It’s that time of year when many of us are thinking about winter activities and vacation destinations. But what does the property market look like in these regions?

A recent report by Royal LePage shows predicted continuous stability in Canada’s winter recreational real estate market, in light of interest rates being expected to stay consistent.

Home prices in the country’s most popular ski regions showed a slight year-over-year decline since the start of the year, as demand continues to soften – much of which is thanks to high interest rates and rising living costs, plus general uneasiness about the economy.

Slower activity over most of the year

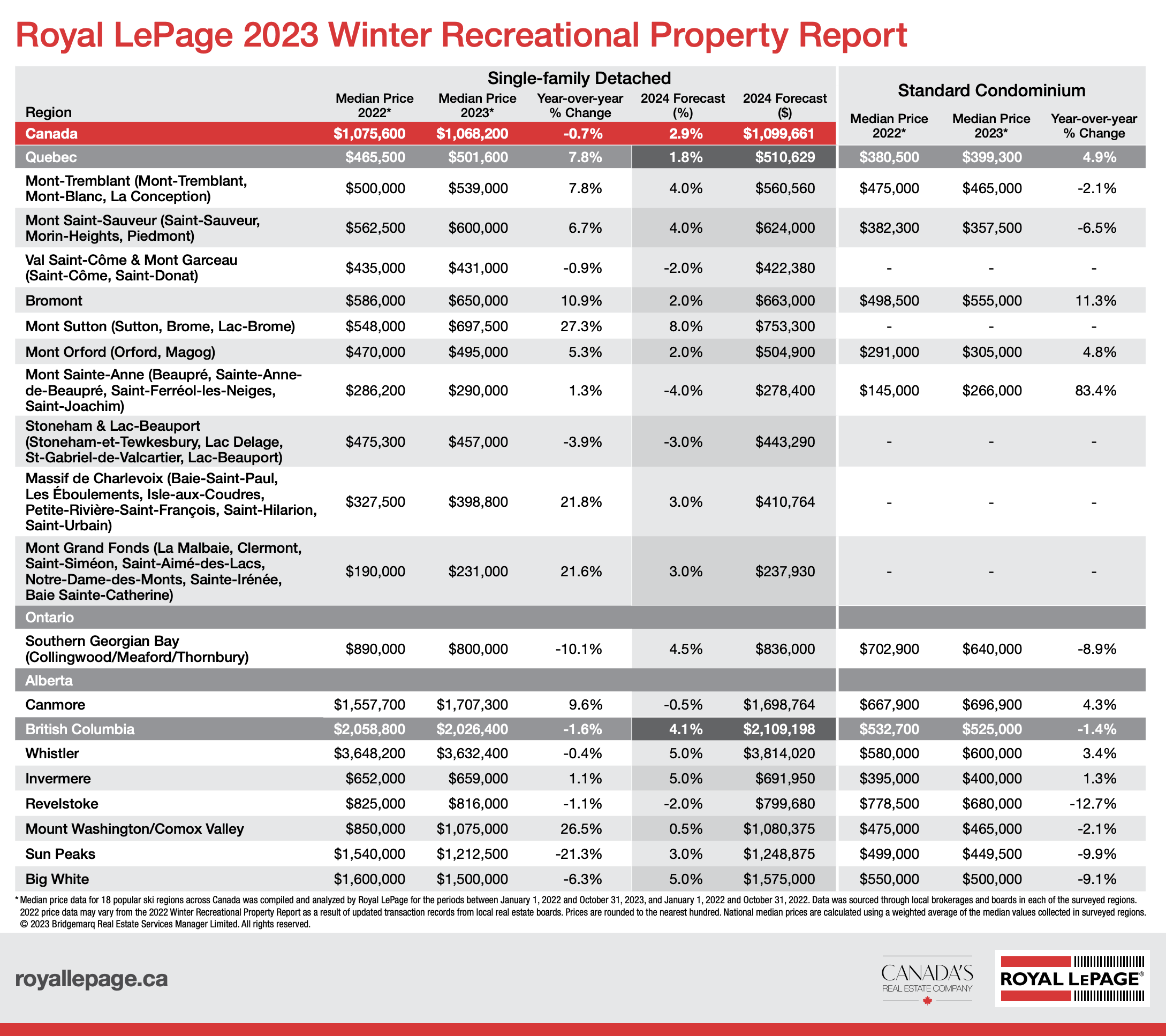

Over the first 10 months of 2023, the nationwide median price of a single-family detached home stayed flat, decreasing by just 0.7 per cent year-over-year to $1.068 million.

