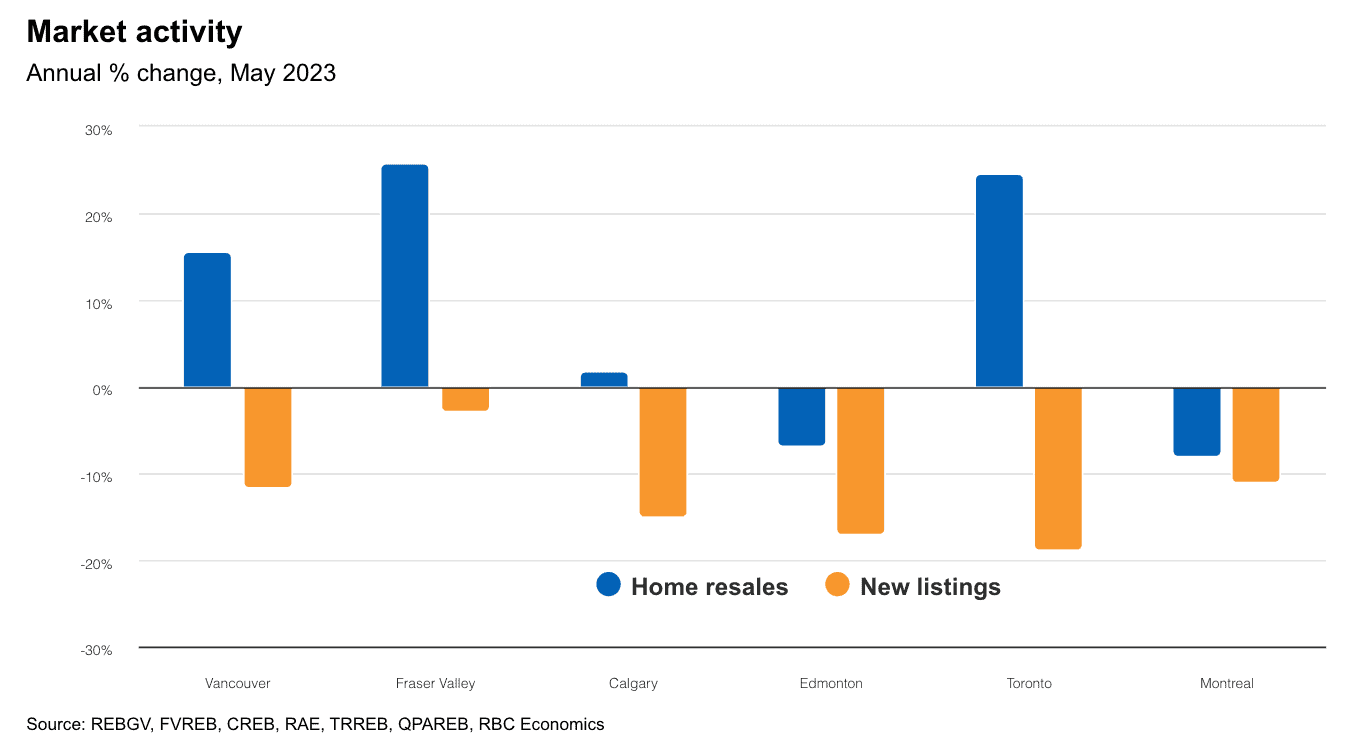

May data housing markets across Canada have shown signs of recovery, with sellers starting to reenter the market.

While this increase in supply is a positive development for buyers struggling with limited inventory, it has not yet been enough to fully balance the demand-supply dynamics, according to a report by Robert Hogue and RBC Economics.

The report suggests that a substantial influx of sellers in the coming months will be necessary to bring the markets into equilibrium. In the meantime, prices continue to rise, putting upward pressure on the market.

