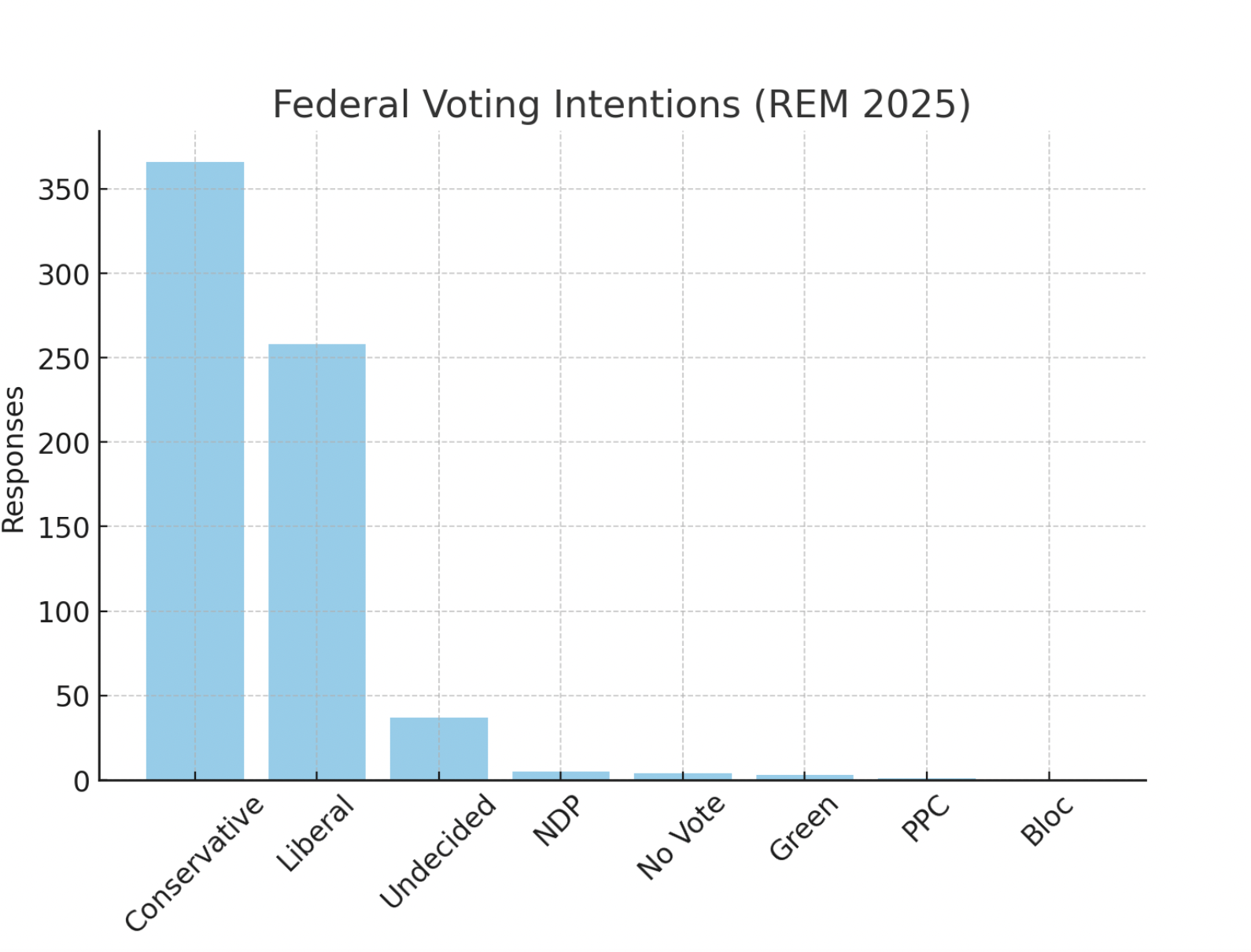

If the federal election were held today, a majority of Real Estate Magazine readers say they’d cast their ballot for the Conservative Party. That’s according to REM’s first large-scale reader poll on federal politics and housing, conducted ahead of the 2025 election.

