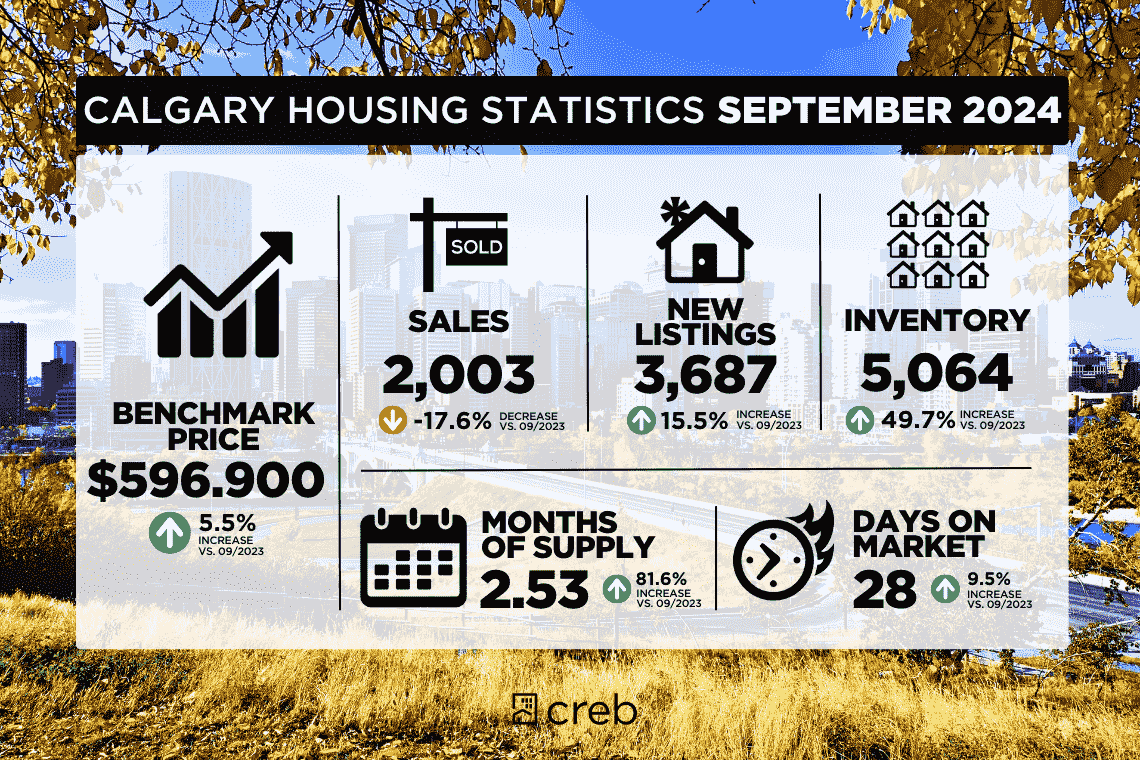

Last month, the Calgary Real Estate Board (CREB) reported that climbing sales in higher price ranges couldn’t fully offset the decline in lower-priced homes. This led to 2,003 sales — 17 per cent below last year’s record. However, sales were still over 16 per cent higher than typical September levels.

Demand strong across all price ranges but lower-priced choice is limited, preventing stronger sales

“We are starting to see a rise in new listings in our market. However, most of the listing growth is occurring in the higher price ranges,” says Ann-Marie Lurie, chief economist at CREB. “While demand has stayed strong across all price ranges, the limited choice for lower-priced homes has likely prevented stronger sales in our market.”

Lurie explains that challenges in the lower price ranges aren’t expected to change and improved supply and lower lending rates should keep demand strong throughout the fall, but without the extreme seller market conditions that fueled rapid price growth earlier this year.

New listings

New listings in September climbed to 3,687 units, the highest since 2008 for this month. While this rise helped boost inventory, September’s count reached 5,064 units — almost double the spring lows but still below the usual 6,000 units for September.

With inventory improving compared to sales, the market is gradually shifting towards more balanced conditions. In September, months of supply reached 2.5 — higher than last year’s record low but creating conditions that still favour sellers.

Home prices and inventory

Increased supply has eased some pressure on home prices. September’s unadjusted benchmark price was $596,900, slightly lower than August but still over 5.0 per cent higher than last year. Detached homes saw nearly 9.0 per cent year-over-year price growth, while apartment condominiums led with a 14 per cent gain, highlighting the shifting sales composition.

Detached homes

Despite 9.0 per cent sales growth for homes over $700,000, a significant pullback in homes priced below $600,000 resulted in 942 total sales — 17 per cent less than last year. New listings are stabilizing the higher-priced segment, leading to more balanced conditions for homes priced above $700,000.

In September, the unadjusted detached benchmark price was $757,100 — down slightly from August but nearly 9.0 per cent higher year-over-year. Tighter conditions for lower-priced homes have driven much of this price growth.

Semi-detached homes

September saw 299 new listings and 182 sales, pushing the sales-to-new-listings ratio to 61 per cent. Despite gains in listings, inventory remains tight, with less than 400 units available — 33 per cent below long-term trends. Months of supply improved to just above two but remained seller-favourable, and the unadjusted benchmark price eased slightly to $678,400 — still over 9.0 per cent higher than last year.

Row homes

Over 600 new listings hit the market in September, with 70 per cent priced above $400,000. Sales totaled 377 units, slightly down from last year, but inventories rose to 747 units — an improvement over the past two years. This increase led to nearly two months of supply, slowing price growth. The unadjusted benchmark price was $459,200 — 10 per cent higher than last year.

Apartment condominium homes

September saw strong gains in new listings with 993 units, while sales dropped to 502. This drop caused the sales-to-new-listings ratio to fall to 50 per cent and inventories to rise to 1,623 units. Months of supply climbed to 3.2, the highest since 2021. The unadjusted benchmark price for apartment condominiums was $345,000 — up 14 per cent year-over-year. Despite the price easing, year-to-date prices still reflect a 17 per cent increase over 2023.

Review CREB’s full reports for the city and region.