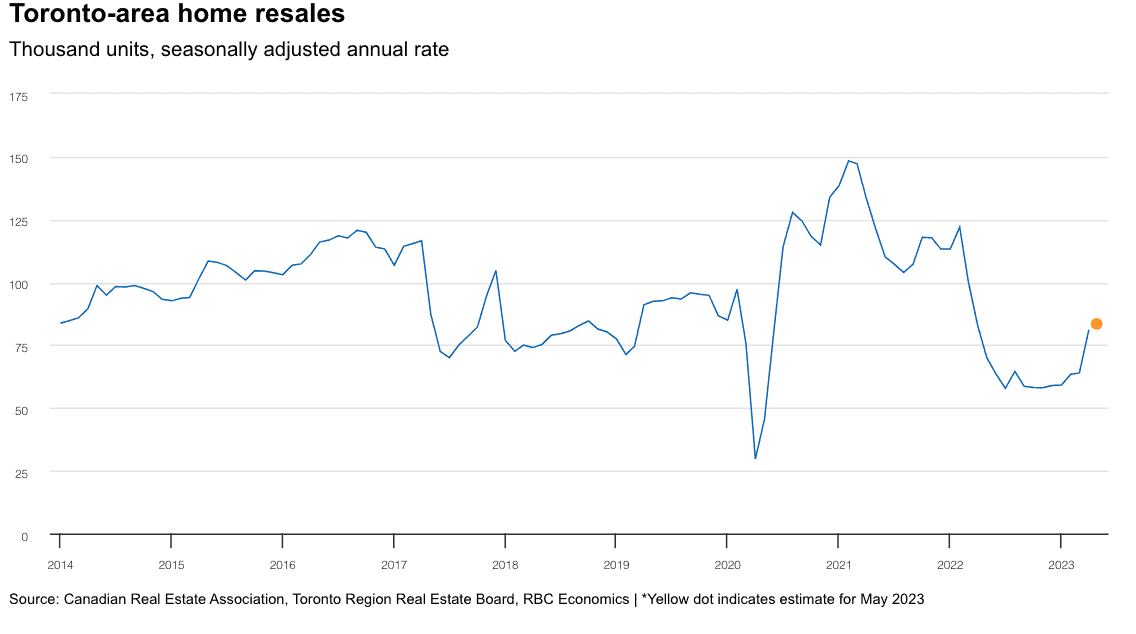

Toronto and Montreal experience price gains

In the Toronto area, market activity remained strong, with a 5.2 per cent month-over-month increase in May. While this growth was not as spectacular as the 25 per cent surge observed in April, it underscored the growing desire of buyers to enter the market.

The standout development was a significant increase in sellers, as new listings rose by 17 per cent on a seasonally-adjusted basis. While this partially met the pent-up demand that had accumulated over the past year, it was still insufficient to balance the market and alleviate the intense upward price pressure.

The MLS HPI for the Greater Toronto Area rose by a robust 3.2 per cent month-on-month, rivalling the gains seen during the pandemic boom. The report emphasizes the need for more sellers to boost inventories and bring the market back into balance.