Of the 674 respondents—most of whom identified as Realtors over the age of 40—54.3 per cent said they would vote for Pierre Poilievre’s Conservative Party, compared to 38.3 per cent for the Liberals under Mark Carney. Just over 5 per cent were undecided, while support for other parties remained in the single digits.

When asked which leader they believed would be better for the real estate industry, respondents once again leaned toward Poilievre (52.7 per cent), with Carney coming in at 35.5 per cent and 11.2 per cent unsure.

Columnist Daniel Foch shared the results live on REM’s monthly market call. “One that didn’t surprise me, based on polling I’ve done with my audience and what I’ve seen in the industry, is that the majority of people in real estate feel Pierre Poilievre would be better for the industry,” he explains.

Foch argues that while Poilievre’s platform aligns with many in the industry on red tape and supply, the Liberal platform—focused on immigration and market intervention—has historically driven up prices. But higher prices don’t always mean a healthy market: “Rising house prices mean people can’t afford homes, which means they don’t buy them. So that’s not necessarily good for the industry.”

Housing policy matters

It’s no surprise housing is top of mind. But what’s especially revealing is how Realtors evaluate proposed solutions.

Respondents were asked which federal party’s housing plan appealed most: 245 respondents preferred the Conservatives’ plan, narrowly ahead of the Liberals at 230.

Key features of the Conservative platform—such as tying federal funding to municipal housing targets, deferring capital gains on investments and removing GST on homes under $1.3-million—struck a chord.

“The Conservative plan—particularly the capital gains deferral piece—seems to have a lot of support,” says Foch. “That’s a fascinating idea… it could appeal to boomers, for instance, selling their property and reinvesting in Canadian stocks.”

Respondents also showed strong support for broader affordability policies like extending mortgage amortizations and removing the stress test.