“Although recreational real estate markets vary greatly from one region to the next, activity on the whole in Canada’s winter recreational communities has noticeably slowed. Annual sales are down in most regions and inventory has climbed modestly as the market continues to regain balance. This has not, however, translated to steep price declines in a majority of markets.

While the rising cost of living has had an impact on demand for recreational real estate, prices have remained stable due to relatively low supply and sellers’ capacity to hold out for a desirable deal,” Pauline Aunger, broker of record for Royal LePage Advantage Real Estate, shares.

“Market activity is trending back to historical norms, following an unprecedented boost in activity during the pandemic. In addition to a return to normal work and social routines, today’s elevated interest rate environment has exacerbated this cooldown, as consumers are more concerned about mortgage expenses and the overall economy, including those shopping in high-end recreational markets.”

What’s expected

Based on expected stable (or modestly declining) interest rates through next year, the company forecasts the median price of a single-family detached home in Canada’s recreational ski regions to increase 2.9 per cent over the next 12 months, bringing it to $1,099,661.

“Recreational house prices in Canada’s popular ski regions are expected to remain stable in the year ahead. While demand has weakened and supply has increased compared to the pandemic-fueled boom, market activity is trending back to normal historical levels. This will keep prices on a modest upward trajectory in the coming year as Canadians continue to seek out a spot on some of the world’s most desirable slopes,” Aunger adds.

Consumers feeling the financial pinch

The Bank of Canada has raised the overnight lending rate 10 times since March 2022, which has raised its policy rate to more than a 20-year high.

These increased borrowing costs along with the rising cost of living have created a cooling effect on recreational markets — similar to what’s happened in residential markets but to a lesser degree.

Nationwide, 41 per cent of recreational property market experts reported a boost from last year in properties for sale directly due to rising interest rates. It’s widely thought that the Bank of Canada will hold its key lending rate at December’s announcement, which may offer some relief.

“Though recreational homeowners may have a higher tolerance for increased costs, they are not totally immune. Many recreational property owners purchase their homes in cash, while others opt for financing,” notes Aunger. “Some would-be buyers who require financing are pausing their purchase plans and are waiting for rates to come down to avoid higher monthly payments. Given the current economic climate, some homeowners are finding their monthly expenses too cumbersome, and are cutting costs or downsizing.”

In addition, Aunger mentions that short-term rental rules in some municipalities are making it much more challenging for recreational property owners to offset higher expenses by renting out their properties. To that end, recent legislation changes were announced in the federal government’s recent Fall Economic Statement, to entice homeowners to rent for longer periods or list their homes for sale.

Post-pandemic shift: Year-round residents attracted to recreational markets

Recreational properties have typically acted as vacation and secondary homes for Canadians, but since the pandemic and shift toward more remote work, more Canadians are opting for recreational markets as their primary residences.

Nearly 60 per cent of recreational regions surveyed noted double-digit declines in the number of properties sold over 2023’s first 10 months, compared to the same time last year.

Across Canada, Royal LePage’s recreational property market experts saw less demand in their respective regions (47 per cent) and, compared to last year, more of both inventory (88 per cent) and the average number of days-on-market (82 per cent).

“While residents are no longer flocking to recreational markets en masse like they were at the peak of the pandemic, when prices and sales were soaring upward, access to high-speed internet in more remote regions has led to an increase in the number of year-round residents,” said Aunger. “We are still adjusting to a softer recreational market that is seeing fewer buyers and rising inventory levels as consumers carefully monitor their discretionary spending under the weight of higher borrowing costs. Unlike purchasing a primary residence, most people in the market for a recreational property have the luxury to wait for the right home to come along, or for more favourable market conditions.”

Another key finding in the study was an unprecedented, record-breaking wildfire season that, along with other climate factors, strongly impacted summer real estate markets, including recreational communities.

Read the full Royal LePage report, including regional summaries, here.

Analyze this. For decades ski towns or recreational towns have historically been boom bust situations. Some of this has changed due to technology allowing people to work remote at a recreational property. The reality is values will continue to plummet regardless of inventories and sellers holding out for big bucks. If holding out for big bucks was an actual economic indicator then all the great economists of the world need to rethink econ 101. Its not only about values. People have to travel to these destinations , travel is getting very expensive. Lift tickets for skiing these days is crazy. As well as skiing being an expensive sport to begin with. This will have an effect not only on values but the local economy. I find it almost Disney like that these forecasts always want that happy ending. Disney is not real folks. As Leonard Cohen sang. ” I’ve seen the future, and it is murder.”