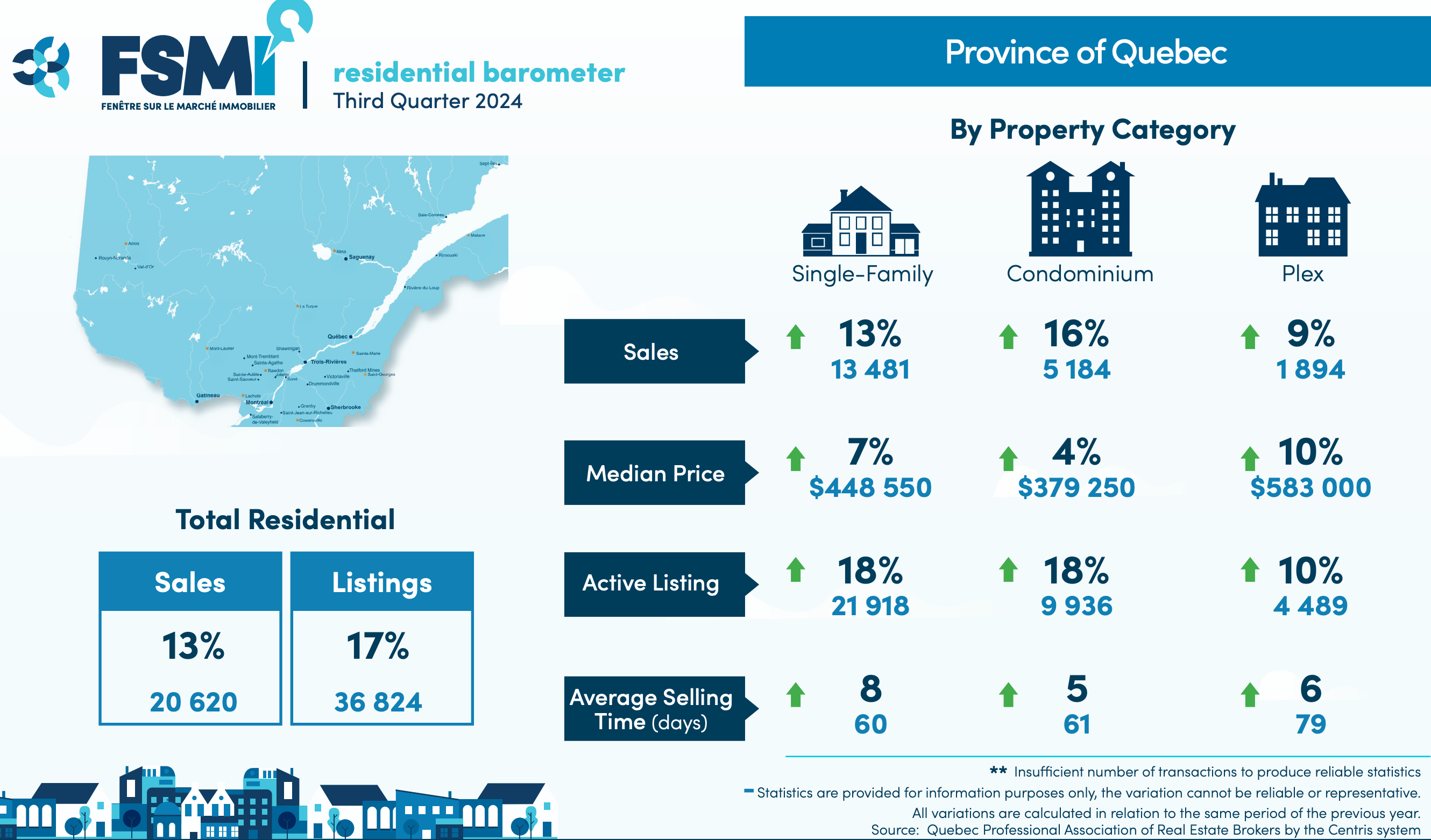

The Quebec Professional Association of Real Estate Brokers (QPAREB) recently released its quarterly real estate market statistics, revealing that 20,620 residential sales were recorded across the province in the third quarter of 2024 — marking a 13 per cent increase from the same period in 2023. This level of activity significantly outpaces historical averages for this time of year.

“The Quebec resale real estate market was robust in the third quarter, with transactional activity returning to levels well above the historical average for this time of year in most metropolitan areas and agglomerations. With the key interest rate dropping 75 basis points since the beginning of the summer, there was a sharp rise in the consumer confidence index in regard to major purchases, such as property.

It is also worth noting that the decline in fixed mortgage rates, which have already reached attractive levels, has occurred more quickly than that of variable rates,” notes Charles Brant, QPAREB market analysis director.

Brant also points out that the rapid financing cost decline has helped to curb the growing number of forced sales or repossessions in a market where job losses are increasing.

Sales trends: High-end market rebounds, many repeat buyers & lower entry-level transactions

Brant continues to note that the largest price increases in the single-family home segment involve transactions over $500,000 (29 per cent). Condominiums are in a similar situation. “This price segment is above the provincial median price ($448,550) and accounts for 40 per cent of transactions in this property category. “On one hand, the market continues to be driven by repeat buyers, and on the other, the high-end market, above $1 million, is experiencing a rebound,” Brant points out.

Sales of entry-level product ($300,000 and below) totalled 23 per cent of total transactions and have decreased by 6.0 per cent due to a lack of sufficient listings. “The mid-range price segment, which is seeing slightly above-average growth and despite the drop in interest rates, only allows the more affluent (or strategic) first-time homebuyers to access homeownership in competition with repeat buyers from Quebec or elsewhere,” concludes Brant.

Quarterly highlights for the province

Condominiums saw the highest sales growth in the province, with a 16 per cent increase in transactions. Single-family homes followed with a 13 per cent rise while plexes saw a 9.0 per cent increase.

Sherbrooke led among Census Metropolitan Areas (CMAs) with a 26 per cent rise in sales. Other CMAs such as Montreal, Quebec City and Gatineau saw increases of 12-13 per cent, while Trois-Rivières and Drummondville posted more modest growth.

Rouyn-Noranda and Lachute saw remarkable growth, with sales surging by 53 per cent and 47 per cent, respectively. Other cities like Shawinigan, Thetford Mines and Saint-Georges also posted gains ranging from 37-41 per cent.

Inventory, pricing, market conditions

Active listings increased by 17 per cent in the third quarter of 2024 compared to the same period last year, reaching 36,824 units. However, this remains well below the historical average of 46,645 listings.

The median price for single-family homes rose by 7.0 per cent to $448,550, while condominium prices increased by 4.0 per cent to $379,250. Small-income properties saw a 10 per cent jump in their median price, reaching $583,000. The upward pressure on median prices was driven by growth in sales of properties priced above $500,000.

On average, single-family homes took 60 days to sell in the third quarter of 2024, an increase of eight days compared to the previous year. Condominiums and small-income properties took slightly longer, with selling times of 61 days and 79 days, respectively (an increase for each of five days compared to last year).

Review the full Q3 2024 report, including by CMA.