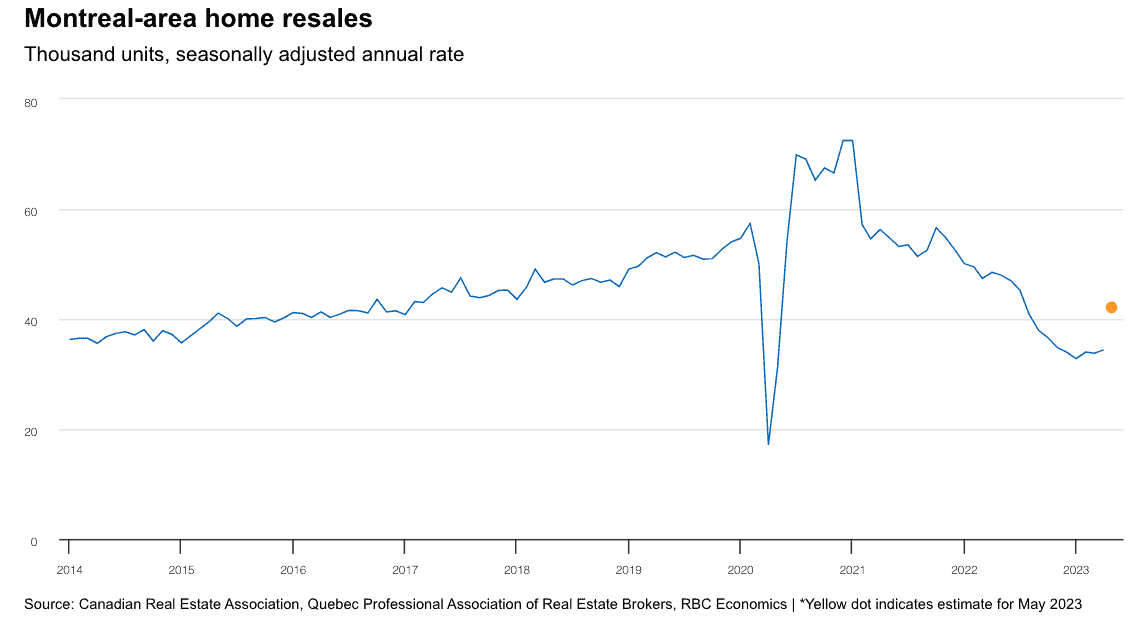

Montreal’s housing market turned a corner in May, experiencing a surge in home resales Hogue estimates at 22 per cent month-over-month (seasonally adjusted). This represents the largest increase in over two years and marks the end of a year-long slide.

Although more homes were listed for sale, the supply was insufficient to meet the resurgent demand, leading to a further price increase. Condo prices saw the largest increase, with median prices rising by 3.3 per cent month-on-month, followed by single-detached homes, which rose by 1.9 per cent. The report expects these trends to continue in the near term.

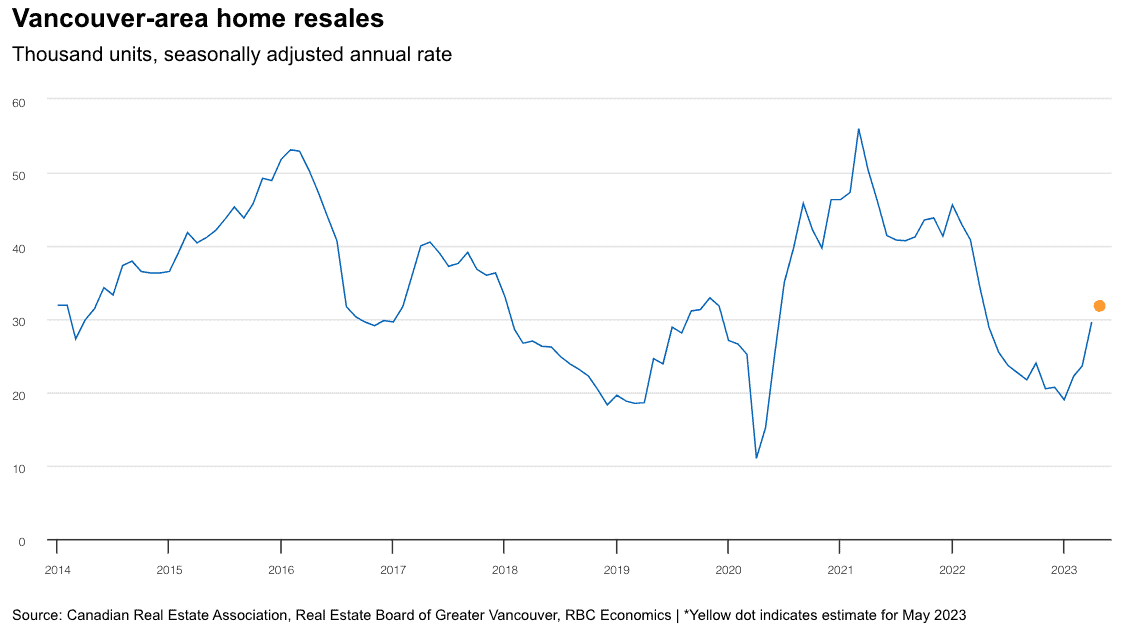

Vancouver sees increased seller activity, and Calgary finds modest relief

In the Vancouver area, an increasing number of sellers took advantage of favourable market conditions in May. New listings jumped by 15 per cent month-over-month (seasonally adjusted), the largest increase since January.

This influx led to further growth in resale transactions, extending the upward trend for four consecutive months. However, despite the rise in new listings, demand-supply conditions remain tight, and prices continue to climb.