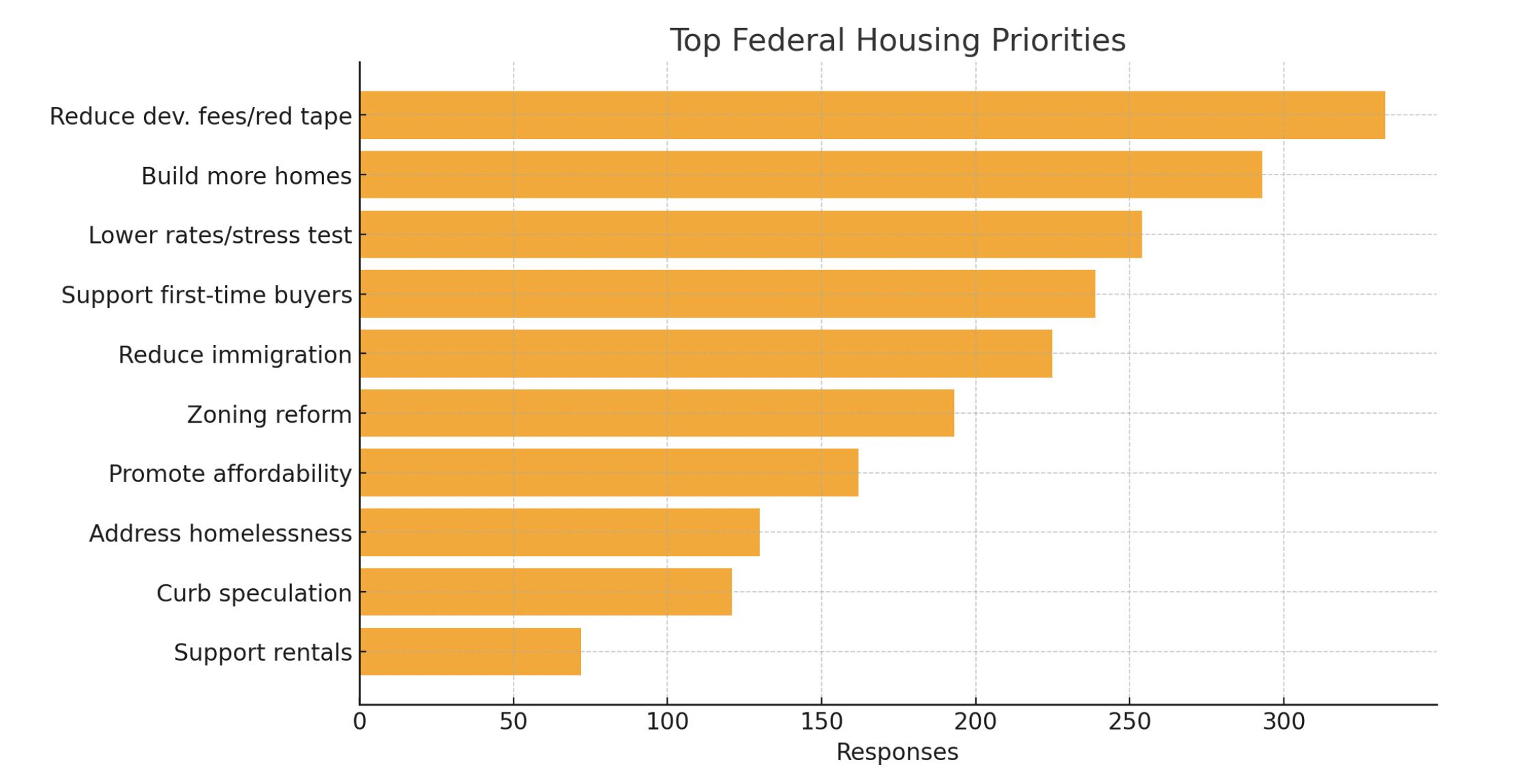

Priorities: cut red tape, build more, ease the squeeze

When asked to identify the top three housing issues the federal government should tackle, the most common responses were:

- Reducing development fees and red tape (49.4 per cent)

- Building more homes (43.5 per cent)

- Easing mortgage qualification rules or interest rates (37.7 per cent)

These responses suggest readers favour a supply-side strategy and financial flexibility over direct intervention or regulation. For instance, policies like national rent control and taxing corporate landlords received notably lower support.

According to Foch, that aligns with a clear desire to increase transaction volume, “Reducing development fees and red tape was seen as a top federal priority. That’s likely why people feel Pierre’s solutions are better for the industry. More supply to transact is always helpful.”

Asked to name the single most important housing issue, 20.3 per cent cited reducing interest rates or mortgage qualification stress, followed by increasing housing supply and cutting bureaucracy.

What kind of federal involvement do readers want?

Nearly half of respondents (47 per cent) said the federal government should be more involved in housing, while 28.3 per cent said it should be less involved. At the same time, 55 per cent said municipal governments should also play a larger role.

Three in four readers (75.8 per cent) said immigration levels should be tied to housing supply capacity—a contentious topic, but one clearly seen through the lens of housing demand.

“This question fascinated me the most,” said Foch. “I used to think Realtors just wanted house prices to go up, but what I’ve determined from reading this survey is that Realtors realize that high house prices are actually a problem for our industry. Affordable homes mean more transactions.”

Optimism vs. uncertainty

While 35.6 per cent of readers said they felt somewhat confident about the housing market over the next two years, a similar share expressed pessimism or neutrality. The biggest challenges facing their business? Market uncertainty (38.7 per cent), buyer affordability (19.4 per cent) and low consumer confidence (18.4 per cent).

“Market uncertainty and consumer confidence were the biggest challenges,” Foch explained. “Over time, people may accept uncertainty and return to the market. That’s when you start seeing a buyer’s market emerge.”

Foch also flagged the economic conditions shaping voter sentiment. “Globally, people interpret Canada as a left-leaning country, but you’re seeing people move from the left to a centrist voting block,” he noted. “This is an economically driven shift.”

A first of its kind for REM

This is REM’s first reader poll of this scale and scope. While the results offer valuable insights into industry sentiment ahead of the federal election, it’s worth noting that we didn’t ask respondents to identify their gender. Additionally, more than 94 per cent of respondents were over the age of 40, and nearly 90 per cent identified as Realtors or brokers.

Ahead of election day, we’ll be watching closely to see how conversations evolve and industry sentiment shifts. What’s clear from this survey is that housing affordability, supply and policy reform remain the beating heart of the conversation among Realtors in Canada.