Vancouver’s MLS HPI increased by 1.3 per cent over April, but the report suggests that poor affordability will likely limit the speed of price appreciation moving forward.

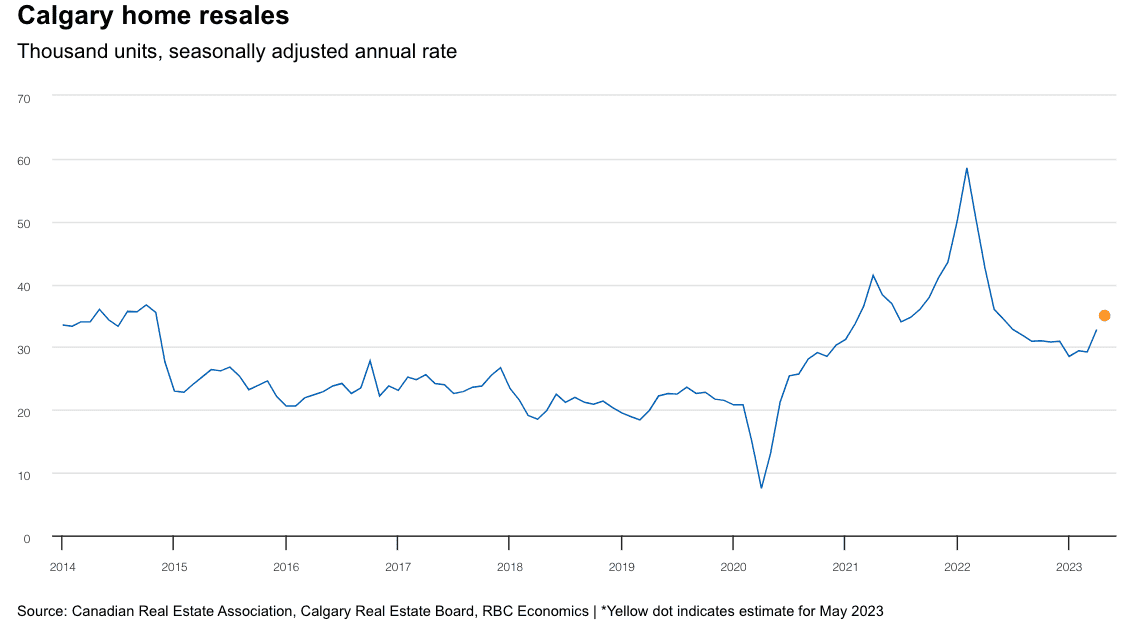

Calgary’s housing market saw a significant increase in new listings, soaring by 27 per cent month-over-month (seasonally adjusted). This jump provided some relief to the tight demand-supply conditions, resulting in a 6.0 per cent rise in home resales.

However, Hogue says it’s important to note that the increase in new listings followed sharp declines earlier this year from historically low levels. As a result, the relief was only modest, and the demand-supply imbalance persists.

Calgary’s MLS HPI continued to rise at a “sustained pace,” with a 1.0 per cent month-on-month increase. The report anticipates this trend to continue in the near term.

Interest rate hikes

Hogue expects “higher prices will play their role as a stabilizer for the market: cooling demand and pulling in more supply.”

Adding to affordability concerns, the Bank of Canada (BoC) raised its key interest rate to 4.75 per cent — the highest level in 22 years.

But according to John Pasalis, president and broker of Realosophy, the 25 basis point rate hike is not expected to directly impact the housing market since most buyers are not currently obtaining variable-rate mortgages.

In a social media post, Pasalis suggests that the rate hike will have implications for fixed rates and market sentiment in the future. Fixed rates have already been increasing in recent weeks, and the current trends in the bond market indicate that they are likely to rise even further.

Higher fixed rates can make it more challenging for buyers to afford homes at current prices and rates. Moreover, the possibility of another increase in rates could shift market sentiment.

Pasalis explains the belief that the BoC was finished with rate hikes was one factor motivating buyers earlier this year, but the increased likelihood of further rate increases and higher rates persisting for a longer duration may dampen the “FOMO” that has been observed in the market during the first half of the year.